US Dollar Outlook: USD/JPY

USD/JPY trades to a fresh weekly high (149.48) as the US Consumer Price Index (CPI) points to sticky inflation, and the exchange rate may attempt to test the 2022 high (151.95) if it clears the opening range for October.

US Dollar Forecast: USD/JPY Pending Breakout of Monthly Opening Range

USD/JPY approaches the monthly high (150.16) as it extends the series of higher highs and lows from earlier this week, and the exchange rate may continue to track the positive slope in the 50-Day SMA (147.01) as the Federal Reserve keeps the door open to implement higher interest rates.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Looking ahead, it remains to be seen if the update to the US CPI will sway the Federal Open Market Committee (FOMC) as the headline reading holds steady at 3.7% in September, and signs of persistent price growth may push the central bank to further combat inflation as ‘the economic forecast prepared by the staff for the September FOMC meeting was stronger than the July projection.’

It seems as though the Fed is in no rush to switch gears as ‘a majority of participants judged that one more increase in the target federal funds rate at a future meeting would likely be appropriate,’ and the US Dollar may continue to outperform against its Japanese counterpart as the Bank of Japan (BoJ) sticks to Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC).

US Economic Calendar

However, the update to the U. of Michigan Consumer Sentiment survey may drag on the Greenback as the index is expected to narrow to 67.4 in October from 68.1 the month prior, and signs of a slowing economy may encourage the FOMC to keep US interest rates unchanged as ‘some judged it likely that no further increases would be warranted.’

At the same time, a positive development may keep USD/JPY afloat as it raises the Fed’s scope to pursue a more restrictive policy, and the exchange rate may continue to retrace the decline from the monthly high (150.16) as it extends the series of higher highs and lows from earlier this week.

Keep in mind, a further depreciation in the Japanese Yen may bring increased attention to foreign exchange markets as it fuels speculation for a currency intervention, and USD/JPY may face increased volatility over the coming days as long-term US Treasury yields rebound from fresh monthly lows.

With that said, USD/JPY may continue to track the positive slope in the 50-Day SMA (147.01) as it reverses ahead of the monthly low (147.29), but the exchange rate may struggle to hold above the moving average if it fails to break out of the opening range for October.

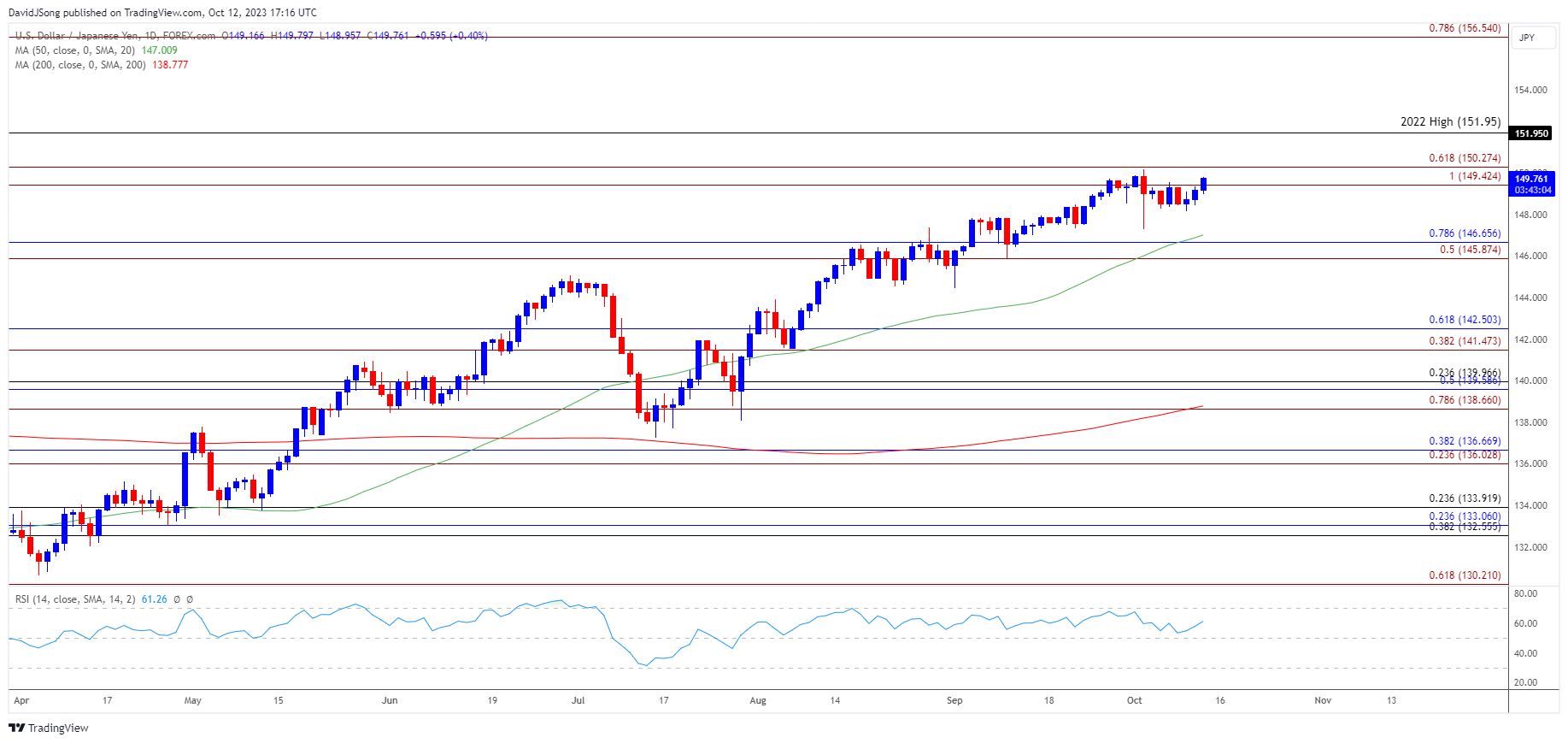

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY may track the positive slope in the 50-Day SMA (147.01) as it bounces back ahead of the October low (147.29), with the exchange rate approaching the monthly high (150.16) as it extends the series of higher highs and lows from earlier this week.

- A break/close above the 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension) area brings the 2022 high (151.95) on the radar, but USD/JPY may snap the bullish price action if it fails to clear the opening range for October.

- Lack of momentum to hold above the moving average may push USD/JPY towards the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) region, with the next area of interest coming in around the September low (144.45).

Additional Market Outlooks:

US Dollar Forecast: USD/CAD Defends Monthly Low Ahead of US CPI

GBP/USD Forecast: Test of Former Support Zone Looms

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong