US Dollar Outlook: USD/JPY

USD/JPY attempts to trade back above the 50-Day SMA (148.34) despite the kneejerk reaction to the weaker-than-expected US Retail Sales Report, and the exchange rate may further retrace the decline from the start of the month as it bounces back ahead of the February low (145.90).

US Dollar Forecast: USD/JPY Attempts to Climb Back Above 50-Day SMA

USD/JPY seems to be mirroring the recovery in long-term US Treasury yields as it climbs a fresh weekly high (148.32), and the exchange rate may stage a larger recovery ahead of the Federal Reserve interest rate decision on March 20 should the Bank of Japan (BoJ) continue to carry out Quantitative and Qualitative Easing (QQE) with Yield Curve Control (YCC).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Japan Economic Calendar

It remains to be seen if the BoJ will alter the course for monetary policy as Governor Kazuo Ueda warns that ‘weakness has been seen in some data’ while speaking in front of parliament, and more of the same from the central bank may keep USD/JPY afloat as the central bank remains reluctant to switch gears.

However, an adjustment in BoJ policy may drag on USD/JPY should the central bank move away from its easing cycle, and a change in regime may also sway carry trade interest as Fed Chairman Jerome Powell tells US lawmakers that ‘it will likely be appropriate to begin dialing back policy restraint at some point this year.’

With that said, the BoJ meeting may influence USD/JPY ahead of the Fed rate decision even as long-term US yields push higher, but the exchange rate may further retrace the decline from the start of the month as it bounces back ahead of the February low (145.90).

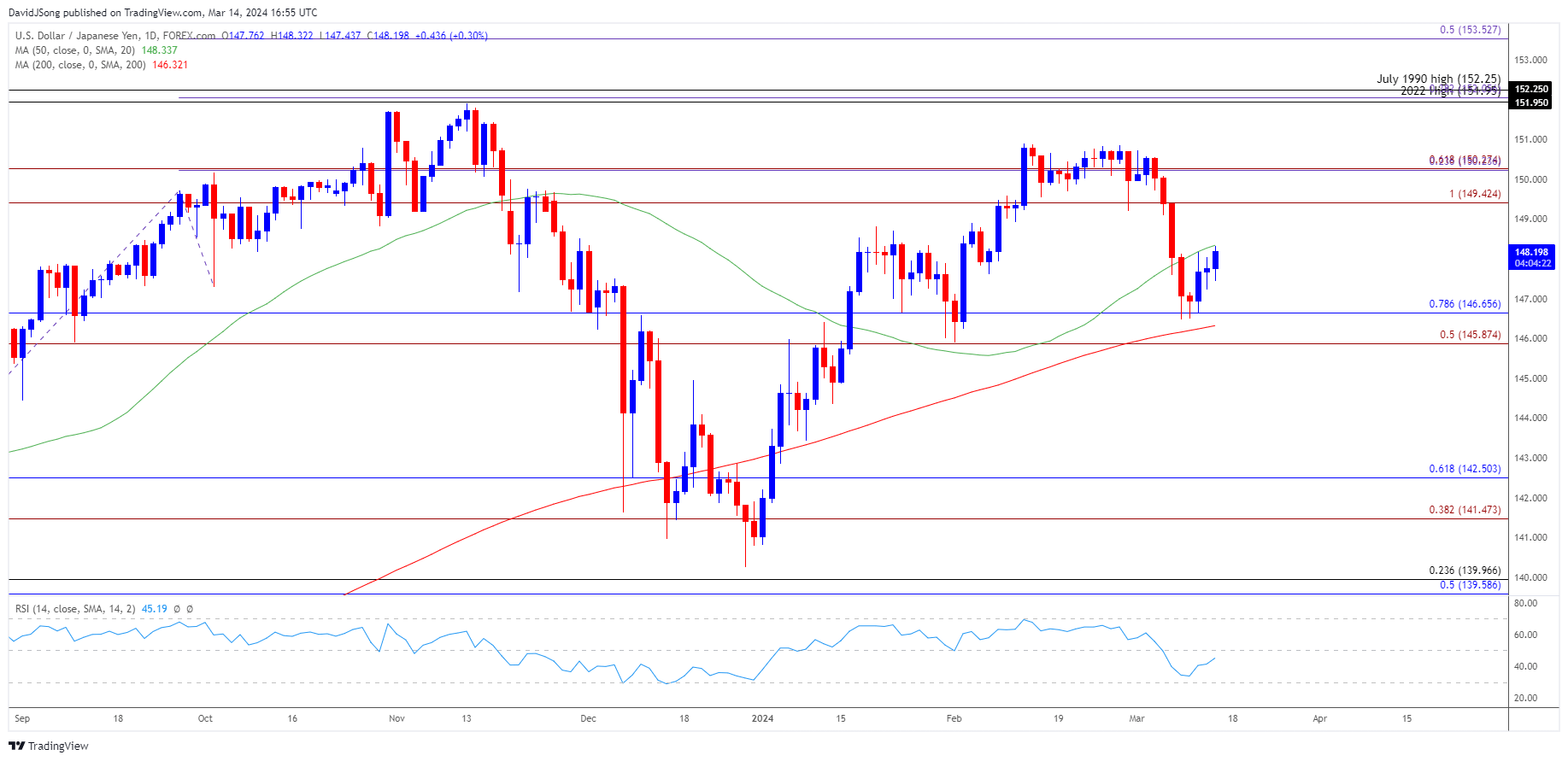

USD/JPY Price Chart – Daily

Chart Prepared by David Song, Strategist; USD/JPY on TradingView

- USD/JPY attempts to trade back above the 50-Day SMA (148.34) as it registers a fresh weekly high (148.32), and the exchange rate may track the positive slope in the moving average as it appears to be reversing ahead of the February low (145.90).

- A breach above the 149.40 (100% Fibonacci extension) to 150.30 (61.8% Fibonacci extension) region raises the scope for a test of the monthly high (150.73), with a move above the February high (150.89) opening up the 2023 high (151.91).

- However, failure to holds above the 145.90 (50% Fibonacci extension) to 146.70 (78.6% Fibonacci retracement) area may push USD/JPY towards the 141.50 (38.2% Fibonacci extension) to 142.50 (61.8% Fibonacci retracement) zone, with the next region of interest coming in around the January low (140.82).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Holds Above 50-Day SMA Despite Sticky US CPI

US Dollar Forecast: USD/CAD No Longer Trades in Ascending Channel

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong