USD/JPY Outlook

USD/JPY extends the advance from earlier this week to clear the June 1990 high (155.80), and the exchange rate may continue to appreciate ahead of the Federal Reserve meeting as the Relative Strength Index (RSI) holds in overbought territory.

US Dollar Forecast: USD/JPY Clears June 1990 High Ahead of Fed Meeting

USD/JPY trades to a fresh yearly high (157.79) as the Bank of Japan (BoJ) keeps the benchmark interest rate in its current threshold of 0.0% to 0.1%, and it seems as though Governor Kazuo Ueda and Co. are in no rush to embark on a hiking-cycle the ‘Bank will conduct monetary policy as appropriate, in response to developments in economic activity and prices as well as financial conditions.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the diverging paths between the BoJ and Federal Reserve may keep USD/JPY afloat as Chairman Jerome Powell and Co. see a lack of progress in bringing down inflation towards the 2% target, and it remains to be seen if the central bank will adjust the forward guidance for monetary policy as the update to the Personal Consumption Expenditure (PCE) Price Index shows the core rate, the Fed’s preferred gauge for inflation, holding steady at 2.8% in March.

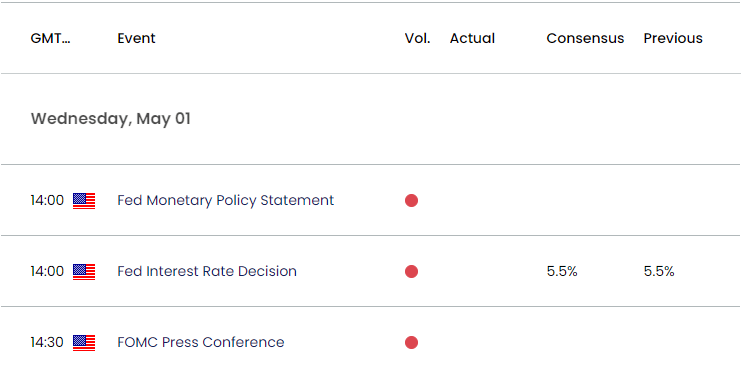

US Economic Calendar

As a result, the FOMC rate decision on May 1 may generate a bullish reaction in the Greenback if the central bank prepares to further combat inflation, and waning expectations for an imminent change in regime may push USD/JPY fresh yearly highs as the ‘Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably down toward 2 percent.’

However, more of the same from the Fed may produce headwinds for the US Dollar should Chairman Powell and Co. reiterate that ‘it will likely be appropriate to begin dialing back policy restraint at some point this year,’ and a dovish forward guidance may curb the recent rally in USD/JPY as market participants brace for lower US interest rates.

With that said, the Fed rate decision may sway the near-term outlook for USD/JPY as data prints coming out of the US warn of persistent inflation, but the overbought reading in the Relative Strength Index (RSI) is likely to be accompanied by a further advance in the exchange rate like the price action from last year.

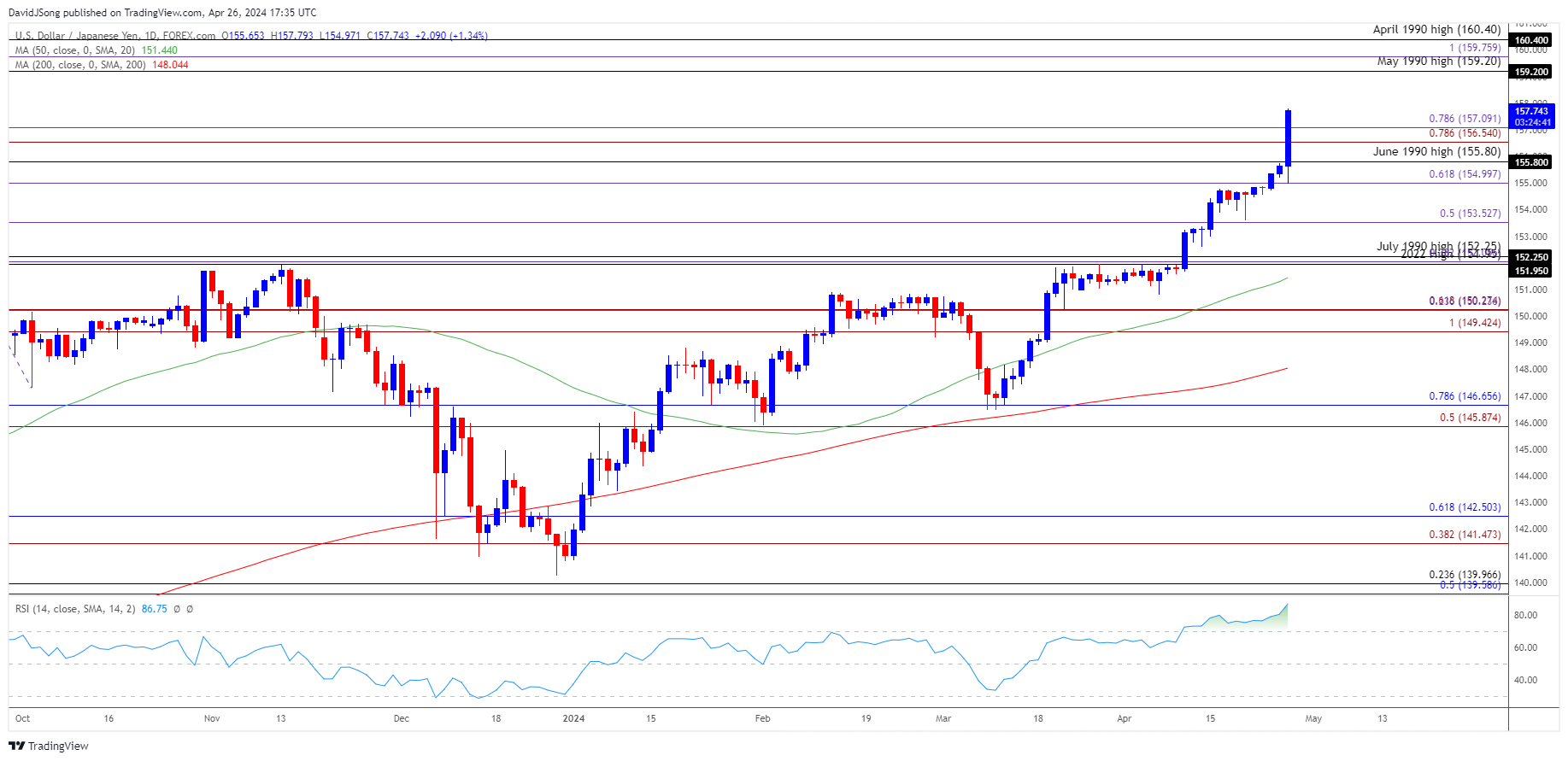

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY clears the June 1990 high (155.80) to keep the Relative Strength Index (RSI) above 70, and the exchange rate may continue to trade to fresh yearly highs as long as the oscillator holds above 70.

- A further advance in USD/JPY may lead to a test of the May 1990 high (159.20), with a break/close above 159.80 (100% Fibonacci extension) opening up the April 1990 (160.40).

- However, failure to test the May 1990 high (159.20) may pull the RSI back from overbought territory, with a move below the 156.50 (78.6% Fibonacci extension) to 157.10 (78.6% Fibonacci extension) region bringing the June 1990 high (155.80) back on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Recovery Continues Ahead of US PCE Report

US Dollar Forecast: EUR/USD Susceptible to Bear Flag Formation

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong