US Dollar Talking Points:

- It was a big week for USD themes as the Federal Reserve kicked off a rate cutting cycle that could potentially last for years.

- In the USD currency itself, there was less clarity as sellers had an open door to push a breakdown given that shifting fundamental backdrop and they failed to do so.

- Below and in the video, I look at the USD from a few different perspectives in EUR/USD, USD/JPY and GBP/USD.

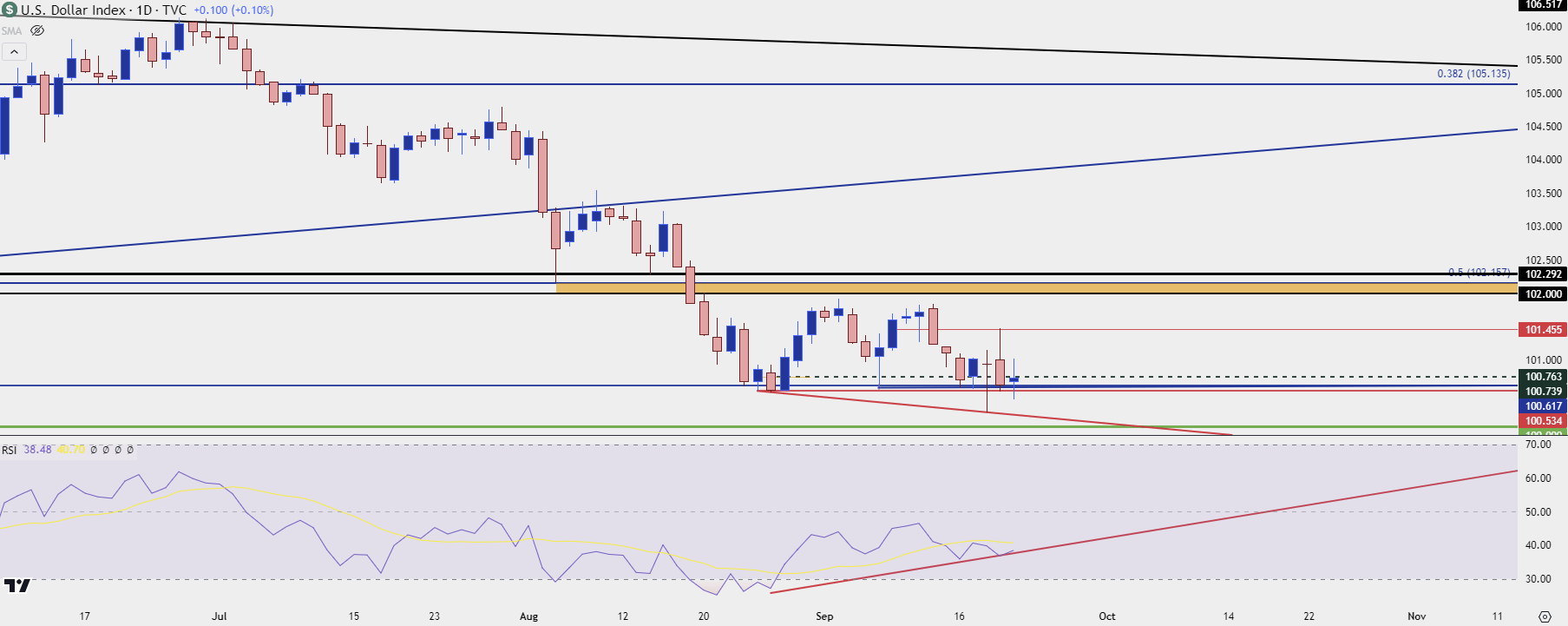

The Fed kicked off a rate cutting cycle this week and despite an open door for USD bears to push bearish trends, they’ve so far been unable to do so. Making matters more interesting is the fact that there’s a few different themes at-play here, after the USD went into oversold territory on the weekly chart in late-August. As I had shared then, those situations can take time to rectify and since then, there’s been a challenge for sellers to re-take control of the matter.

The last time the USD went oversold on the weekly chart was January of 2018. In that episode, we did see another attempt to drive from bears with a fresh low printing. But they failed to push price much lower, and a few months after the oversold reading prices began to turn.

Now this doesn’t mean that the USD has to turn-higher as RSI is a lagging indicator and is far from perfect. It does, however, highlight important context given how aggressive the sell-off in the currency was for the first couple months of Q3 trade.

US Dollar Weekly Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

For this week we did see USD bears establish a fresh yearly low shortly after the FOMC statement was released to announce a 50 bp cut. But the move couldn’t last for long as prices reverted into the prior range.

And now at this point we have a case of RSI divergence showing on the daily chart of the USD, as this week’s fresh low in price was met with a higher-low via RSI on the daily chart.

US Dollar Daily Price Chart

Chart prepared by James Stanley; data derived from Tradingview

Chart prepared by James Stanley; data derived from Tradingview

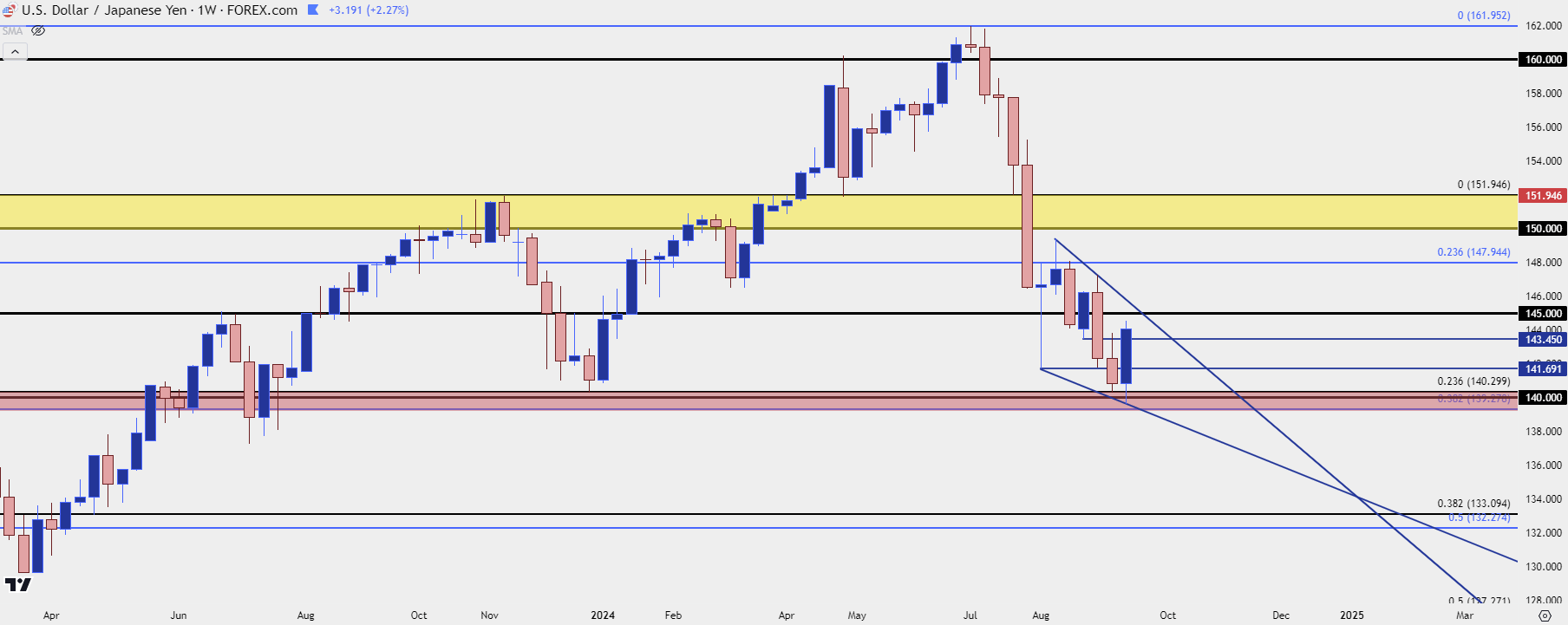

US Dollar Dynamics – USD/JPY

The USD is a composite of underlying currencies with the Euro playing a gargantuan 57.6% role in the DXY basket, followed by a 13.6% clip of JPY.

As I’ve been sharing in videos and articles over the past couple months, I’m of the mind that JPY has been doing much of the drive for DXY as we’ve seen carry trades unwind. And I think there could still be more room to go there as we haven’t yet seen the 38.2% retracement of the 2021-2024 major move tested through yet.

But – that doesn’t mean that price has to make a linear move lower as fundamentals aren’t a direct driver of price, supply and demand is; and while that will often be pushed from fundamentals, the more interesting scenarios are when it’s not, such as we’ve seen in USD/JPY this week.

Despite the narrowing rate divergence between the US and Japan, USD/JPY has put in a strong showing. I looked into this last Friday as a major zone of support started to come into play in the pair and that held despite an early-week test below 140.00. I think there could be more room for pullback in the pair and I’m watching the 145.00 level to gauge whether I think there’ll be more.

But if USD/JPY can hold-up above that key support, there’s more scope for USD range continuation which can press against other currency pairs such as EUR/USD.

USD/JPY Weekly Chart

Chart prepared by James Stanley, USD/JPY on Tradingview

Chart prepared by James Stanley, USD/JPY on Tradingview

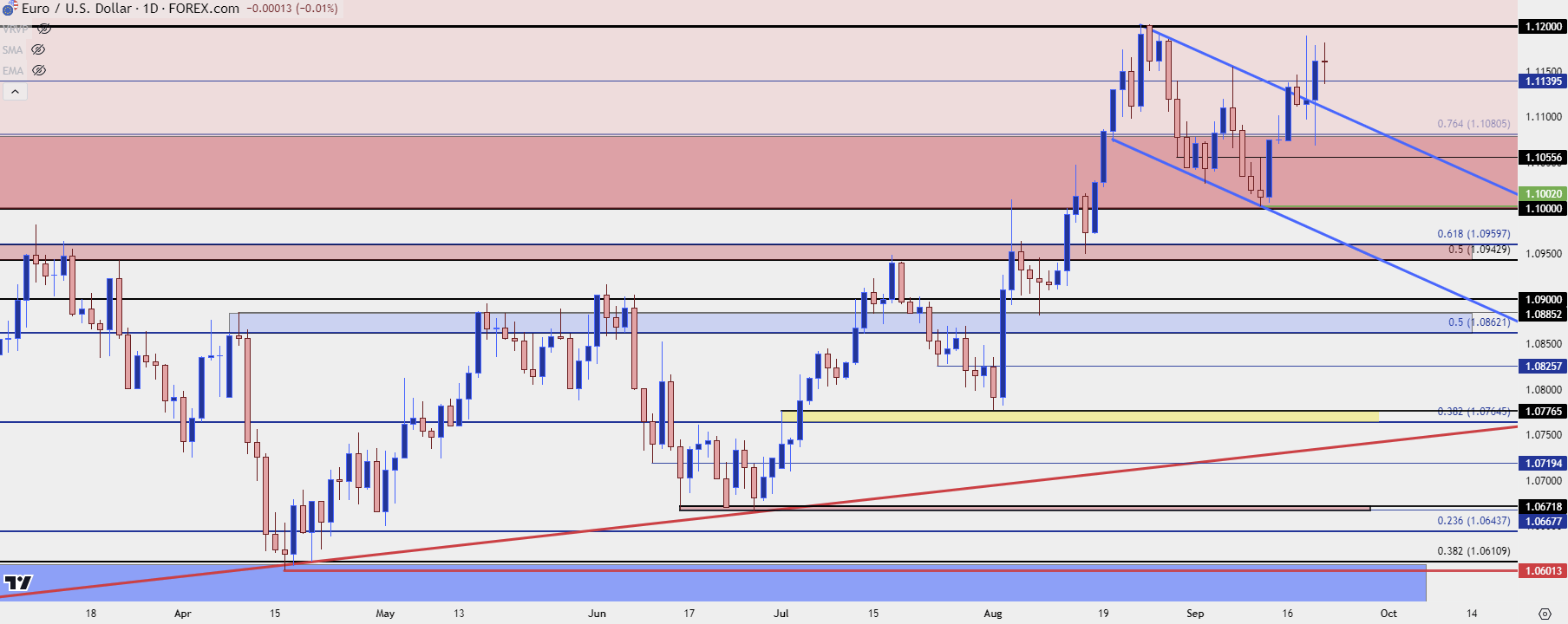

EUR/USD

The European economy isn’t exactly in a significantly stronger spot than the US. The ECB has already started to cut rates and it looks like there’ll be more in store there, as well. But if we look at EUR/USD in Q3 you’d be hard pressed to argue against the bullish trend that’s built, and there was even continuation in that through the past week.

I looked at a bull flag in the pair last Friday as a bearish channel built after the resistance hold at 1.1200. Bulls have forced a break of that over the past few days but they haven’t yet been able to jump back up for another test of the big figure.

I can also make the argument that the pair remains within the confines of a longer-term range as we’re still inside of the 1.1275 high from last year.

For next week this remains an area of attraction for USD-strength scenarios. A failed run above 1.1200 can begin to open the door for reversal scenarios. For confirmation of the bearish theme and the longer-term mean reversion or range continuation theme, a closed-body break through the 1.0943 level would be key, as that’s the 50% mark of the same Fibonacci retracement that caught the high last year at the 61.8 and the low so far this year at the 38.2.

EUR/USD Daily Price Chart

Chart prepared by James Stanley, EUR/USD on Tradingview

Chart prepared by James Stanley, EUR/USD on Tradingview

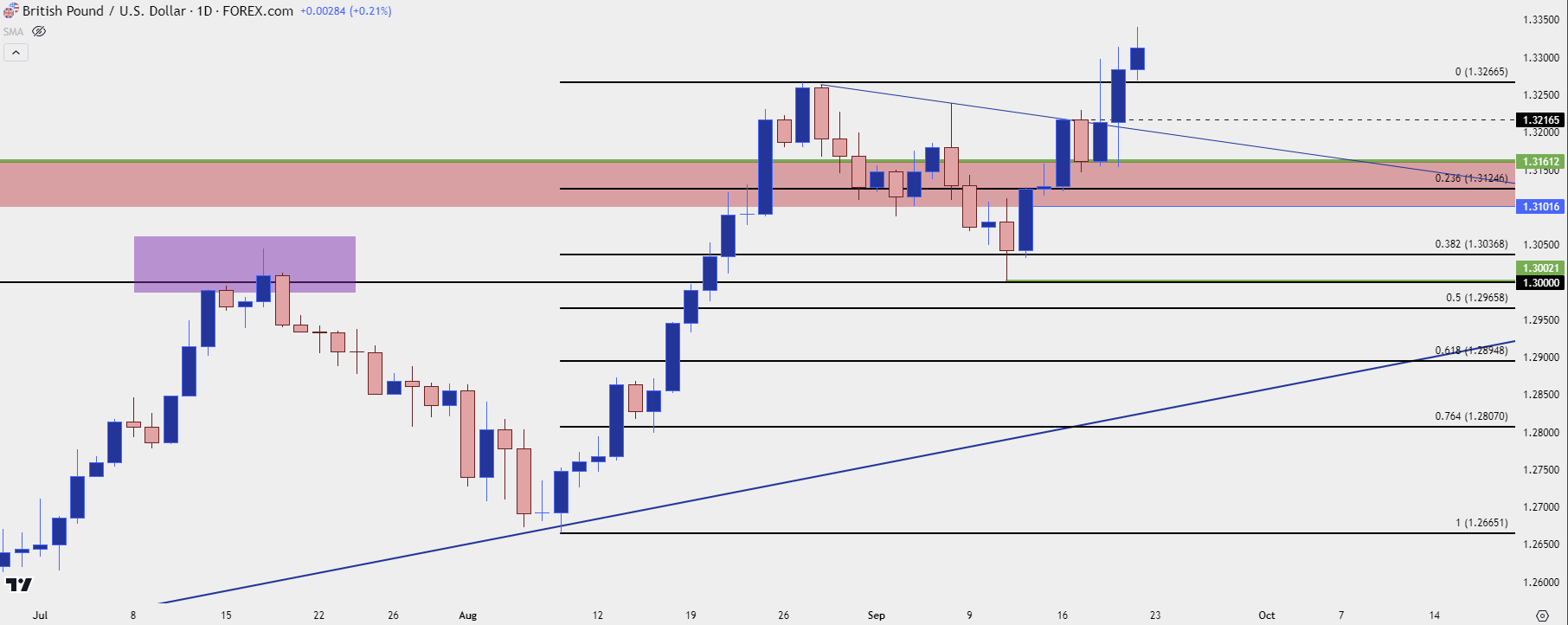

GBP/USD

On the other side of the greenback, I still like GBP/USD. I had looked at the pair when testing support at the 1.3000 handle a week ago. The rally from that level has been sizable with as much as 338 pips, or 2.6%. The gain in EUR/USD over the same period of time has been a more moderate 1.7%.

For USD-weakness scenarios, I still think GBP/USD is a more attractive venue, especially considering the fact that Cable has just pushed a fresh two-year-high while that range scenario remains in EUR/USD.

In GBP/USD for next week, there’s support potential at the prior two-year-high of 1.3267, and another price action swing 50 pips lower at 1.3217. Below that, it was this week’s support at the 1.3161 level that sticks out. I was looking at that price as resistance in last Friday’s piece on GBP/USD.

Bulls have put in strong effort here and if we do see USD-bears prevail, Cable appears to be an attractive spot to look for trend continuation themes.

GBP/USD Daily Price Chart

Chart prepared by James Stanley, GBP/USD on Tradingview

Chart prepared by James Stanley, GBP/USD on Tradingview

--- written by James Stanley, Senior Strategist