US Dollar Outlook: USD/JPY

USD/JPY climbs to a fresh monthly high (159.48) following a batch of positive data prints coming out of the US, with the seven-day rally in the exchange rate pushing the Relative Strength Index (RSI) towards overbought territory.

US Dollar Forecast: USD/JPY Rally Pushes RSI Towards Overbought Zone

USD/JPY extends the recent series of higher highs and lows as the S&P Purchasing Managers Index (PMI) for US Manufacturing unexpectedly climbs to 51.7 in June from 51.3 the month prior, with the gauge for service-based activity reflecting a similar dynamic as the index rises to 55.1 from 54.8 during the same period.

As a result, USD/JPY may continue to retrace the decline from the yearly high (160.22) amid the diverging paths between the Bank of Japan (BoJ) and Federal Reserve, and it seems as though Governor Kazuo Ueda and Co. are in no rush to pursue a rate-hike cycle as the central bank plans to adjust its non-standard measures over the coming months.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Meanwhile, the Federal Open Market Committee (FOMC) may stick to a restrictive policy as Governor Adriana Kugler warns that ‘inflation remains too high,’ with the official going onto say that ‘I believe that policy has more work to do’ while speaking at the Peterson Institute for International Economics.

The comments suggest the FOMC will retain a data-dependent approach in managing monetary policy as Governor Kugler insist that ‘we need to see more progress toward 2 percent inflation before I will have confidence that inflation is moving sustainably toward that objective,’ and the committee may keep US interest rates higher for longer as the economy shows little signs of an imminent recession.

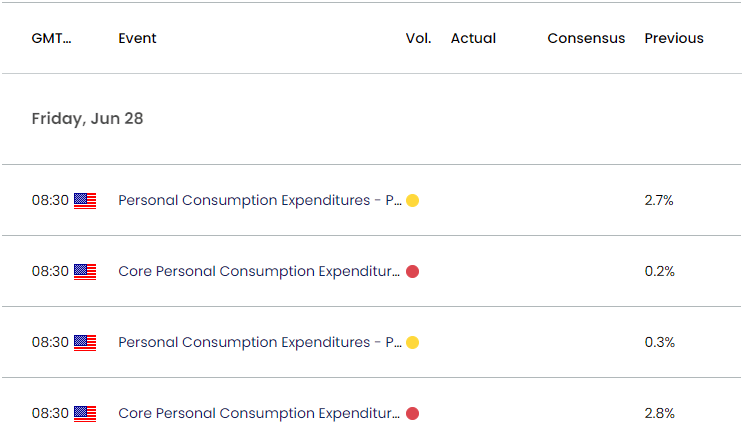

US Economic Calendar

In turn, the update to the US Personal Consumption Expenditure (PCE) Price Index, the Fed’s preferred gauge for inflation, may sway the near-term outlook for USD/JPY, and evidence of persistent price growth may keep the exchange rate afloat as it puts pressure on Chairman Jerome Powell and Co. to retain a restrictive policy.

At the same time, a slowdown in the headline and core PCE may encourage the FOMC to prepare US households and businesses for a change in regime, and signs of easing inflation may produce headwinds for the US Dollar as it raises the Fed’s scope to implement a rate-cut later this year.

With that said, lack of momentum to test the yearly high (160.22) may curb the recent series of higher highs and lows in USD/JPY, but a further advance in the exchange rate may push the Relative Strength Index (RSI) into overbought territory as the oscillator climbs to its highest level since April.

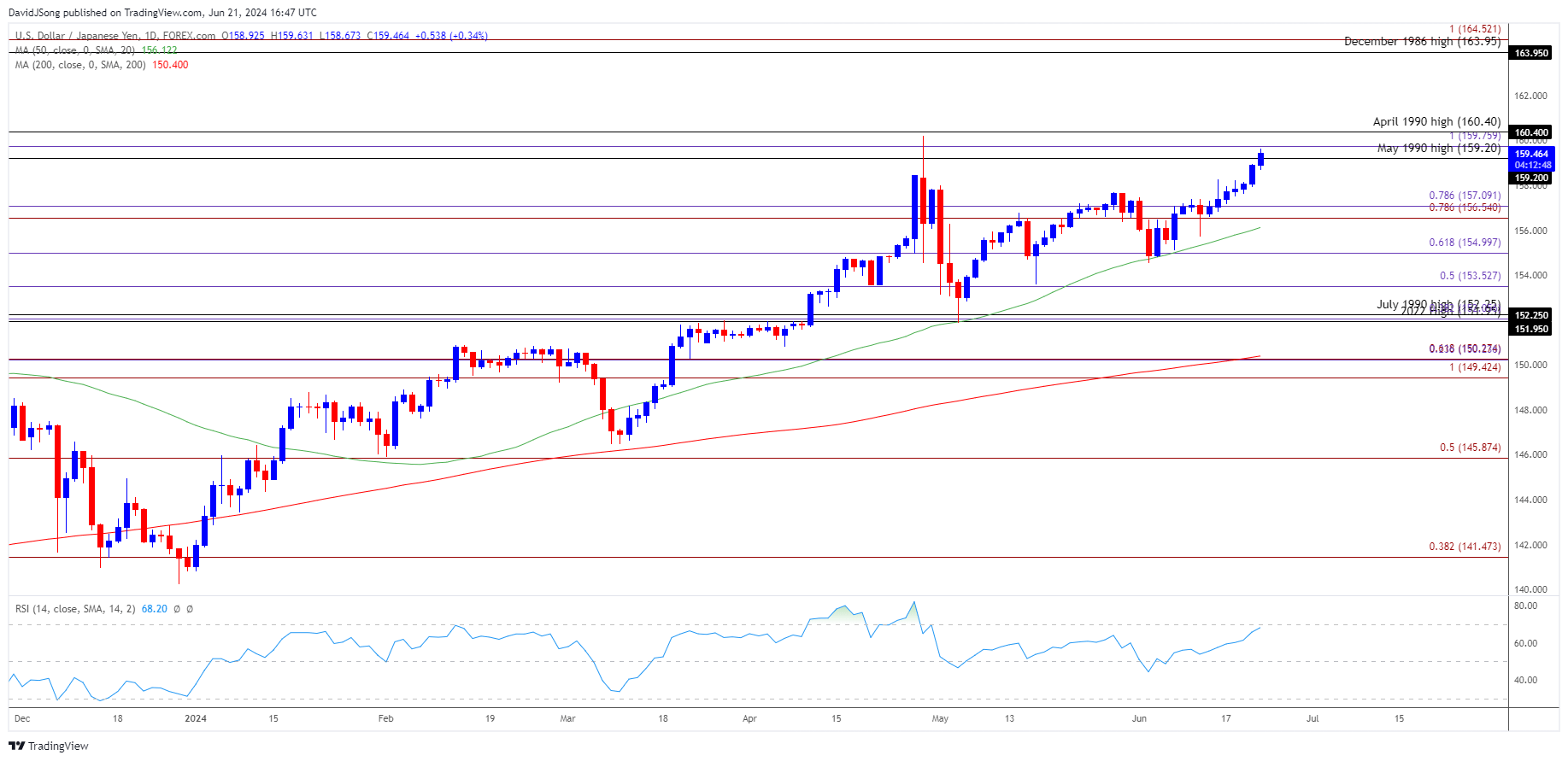

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY climbs to a fresh monthly high (159.48) as it stages a seven-day rally for the first time since March, with the recent strength in the exchange rate pushing the Relative Strength Index (RSI) towards overbought territory.

- A move above 70 in the RSI is likely to be accompanied by a further advance in USD/JPY like the price action from earlier this year, with a breach above the April high (160.22) raising the scope for a test of the April 1990 high (160.40).

- Next area of interest comes in around the December 1986 high (163.95) but lack of momentum to test the April high (160.22) may keep USD/JPY within a defined range and the RSI out of overbought territory.

- Failure to extend the recent series of higher highs and lows may push USD/JPY back towards the 156.50 (78.6% Fibonacci extension) to 157.10 (78.6% Fibonacci extension) region, with a breach below the 50-Day SMA (156.12) bringing 155.00 (61.8% Fibonacci extension) on the radar.

Additional Market Outlooks

Canadian Dollar Forecast: USD/CAD Ascending Channel Under Threat

US Dollar Forecast: EUR/USD Susceptible to Test of May Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong