US Dollar Outlook: USD/JPY

USD/JPY mirrors the weakness in long-term US Treasury yields as it struggles to extend the advance from the start of the week, but the exchange rate may continue to track the positive slope in the 50-Day SMA (153.24) as it holds above the moving average.

US Dollar Forecast: USD/JPY Rate Mirrors Weakness in US Yields

USD/JPY extends the recent series of higher highs and lows to retrace the decline following the update to the US Consumer Price Index (CPI), and it remains to be seen if Japanese authorities will intervene in foreign exchange markets as the Bank of Japan (BoJ) shows little interest in pursuing a hiking-cycle.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In the meantime, developments coming out of the US may sway USD/JPY as the Federal Reserve endorses a data-dependent approach in managing monetary policy, and the central bank may retain a restrictive policy over the coming months as Chairman Jerome Powell and Co. ‘do not expect that it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

It seems as though the FOMC is in no rush to switch gears as Governor Christopher Waller warns that he needs to ‘see more evidence of moderating inflation before supporting any easing of monetary policy,’ with the official going onto say that ‘while the April inflation data represents progress, the amount of progress was small.’

US Economic Calendar

In turn, the Federal Open Market Committee (FOMC) Minutes may reflect a similar tone as the central bank is ‘prepared to maintain the current target range for the federal funds rate for as long as appropriate,’ and waning speculation for an imminent rate cut may keep USD/JPY afloat as the Fed continues to combat inflation.

At the same time, the FOMC Minutes may reveal a dissent within the committee amid signs of a slowing economy, and USD/JPY may struggle to retain the advance from the start of the week should Fed officials keep the door open for a rate-cut in 2024.

With that said, USD/JPY may continue to pullback from the weekly high (156.55) if it snaps the recent series of higher highs and lows, but the exchange rate may track the positive slope in the 50-Day SMA (153.24) as long as it holds above the moving average.

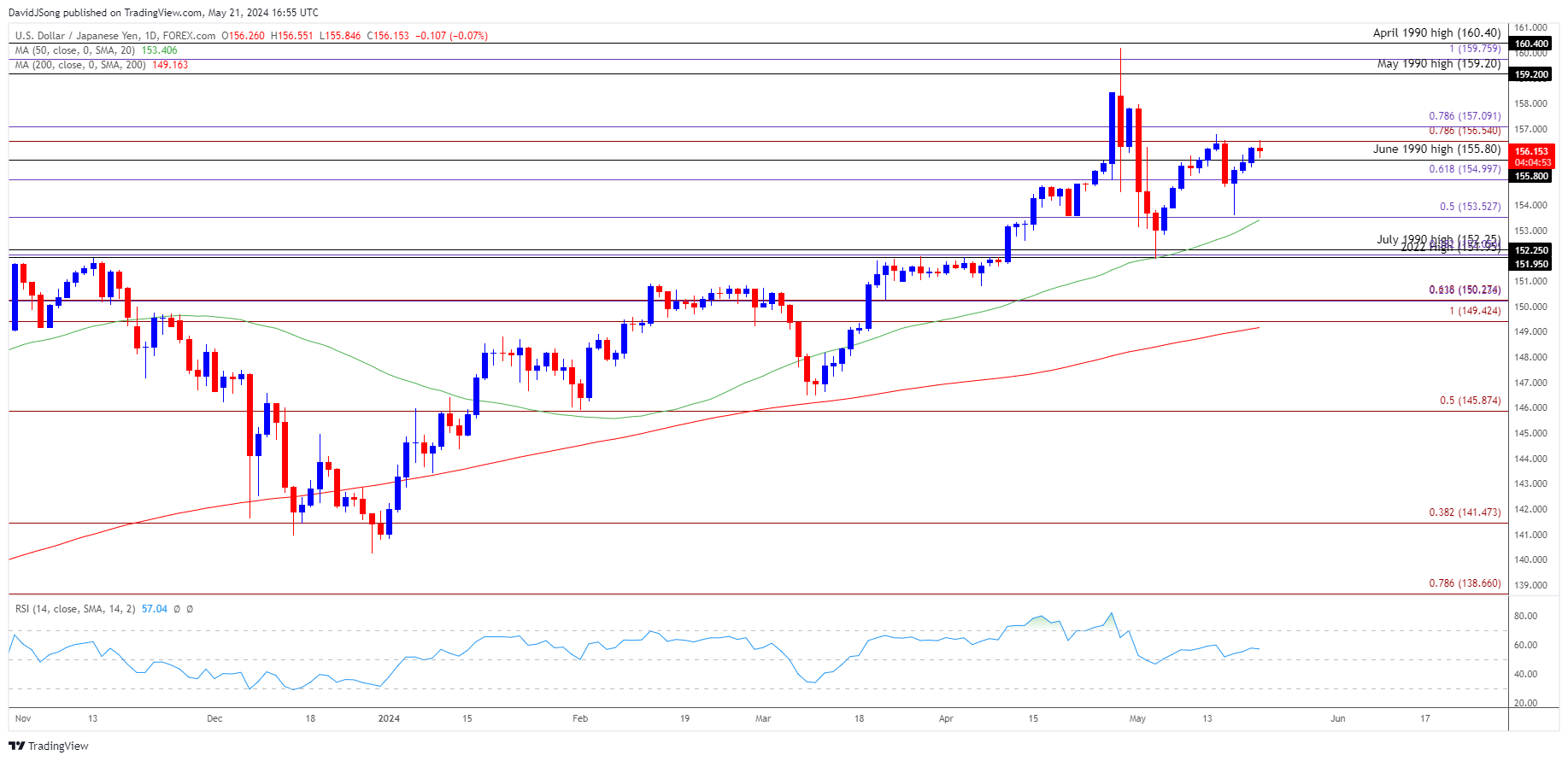

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- Keep in mind, USD/JPY bounced back from the 50-Day SMA (153.40) as the former-resistance zone around the July 1990 high (152.25) offered support, and the exchange rate may extend the recent series of higher highs and lows should it continue to track the positive slope in the moving average.

- A break/close above the 156.50 (78.6% Fibonacci extension) to 157.10 (78.6% Fibonacci extension) region may lead to a test of the monthly high (157.99), with the next area of interest coming in around 159.20 (May 1990 high) to 159.80 (100% Fibonacci extension).

- However, failure to trade back above the 156.50 (78.6% Fibonacci extension) to 157.10 (78.6% Fibonacci extension) region may curb the bullish price series, with a move below 155.00 (61.8% Fibonacci extension) bringing 153.50 (50% Fibonacci extension) back on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Clears April High Ahead of UK CPI

US Dollar Forecast: EUR/USD Pullback Keeps RSI Out of Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong