US Dollar Outlook: USD/JPY

USD/JPY may attempt to retrace the decline from the start of the week as it bounces back from the 50-Day SMA (154.90), and the exchange rate may continue to track the positive slope in the moving average amid the deviating paths between the Federal Reserve and Bank of Japan (BoJ).

US Dollar Forecast: USD/JPY Rebounds from 50-Day SMA Ahead of US NFP

Keep in mind, USD/JPY still holds within the opening range for May as Japan’s Ministry of Finance revealed its currency intervention operations for the period from April 26 to May 29 totaled ¥9,788.5 billion, and it remains to be seen if the authorities will continue to intervene in foreign exchange markets as the BoJ remains in no rush to embark on a rate-hiking cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Meanwhile, the Federal Open Market Committee (FOMC) may stick to a restrictive policy as ISM Services Purchasing Managers Index (PMI) prints at 53.8 in May versus forecasts for a 50.8 reading, and the US Non-Farm Payrolls (NFP) report may keep the Fed on the sidelines as the update is anticipated to show another rise in employment.

US Economic Calendar

The US is expected to add 185K jobs in May following the 175K expansion the month prior, and ongoing signs of a resilient labor market may produce a bullish reaction in the Greenback as it encourages the Fed to further combat inflation.

However, a weaker-than-expected NFP print may put pressure on the FOMC to alter the course for monetary policy, and a dismal development may drag on the Greenback as it fuels speculation for lower US interest rates.

With that said, USD/JPY may hold within the May range should it struggle to retrace the decline from the weekly high (157.48), but the exchange rate may continue to track the positive slope in the 50-Day SMA (154.90) amid the failed attempt to close below the moving average.

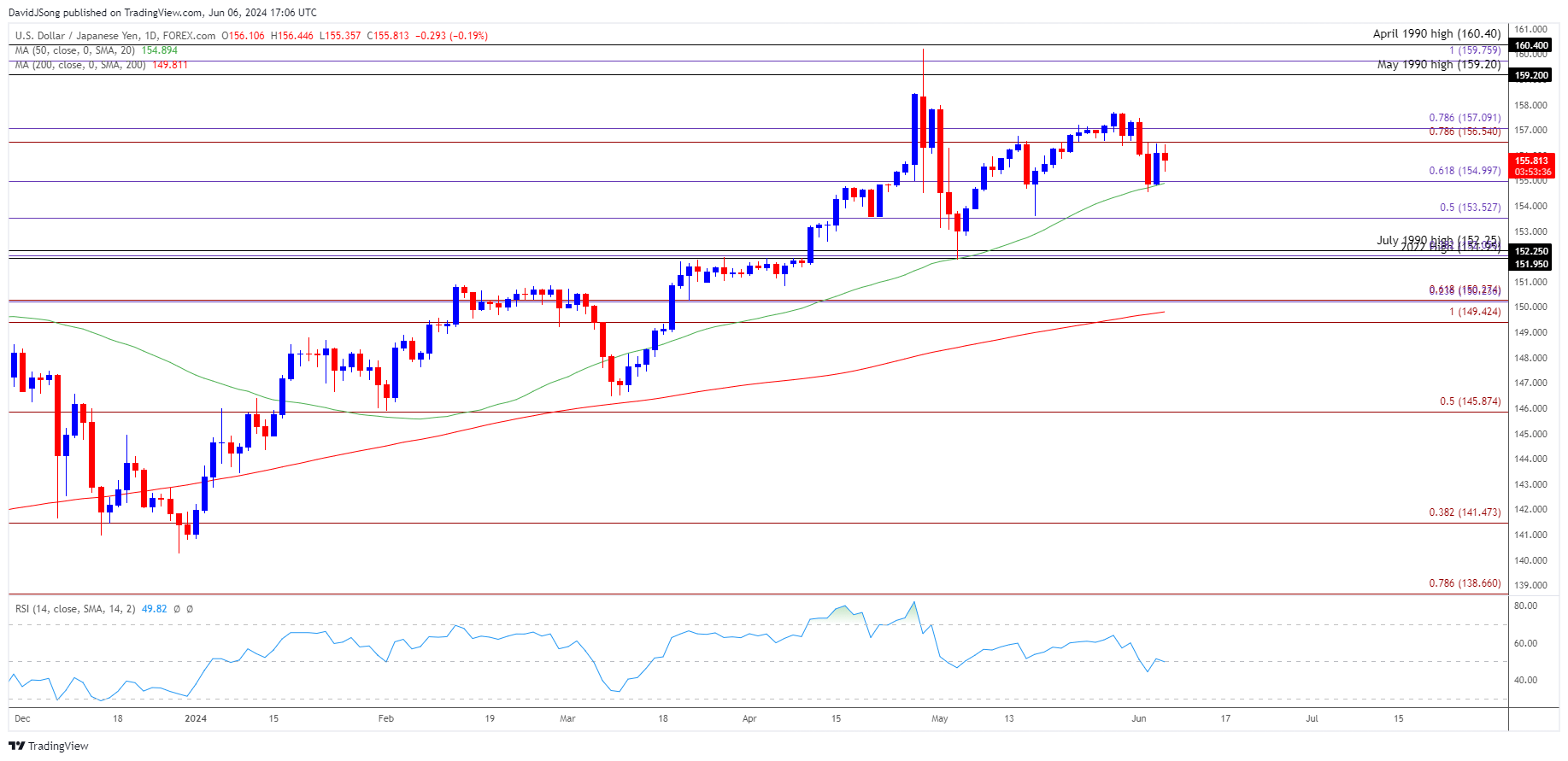

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY may track sideways as it holds within the May range, and lack of momentum to retrace the decline from the weekly high (157.48) may push the exchange rate back towards 155.00 (61.8% Fibonacci extension).

- Failure to defend the monthly low (154.54) may push USD/JPY towards 153.50 (50% Fibonacci extension), with the next area of interest coming in around the May low (151.87).

- Nevertheless, USD/JPY may track the positive slope in the 50-Day SMA (154.90) amid the failed attempt to close below the moving average, with a break/close above the 156.50 (78.6% Fibonacci extension) to 157.10 (78.6% Fibonacci extension) region raising the scope for a run at the April high (160.22).

Additional Market Outlooks

US Dollar Forecast: Post-BoC USD/CAD Rally Eyes May High Ahead of NFP

US Dollar Forecast: EUR/USD Vulnerable to ECB Rate Cut

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong