US Dollar Outlook: USD/JPY

USD/JPY extends the series of lower highs and lows from last week to register a fresh monthly low (146.23), but data prints coming out of the US may prop up the exchange rate as the Non-Farm Payrolls (NFP) report is anticipated to show another rise in employment.

US Dollar Forecast: USD/JPY Vulnerable Ahead of NFP Report

USD/JPY seems to have changed course after failing to test the July 1990 high (152.25), and the exchange rate may continue to give back the advance from the September low (144.45) as the 50-Day SMA (149.56) no longer reflects a positive slope.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, swings in risk sentiment may sway USD/JPY as the Bank of Japan (BoJ) looks poised to carry the Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC) policy into 2024, and the exchange rate may struggle to hold its ground ahead of the Federal Reserve interest rate decision on December 13 amid speculation of a looming change in US monetary policy.

However, recent remarks from Fed Chairman Jerome Powell suggest the central bank is in no rush to switch gears as ‘it would be premature to conclude with confidence that we have achieved a sufficiently restrictive stance,’ and it remains to be seen if the central bank will adjust the forward guidance for monetary policy as Chairman Powell and Co. are slated to update the Summary of Economic (SEP).

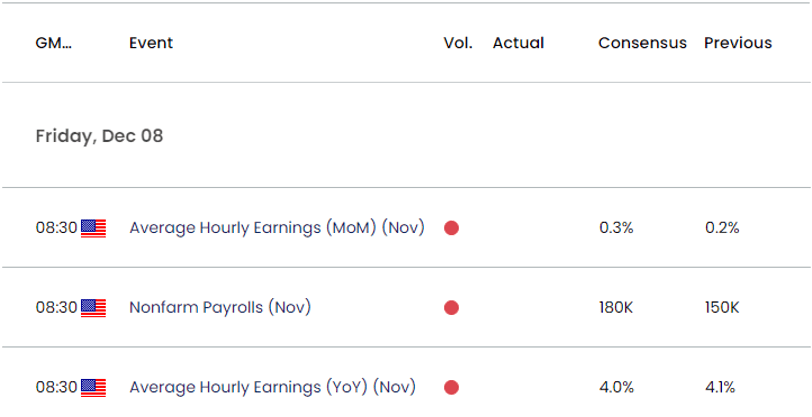

US Economic Calendar

Until then, the NFP report may influence the near-term outlook for USD/JPY as the economy is projected to add 180K jobs in November, and evidence of a tight labor market may generate a bullish reaction in the Greenback as it raises the Fed’s scope to further combat inflation.

However, a weaker-than-expected NFP print may produce headwinds for the US Dollar as it puts pressure on the Federal Open Market Committee (FOMC) to keep interest rates on hold, and USD/JPY may continue to give back the advance from the September low (144.45) as the 50-Day SMA (149.56) no longer reflects a positive slope.

With that said, the opening range for December is in focus as USD/JPY extends the series of lower highs and lows from last week, but the diverging paths between the Fed and BoJ may keep the exchange rate afloat as Chairman Powell reiterates that ‘we are prepared to tighten policy further if it becomes appropriate to do so.’

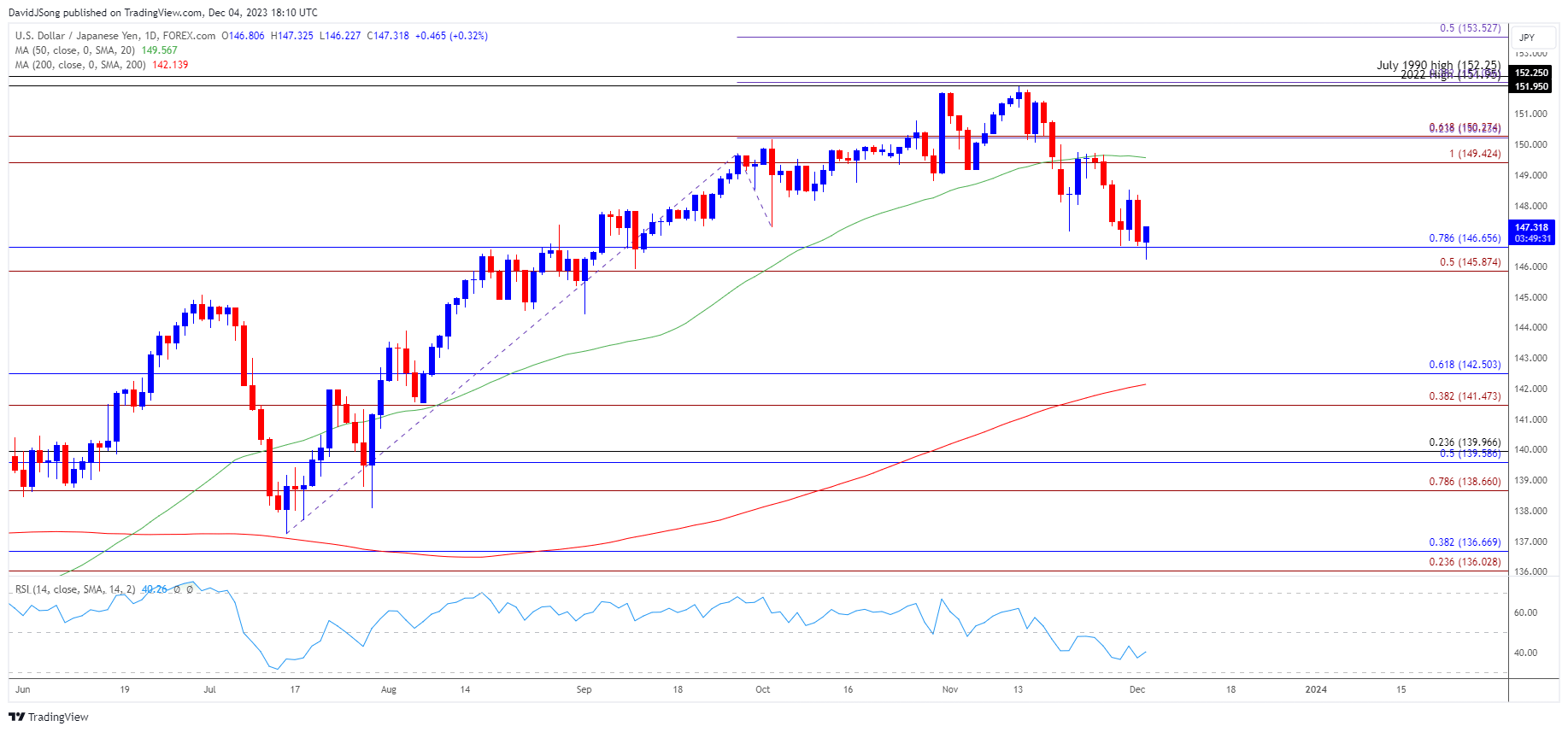

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY registers a fresh monthly low (146.23) as it carves a series of lower highs and lows, with the 50-Day SMA (149.56) no longer reflecting a positive slope following the failed attempts to test the July 1990 high (152.25).

- A break/close below the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region opens up the September low (144.45), with the next area of interest coming in around the 141.50 (38.2% Fibonacci extension) to 142.50 (61.8% Fibonacci retracement).

- However, lack of momentum to break/close below the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region may push USD/JPY back towards the 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension) zone, with a breach above the moving average bringing the November high (151.91) on the radar.

Additional Market Outlooks:

USD/CAD Forecast: December Open Range in Focus with BoC on Tap

US Dollar Forecast: EUR/USD Reverses Ahead of August High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong