US Dollar Outlook: USD/JPY

The recent recovery in USD/JPY appears to have stalled ahead of the monthly high (150.89) as it carves a series of lower highs and lows, but developments coming out of the Federal Reserve may sway the exchange rate as the central bank endorses a data-dependent approach in managing monetary policy.

US Dollar Forecast: USD/JPY Rebound Unravels Ahead of Fed Symposium

USD/JPY may continue to give back the rebound from the monthly low (141.69) amid speculation for an imminent Federal Reserve rate-cut, and it remains to be seen if the Federal Open Market Committee (FOMC) Minutes will reveal anything new as Chairman Jerome Powell and Co. ‘do not expect it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

US Economic Calendar

In turn, more of the same from the FOMC may prop up USD/JPY ahead of the Kansas City Fed Economic Symposium in Jackson Hole, Wyoming, but hints of a looming change in regime may produce headwinds for the US Dollar as it fuels speculation for a rate-cut at the next Fed interest rate decision on September 18.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

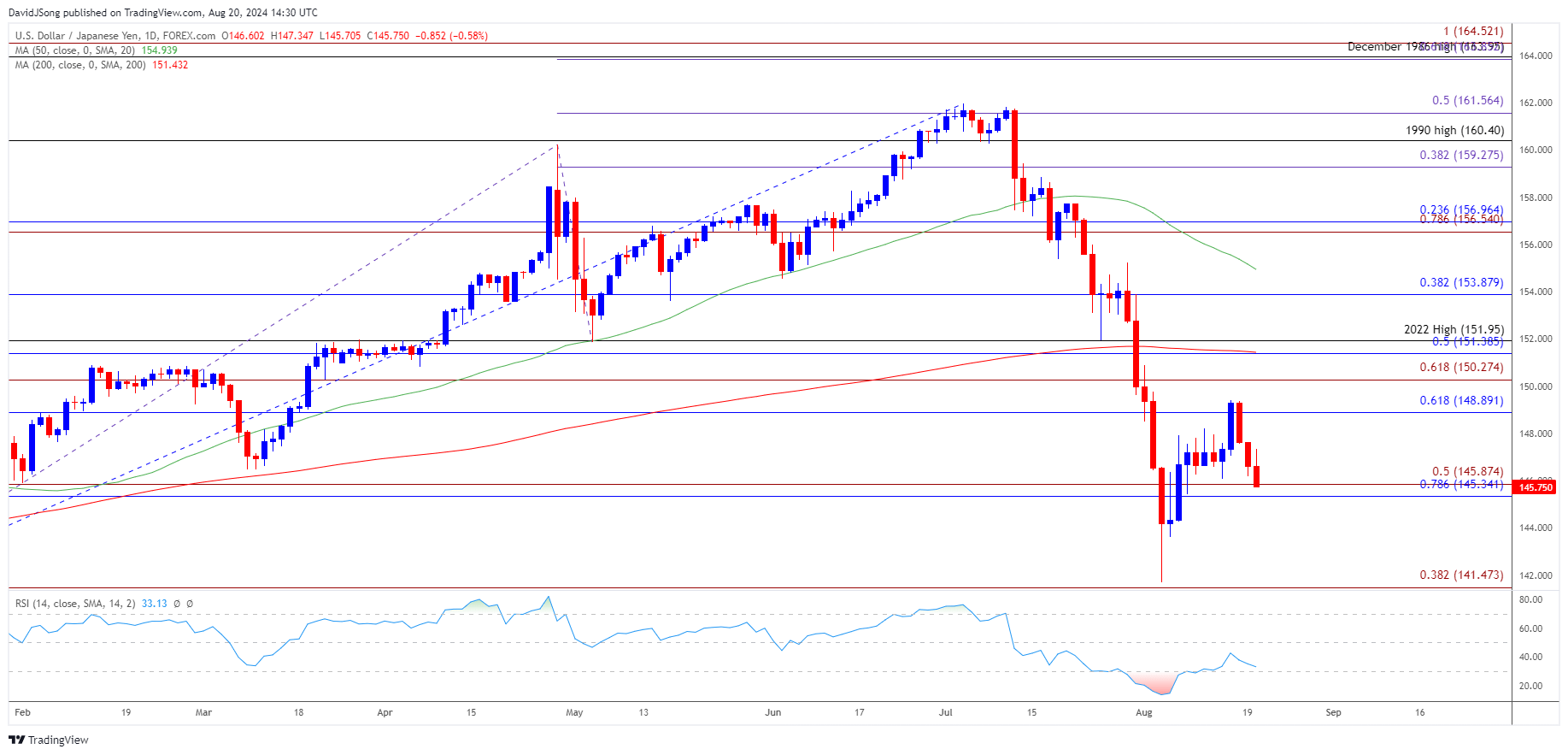

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY carves a series of lower highs and lows after as it pulls back ahead of the monthly high (150.89), and failure to hold above the 145.30 (78.6% Fibonacci retracement) to 145.90 (50% Fibonacci extension) region may lead to test of 141.50 (38.2% Fibonacci extension).

- Next area of interest comes in around the January low (140.82) but USD/JPY may face range bound conditions should it continue to hold above the monthly low (141.69).

- Need a break/close above the 150.30 (61.8% Fibonacci extension) to bring the monthly high (150.89) on the radar, with the next hurdle coming in around 151.40 (50% Fibonacci retracement) to 151.95 (2022 high).

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Susceptible to Test of July Low

GBP/USD Forecast: Test of Weekly High in Focus

US Dollar Forecast: AUD/USD Bullish Price Series Persists

US Dollar Forecast: EUR/USD Eyes Monthly High with US CPI on Tap

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong