US Dollar Outlook: USD/JPY

USD/JPY attempts to retrace the decline following the Federal Reserve interest rate decision as the Bank of Japan (BoJ) sticks to Quantitative and Qualitative Easing (QQE) with Yield-Curve Control (YCC), and the exchange rate climb towards the monthly high (148.35) as it carves a series of higher highs and lows.

US Dollar Forecast: USD/JPY Rebound Pulls RSI Out of Oversold Zone

USD/JPY trades to a fresh weekly high as the BoJ pledges to ‘achieve the price stability target of 2 percent in a sustainable and stable manner,’ and it seems as though the central bank is in no rush to switch gears as Governor Kazuo Ueda and Co. plan to ‘patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, speculation surrounding US monetary policy may influence USD/JPY as the Federal Open Market Committee (FOMC) appears to be on track to unwind the restrictive policy, and the US Dollar may face headwinds ahead of the Fed’s first meeting for 2024 as the central bank forecasts lower interest rates for next year.

US Economic Calendar

Until then, data prints coming out of the US may sway foreign exchange markets as the Personal Consumption Expenditure (PCE) Price Index is anticipated to slow further in November, with the core rate, the Fed’s preferred gauge for inflation, projected to narrow to 3.3% from 3.5% per annum the month prior.

Signs of easing price growth may produce a bearish reaction in the US Dollar as it puts pressure on the FOMC to implement a rate-cut sooner rather than later, but a higher-than-expected core PCE print may prop up USD/JPY as the BoJ continues to carry out its easing cycle.

With that said, expectations for lower US interest rates may produce headwind for the Greenback going into 2024, but the exchange rate may stage a larger rebound over the coming days as it carves a series of higher highs and lows.

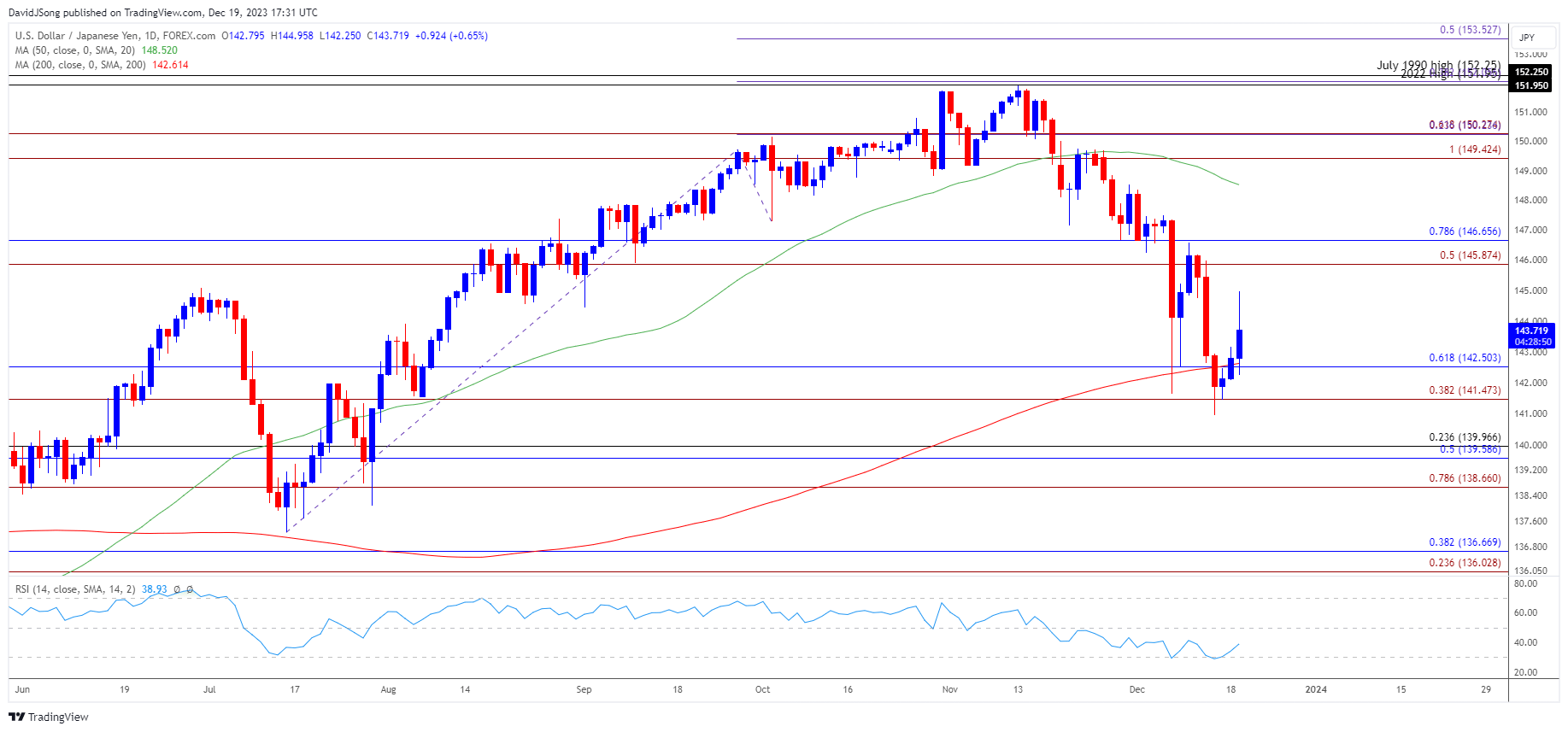

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY extends the rebound from the monthly low (140.96) to pull the Relative Strength Index (RSI) above 30, and the oscillator may continue to show the bearish momentum abating as it recovers from oversold territory.

- A break/close above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region raises the scope for a move towards the monthly high (148.35), with the next area of interest coming in around 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension).

- However, USD/JPY may respond to the negative slope in the 50-Day SMA (148.52) if it struggles to retrace the decline from the monthly high (148.35), with a close below the 141.50 (38.2% Fibonacci extension) to 142.50 (61.8% Fibonacci retracement) zone bringing the 138.70 (78.6% Fibonacci extension) to 140.00 (23.6% Fibonacci retracement) region on the radar.

Additional Market Outlooks:

US Dollar Forecast: USD/CAD Post-Fed Selloff Stalls Ahead of August Low

US Dollar Forecast: GBP/USD Pulls Back from Channel Resistance

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong