US Dollar Talking Points:

- This is from an archived webinar hosted on June 25th, with the full recording of that session below the talking points of this article.

- In that webinar I looked at 15 different markets, technically 16 including the look at NVDA. In this article, I’m going to recap the high points.

- If you’d like to attend next week’s webinar as it’s happening live, the following link will allow for registration: Click here to register.

The US Dollar has continued to show strength, albeit in a rather tepid manner, and this is something that could continue into the PCE report set for release later this week. Given that lack of near-term volatility in the Greenback, there’s several other markets also displaying a similar backdrop. And as I said in the opening of the webinar, that’s generally where I’ll try to open the range of setups that I’m looking at, in effort of being best prepared for when volatility does show. In this write-up, I’m going to recap some of the high points.

US Dollar

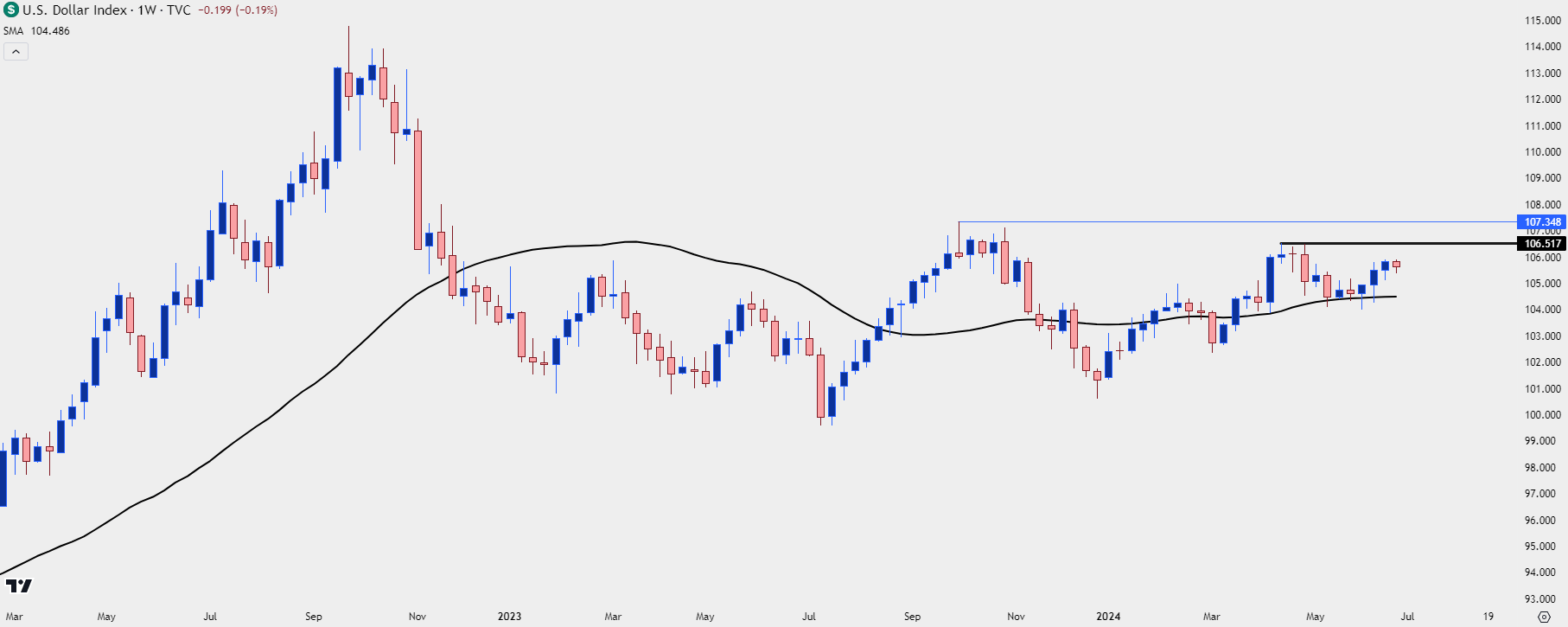

At this point there remains a bullish lean in the USD. I think the weekly chart is key here as this highlights the recent role of the 200-day moving average, which came into play after the May FOMC rate decision. The 200-dma then held support for five consecutive weeks – without a weekly close below – and that’s helped to push prices higher with an assist from the June FOMC rate decision. Last week was the first that DXY did not test the 200-day moving average during the week.

Also from the below weekly chart, we can see the importance of the 106.50 level that sits overhead.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

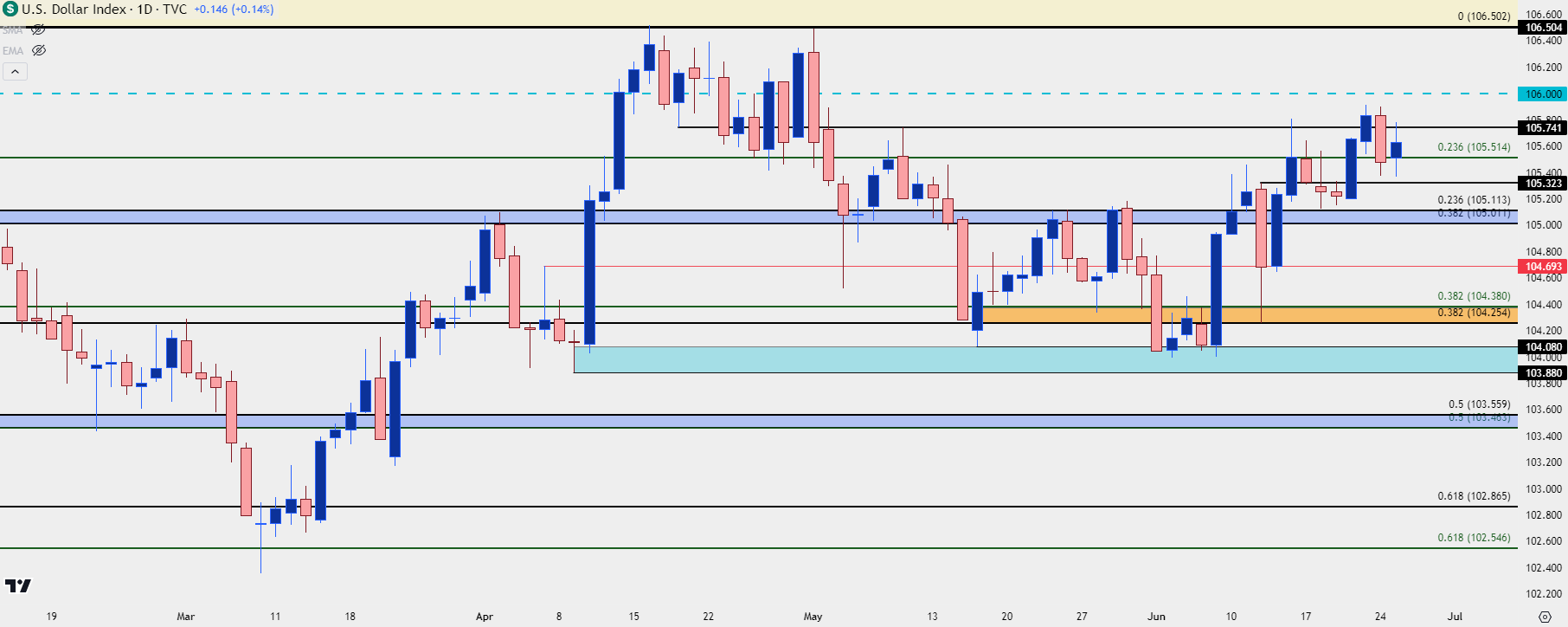

USD Daily

The FOMC rate decision delivered a jolt to the DXY and that shows with the elongated wick that touched the 104.25 Fibonacci level two weeks ago. Since then, there’s been higher-highs and higher-lows but the bulk of that move was in the two days after the rate decision. The 105.74 level that held resistance that Friday remains as resistance today.

The next level overhead is the 106.00 round number but the 106.50 level above that is key, as this is where a double top formation built into the May FOMC rate decision, and that formation triggered and completed in the couple of weeks that followed. If USD bulls can muster another test in that zone there’s also a fair chance that we’d be looking at a range support test in EUR/USD, which I’ll look into below.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

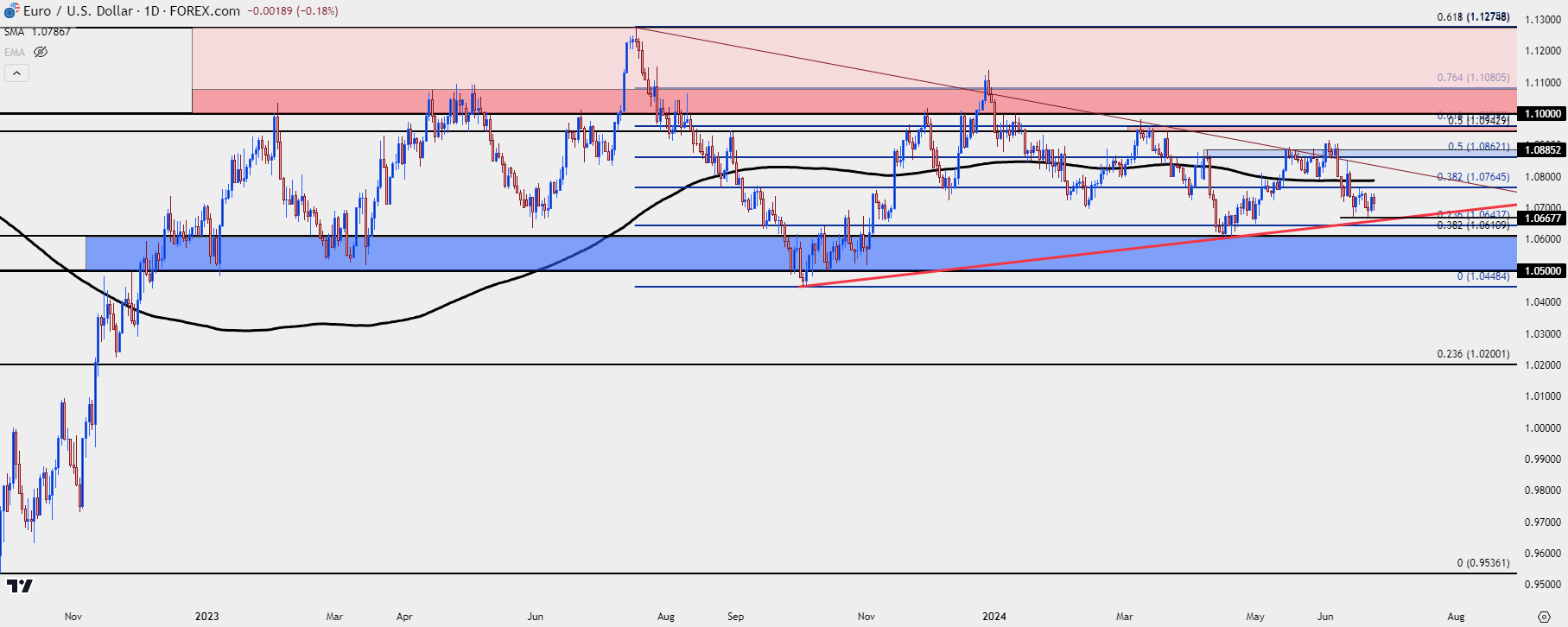

EUR/USD

In the webinar I talked about a comment from ECB member Isabel Schnabel, where she said that she doubted that there would be much policy divergence between the Fed and the European Central Bank. And this speaks to something I’ve been talking about on webinars for some time, and this is at least part of the reason why EUR/USD has been range-bound now for almost 18 months.

Frankly, there’s repercussions of prolonged trends in either the Euro or US Dollar, and those reverberations can make it more challenging for central bankers to thread the policy needle. So, it comes as little surprise that each central bank has retained a similar vantage point as the other, and the ECB’s recent rate cut came along with question marks as to what their next move might be. And given the strength in US data, that makes sense, as another strong bearish trend in the Euro could serve to boost European inflation again, thereby making it more difficult for the ECB to support growth.

The range in EUR/USD has been clean for the past year and a half and range support is already nearby. I’m tracking that from the 1.0500 psychological level up to the 1.0611 Fibonacci level, and sellers pulled up just shy of that zone last week.

This puts more focus on the Friday Core PCE print, and if it does come out strong, pushing US rate cut expectations even further down the road, we might get that dip into range support at which point we can get a reading as to how aggressive bears will remain to be. But, if Core PCE comes out soft, there’s deeper scope for a pullback and that highlights short-term resistance potential in EUR/USD at the 200-day moving average.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

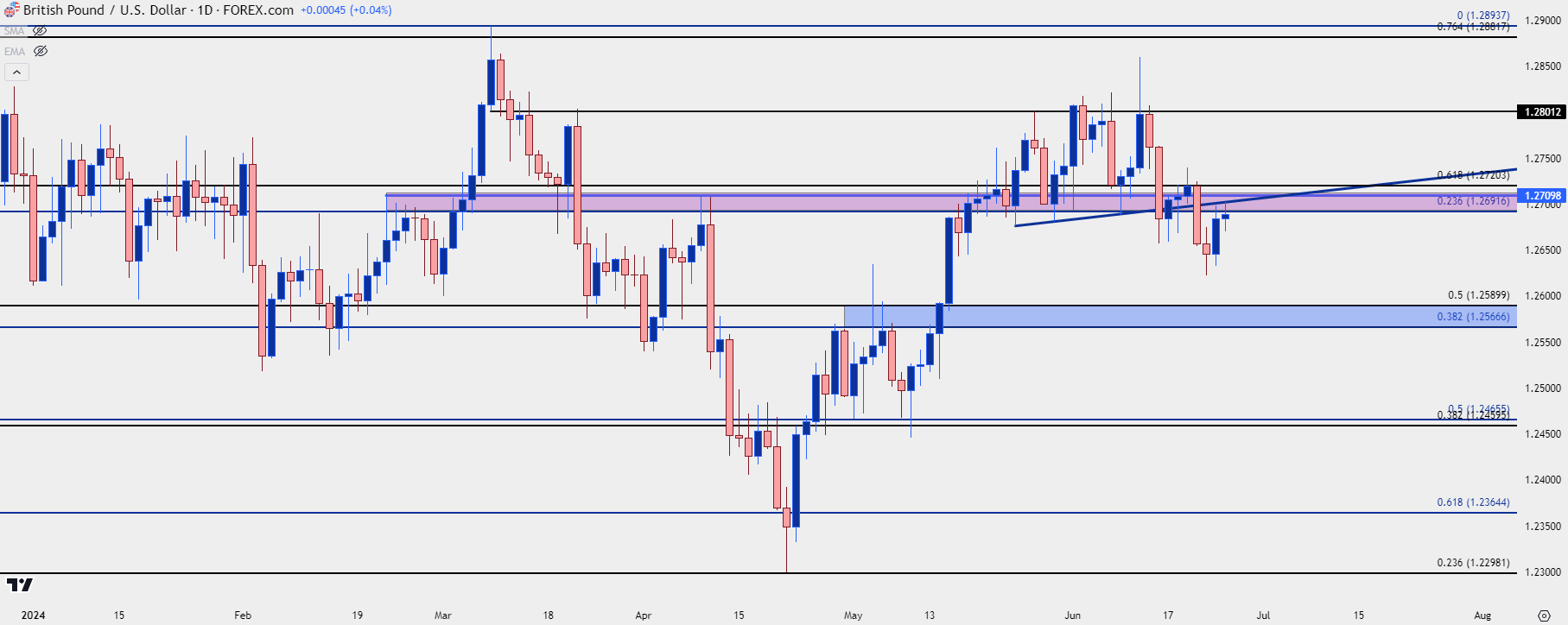

GBP/USD: Cable Slipping

I had been tracking GBP/USD as one of the more attractive backdrops for USD-weakness, but that’s starting to shift.

After the last failed test above the 1.2800 level sellers have gotten more aggressive, and the same support that I was using last month is now showing as resistance. This highlights the next confluent zone below, which I’m tracking from 1.2567-1.2590; and above price, the same 1.2720 level that I was harping on the week before remains in-play as lower-high resistance potential.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

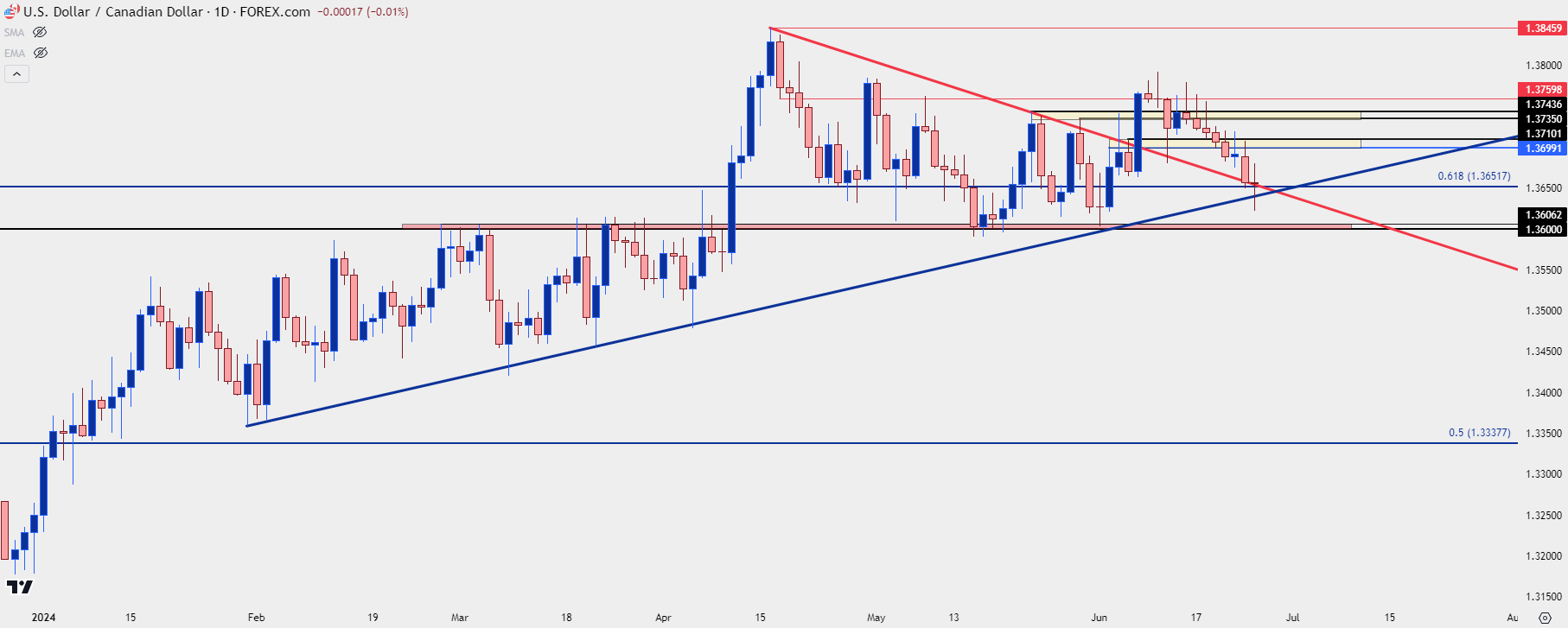

USD/CAD Support Test

Also in the ‘adaptation’ camp on my radar is USD/CAD. The pair was previously looking attractive for USD-strength scenarios, but that backdrop is also shifting. But, unlike GBP/USD above, there’s still scope for the prior theme to continue as USD/CAD is putting in a test of a major support level, taken from the Fibonacci retracement at 1.3652. If that doesn’t hold, the 1.3600 level remains of interest but penetration below that would negate the prior series of higher-lows that had built from that support.

USD/CAD Daily Price Chart

Chart prepared by James Stanley, USD/CAD on Tradingview

Chart prepared by James Stanley, USD/CAD on Tradingview

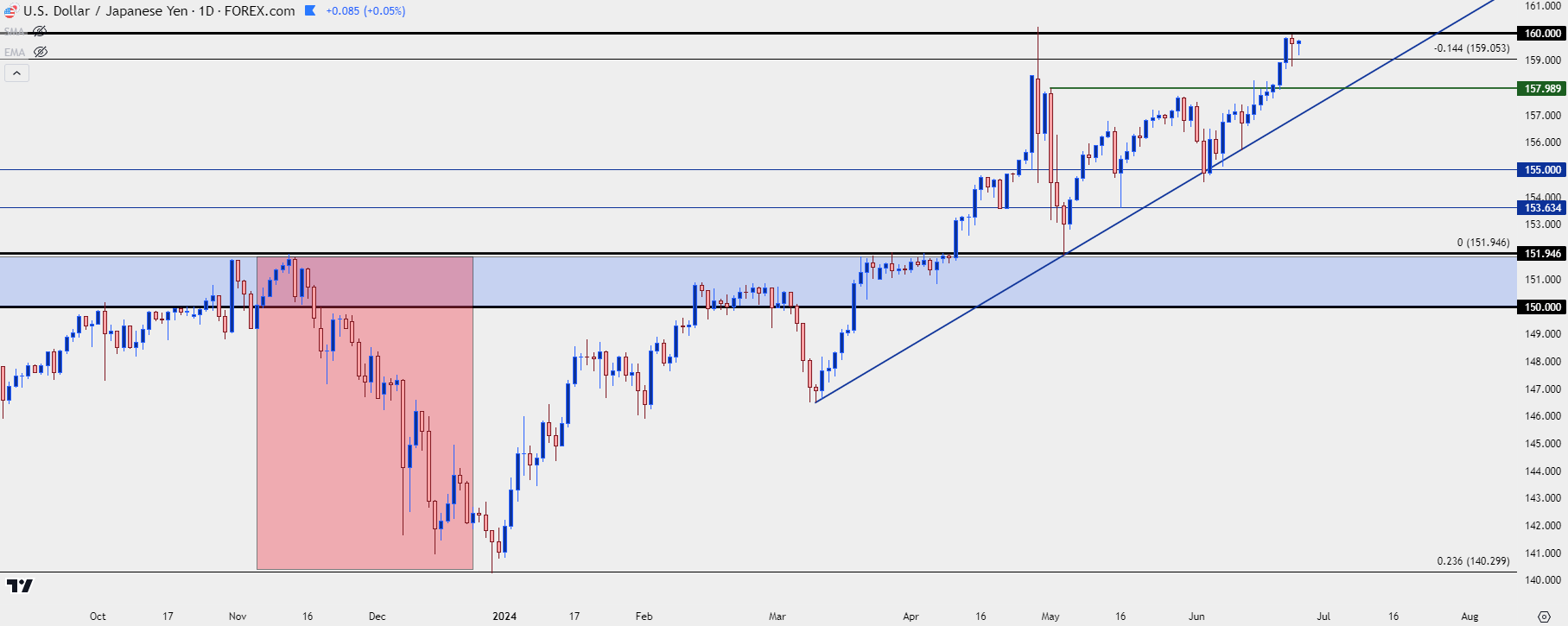

USD/JPY 160.00

The Bank of Japan has so far defended 160.00 and since the late-April test that led into an intervention, there’s hasn’t been another breach of the big figure. But that could be nearing and the big question is whether the BoJ will defend it again.

In the webinar, I highlighted the roll of carry and rollover in such a backdrop as it helped to build a strong bullish move off of support (from prior resistance) after that intervention took place. So, if the BoJ does intervene, that could possibly be a pullback opportunity for bulls, particularly if the carry remains tilted to the long side of JPY pairs.

In the webinar, I shared my preference for other markets in that scenario, such as AUD/JPY and GBP/JPY. USD/JPY remains a hot button as this is the market that the Ministry of Finance is often watching in reference to the Japanese Yen, and this is the market that I would expect would trigger an intervention, if it does in fact happen.

USD/JPY Daily Price Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

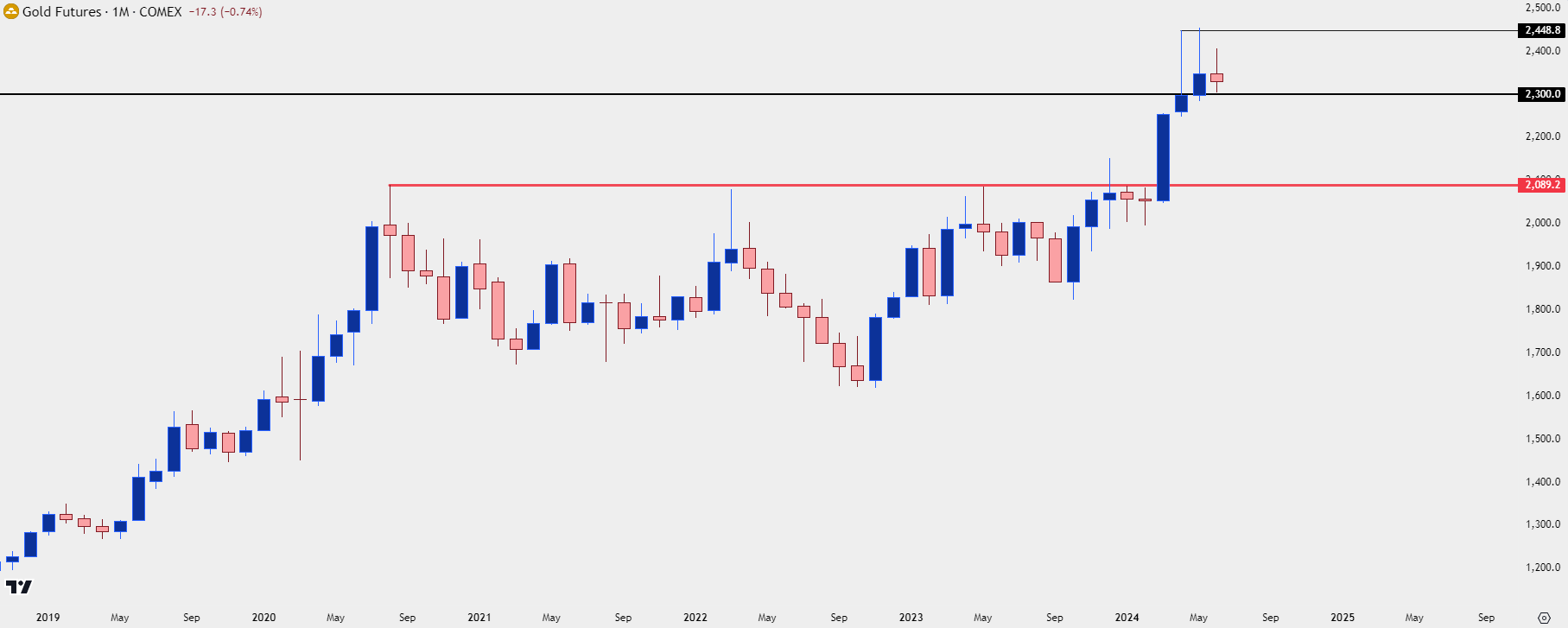

Gold

I’m still looking at Gold with a short-term bullish bias, as bears haven’t yet been able to take out the $2300 psychological level on a sustained basis. But, from a longer-term perspective that bullish picture may be shifting and the monthly chart is of interest here.

Notice the two extended upper wicks for both April and May’s showing, with June so far remaining inside of the prior month’s range. Also – notice that prior range resistance, around 2075-2090, has yet to see a re-test after the decisive breakout in March.

Gold Monthly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

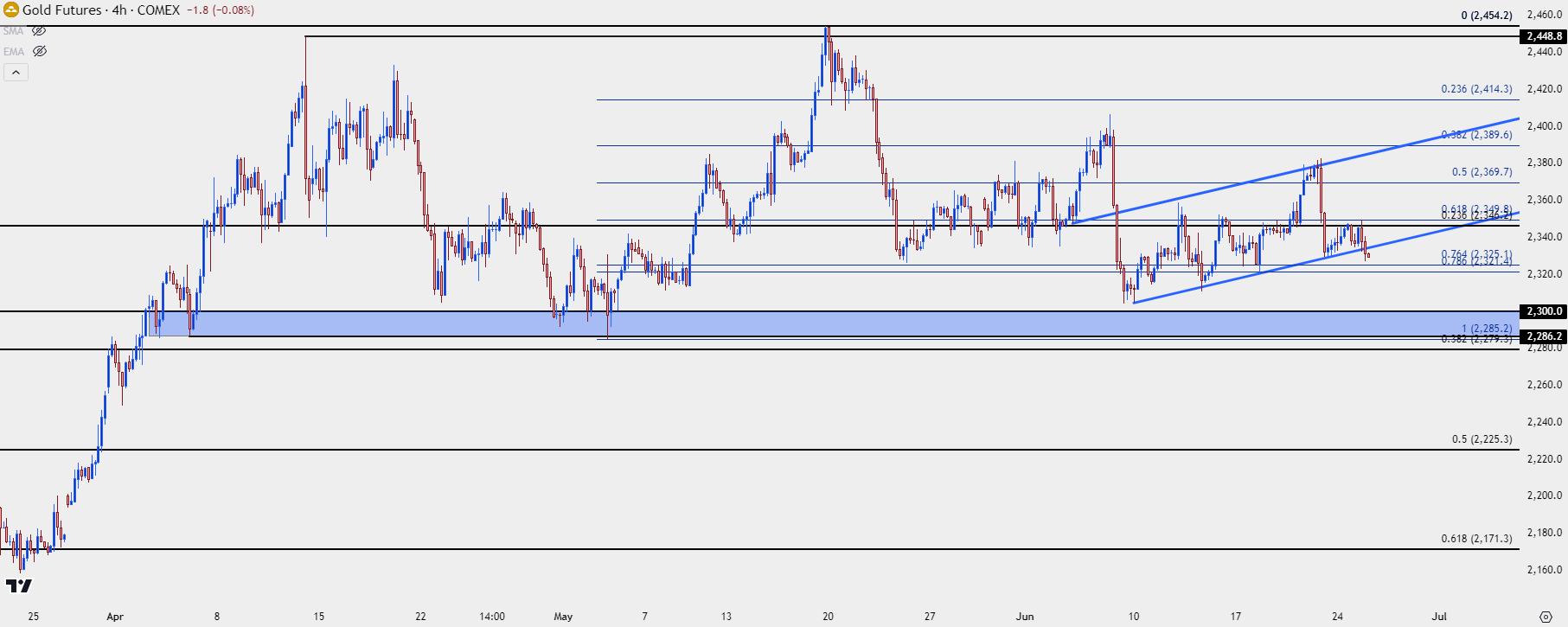

Gold Shorter-Term

From the daily, I shared that there’s a backdrop resembling a head and shoulders formation, along with a short-term bear flag that appears to be setting up. The key remains that support which is highlighted on the below chart from 2286 up to the 2300 psychological level.

If sellers can finally start to push below that, there could be scope for an eventual re-test of prior range resistance around that 2075-2090 zone.

Gold Four-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

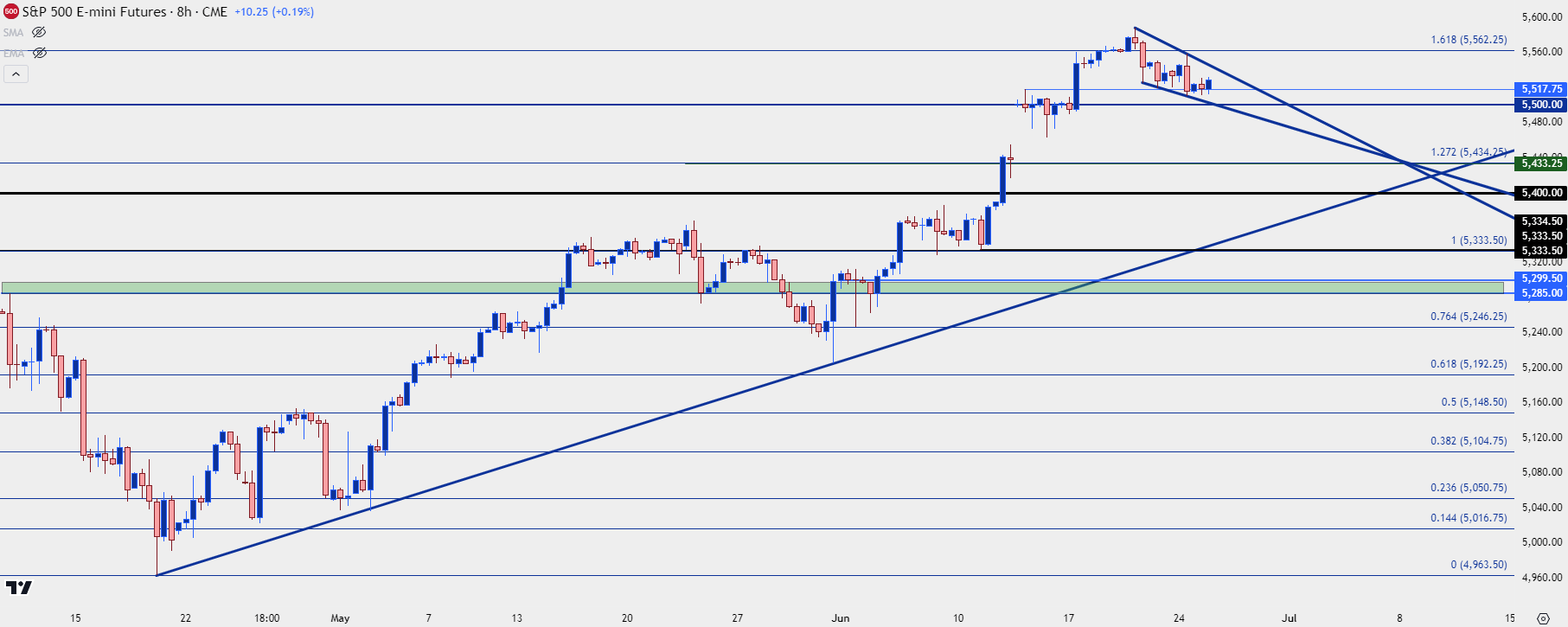

SPX

I had looked into stocks yesterday so I’ll keep this rather brief. The NVDA pullback has helped to push a pullback in the Nasdaq. But, elsewhere, matters don’t look as threatening at this point and in the S&P 500, there’s scope for bullish continuation scenarios at this point.

S&P 500 futures have so far held support at prior resistance of 5517, not yet allowing for a re-test of the 5500 level that was resistance for the two days after the last FOMC rate decision. Since last Thursday’s high, there’s been the build of a falling wedge formation, often approached with aim of bullish continuation.

S&P 500 Futures Eight-Hour Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

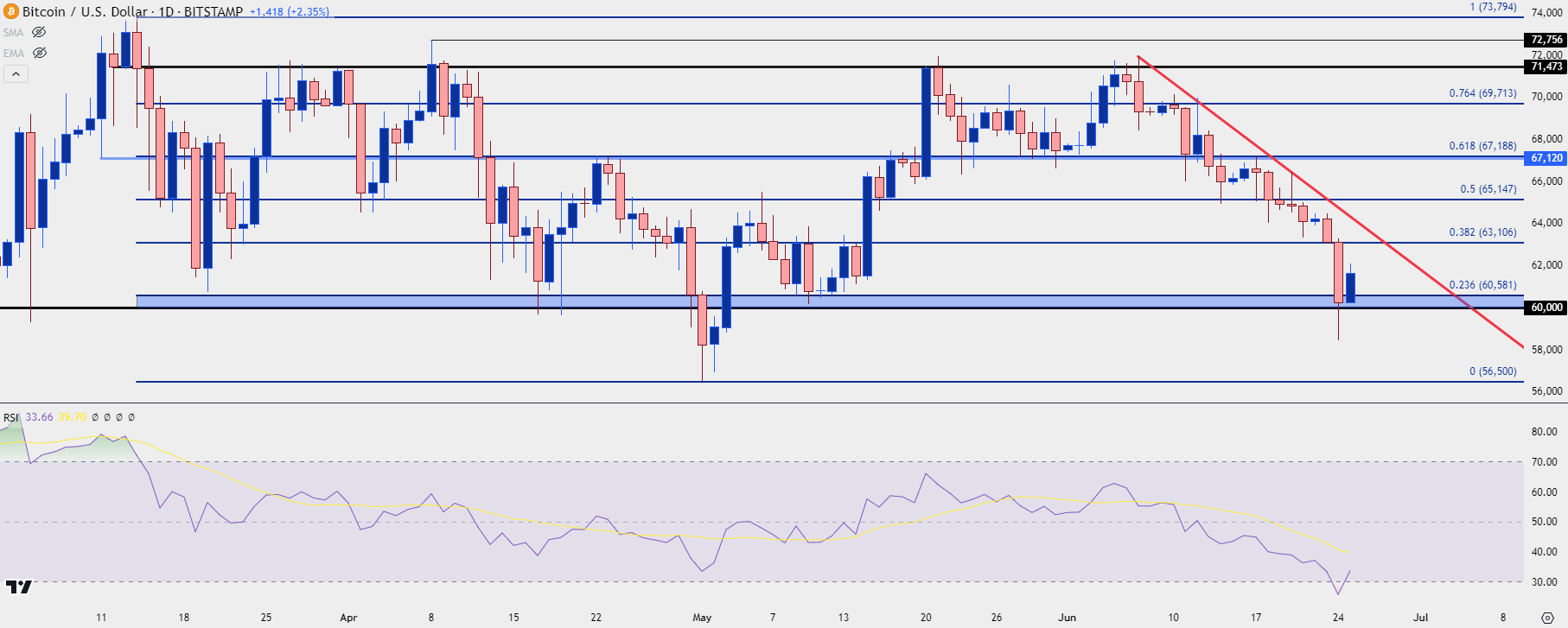

Bitcoin

Bitcoin has been in a hard bearish trend for the past couple of weeks, and it’s threatening to break through support structure around the 60k handle. There was a test below the big figure but 60k has so far held on a daily close basis, and this exposes the next spot of possible resistance at the 38.2% Fibonacci retracement of the March-April range, plotted at 63,106.

Notably, BTC/USD just showed its first oversold cross via 14-period RSI on the daily chart since last August, when it was trading around 27k.

BTC/USD Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

--- written by James Stanley, Senior Strategist