US Dollar Outlook: USD/JPY

USD/JPY registers a fresh monthly high (145.98) following the stronger-than-expected US Non-Farm Payrolls (NFP) report, and the exchange rate may attempt to test the December high (148.35) as it extends the series of higher highs and lows from earlier this week.

US Dollar Forecast: USD/JPY Post-NFP Advance Opens Up December High

USD/JPY retraces the decline following the Federal Reserve interest rate decision as the 216K rise in US NFP limits the central bank’s scope to unwind the restrictive policy, with the recent rebound in the exchange rate keeping the Relative Strength Index (RSI) out of oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The ongoing expansion in US employment may keep the Federal Open Market Committee (FOMC) on the sideline even though the central bank states that ‘a lower target range for the federal funds rate would be appropriate by the end of 2024,’ and data prints coming out of the US may continue to influence USD/JPY ahead of the next rate decision on January 31 as the Bank of Japan (BoJ) sticks to Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC).

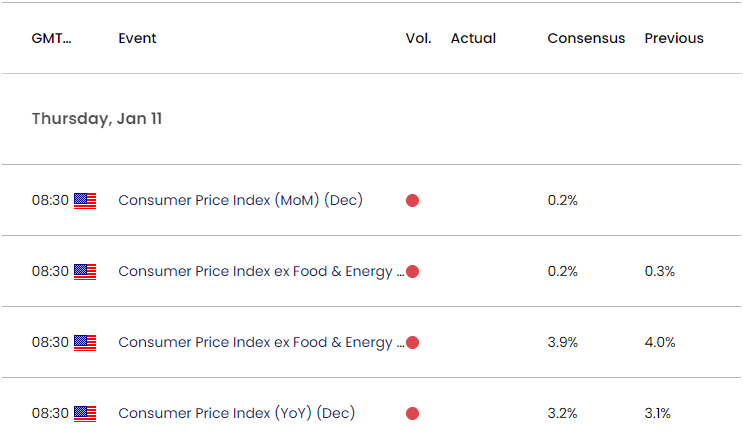

US Economic Calendar

As a result, the update to the Consumer Price Index (CPI) may curb the recent recovery in USD/JPY as the core rate is anticipated to show slowing inflation, but a stronger-than-expected print may generate a bullish reaction in the Greenback as it puts pressure on the Fed to keep US interest rates higher for longer.

Until then, swings in carry-trade interest may sway USD/JPY as Chairman Jerome Powell and Co. insist that the ‘economy could evolve in a manner that would make further increases in the target range appropriate,’ and the opening range for January in focus for the coming days as USD/JPY extends the advance from the start of the year.

With that said, the advance from the monthly low (140.82) may persist as USD/JPY carves a series of higher highs and lows, but the exchange rate may struggle to retrace the decline from the December high (148.35) if it responds to the negative slope in the 50-Day SMA (146.97).

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY seems to have reversed ahead of the December low (140.25) to keep the Relative Strength Index (RSI) out of oversold territory, with a break/close above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region raising the scope for a test of the December high (148.35).

- Next area of interest comes in around 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension), but USD/JPY may struggle to retain the recent series of higher highs and lows if it responds to the negative slope in the 50-Day SMA (146.97).

- Lack of momentum to break/close above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region may push USD/JPY back towards the 141.50 (38.2% Fibonacci extension) to 142.50 (61.8% Fibonacci retracement) zone, with a breach of the monthly low (140.82) bringing the December low (140.25) on the radar.

Additional Market Outlooks:

US Dollar Forecast: GBP/USD Rebounds within Ascending Channel

US Dollar Forecast: USD/CAD Recovery Pulls RSI Out of Oversold Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong