US Dollar Outlook: USD/JPY

USD/JPY struggles to track the rise in long-term US Treasury yields as Federal Reserve Chairman Jerome Powell emphasizes that the central bank ‘has tightened policy substantially over the past 18 months,’ but the exchange rate may attempt to retrace the decline from the 2022 high (151.95) if it clears the opening range for October.

US Dollar Forecast: USD/JPY Steady Following Fed Chair Powell Speech

USD/JPY fails to extend the advance following the stronger-than-expected US Retail Sales report as Chairman Powell warns that ‘financial conditions have tightened significantly in recent months,’ and it seems as though the Federal Open Market Committee (FOMC) is in no rush to pursue a more restrictive policy as ‘longer-term bond yields have been an important driving factor in this tightening.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, USD/JPY may consolidate ahead of the next FOMC interest rate decision on November 1 as ‘a range of uncertainties, both old and new, complicate our task of balancing the risk of tightening monetary policy too much against the risk of tightening too little,’ and it remains to be seen if Fed officials will adjust the forward guidance for monetary policy as Chairman Powell insists that ‘the Committee is proceeding carefully’ while speaking at the Economic Club of New York.

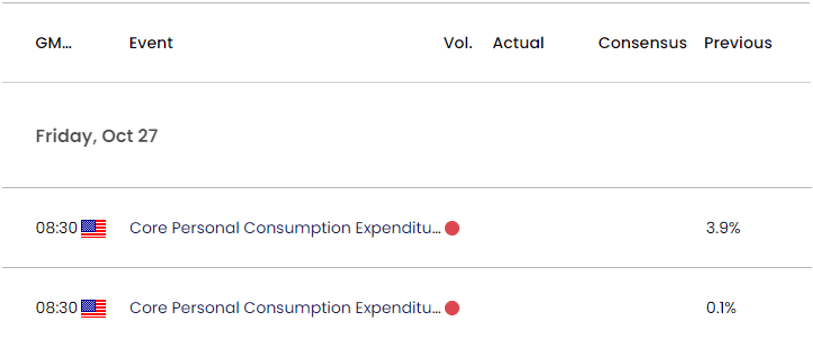

US Economic Calendar

Until then, speculation surrounding US monetary policy may sway USD/JPY as the FOMC keeps the door open to implement higher interest rates, but the update to the US Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, may produce headwinds for the Greenback should the update show a slowdown in both the headline and core reading.

At the same time, a stronger-than-expected PCE report may generate a bullish reaction in the Dollar as it puts pressure on the FOMC to further combat inflation, and the different approach in managing monetary policy may keep USD/JPY afloat as the Bank of Japan (BoC) continues to carry out Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC).

With that said, USD/JPY may attempt to track the positive slope in the 50-Day SMA (147.66) as it holds near the monthly high (150.16), and the exchange rate may attempt to retrace the decline from the 2022 high (151.95) if it clears the opening range for October.

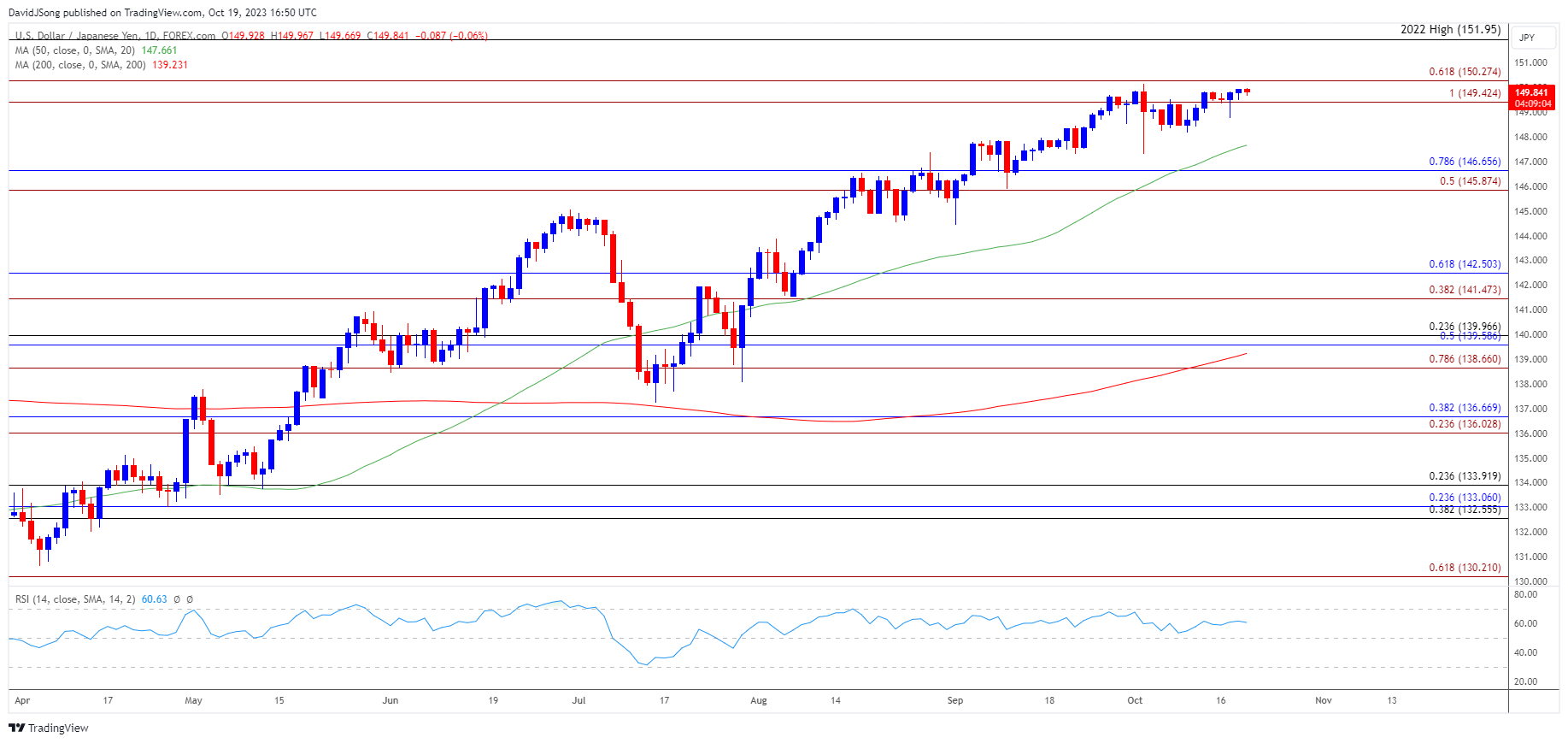

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY seems to be stuck in a narrow range after failing to break/close above the 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension) region, and the exchange rate may continue to consolidate as it holds within the opening range for October.

- However, failure to hold above the 50-Day SMA (147.66) may push USD/JPY towards the monthly low (147.29), with the next area of interest coming in around 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement).

- At the same time, USD/JPY may threaten the monthly high (150.16) if it tracks the positive slope in the moving average, with a close above the 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension) region bringing the 2022 high (151.95) on the radar.

Additional Market Outlooks:

British Pound Forecast: GBP/USD Rebound Stalls at Former Support Zone

Australian Dollar Forecast: AUD/USD Enclosed in Monthly Opening Range

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong