US Dollar Outlook: USD/JPY

USD/JPY holds near the yearly high (147.95) ahead of the Federal Reserve and Bank of Japan (BoJ) interest rate decisions on tap for later this week, and the exchange rate continue to exhibit a bullish trend should the diverging path for monetary policy persists.

US Dollar Forecast: USD/JPY Pulls Back with Fed and BoJ on Tap

USD/JPY may stage further attempts to test the November 2022 high (148.83) as it seems to be tracking the positive slope in the 50-Day SMA (144.00), and fresh developments coming out of the Federal Open Market Committee (FOMC) may sway foreign exchange markets as the central bank is expected to keep US interest rates unchanged.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

More of the same from the FOMC may produce headwinds for the Greenback as the committee appears to be nearing the end of its hiking-cycle, and the update to the Summary of Economic Projections (SEP) may fuel speculation for a looming change in regime as Chairman Jerome Powell and Co. forecast lower interest rates for 2024.

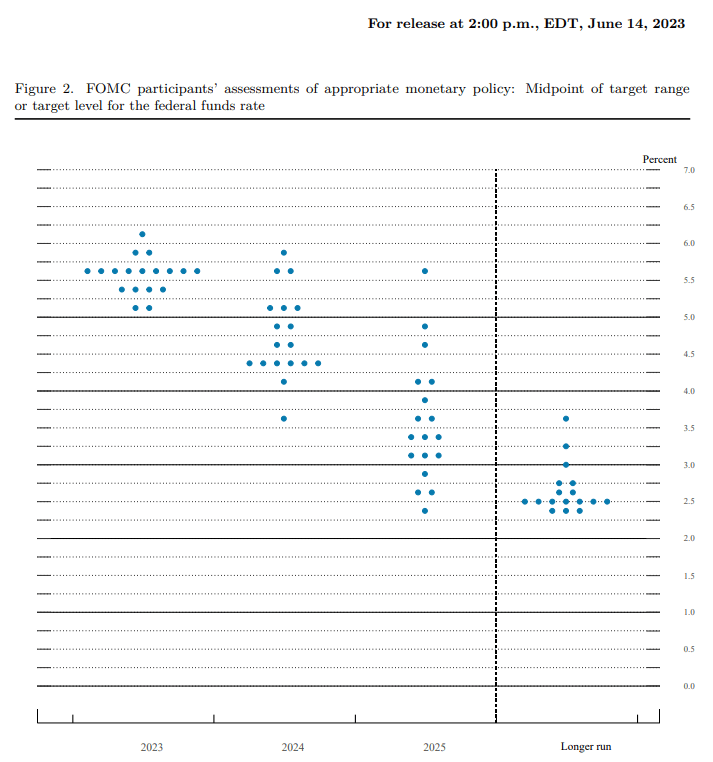

Fed Summary of Economic Projections (SEP)

According to the projections from June, Fed officials see lower interest rates in the years ahead as inflation is expected to cool, but another upward revision in the interest rate dot-plot may trigger a bullish reaction in the US Dollar as market participants prepare for a more restrictive policy.

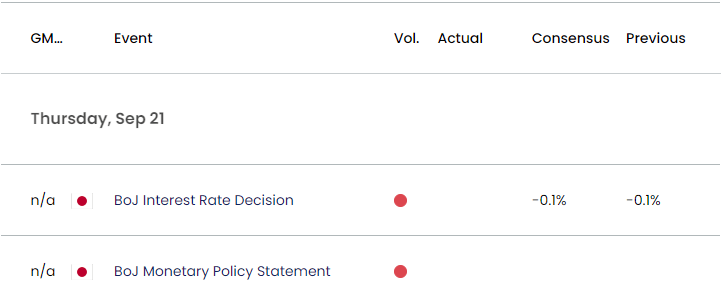

Japan Economic Calendar

As a result, USD/JPY may continue to reflect a bullish trend as the BoJ sticks to Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC), and it remains to be seen if Governor Kazuo Ueda and Co. will retain a dovish guidance as the central bank pledges to ‘patiently continue with monetary easing while nimbly responding to developments in economic activity and prices as well as financial conditions.’

With that said, the Fed and BoJ rate decisions may influence the near-term outlook for USD/JPY amid the different approach in managing monetary policy, and the exchange rate may stage further attempts to test the November 2022 high (148.83) as it seems to be tracking the positive slope in the 50-Day SMA (144.00).

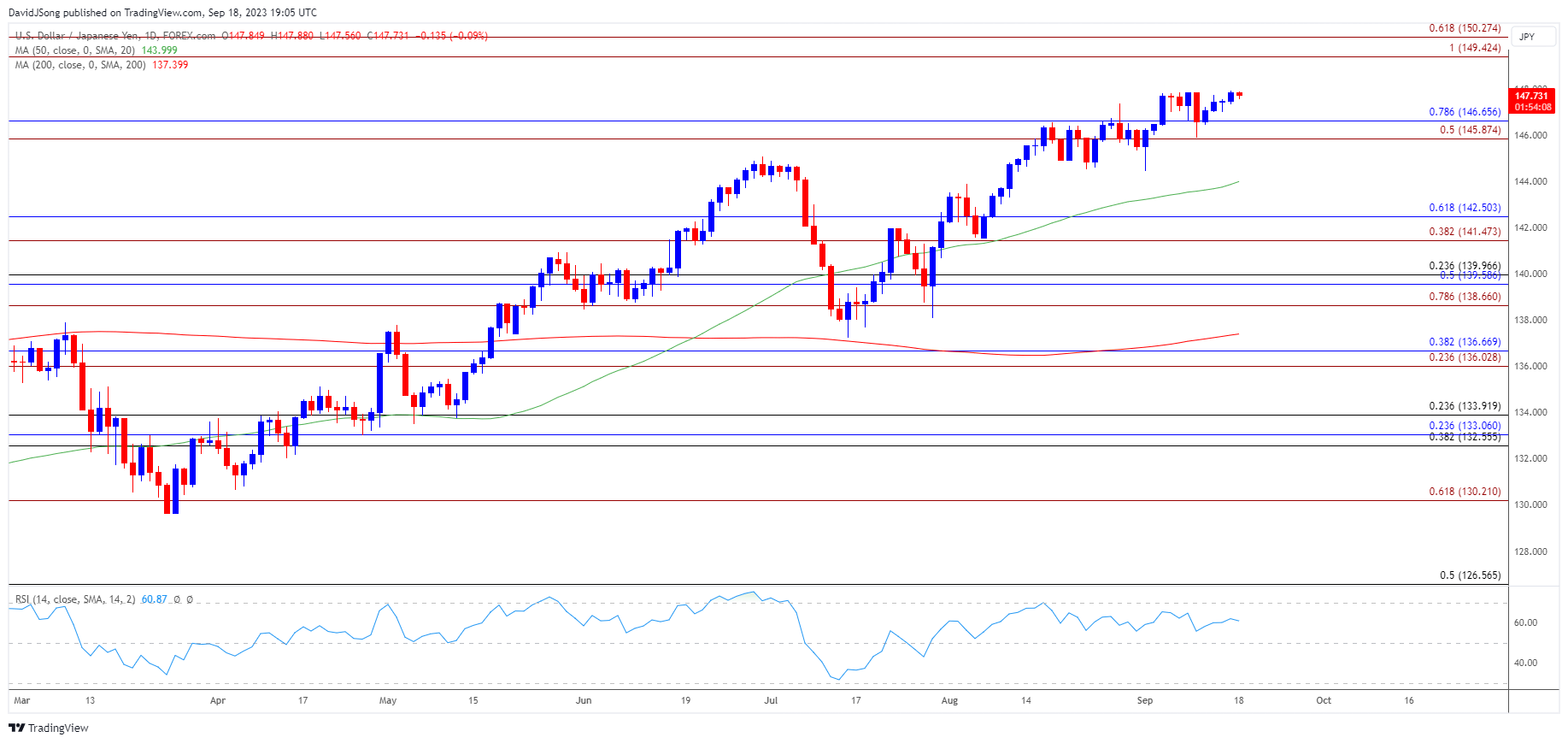

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY registered a fresh yearly high (147.95) during the previous week even as the Relative Strength Index (RSI) failed to push towards overbought territory, and the exchange rate may continue to exhibit a bullish trend as it seems to be tracking the positive slope in the 50-Day SMA (144.00).

- In turn, USD/JPY may stage further attempts to test the November 2022 high (148.83), with the next area of interest coming in around 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension).

- However, failure to test the November 2022 high (148.83) may lead to a larger pullback in USD/JPY, with a move below the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region bringing the monthly low (144.45) on the radar.

Additional Market Outlooks:

Canadian Dollar Forecast: USD/CAD Rebounds Ahead of Canada CPI

Euro Forecast: EUR/USD Post-ECB Selloff Puts May Low in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong