US Dollar Outlook: USD/CAD

USD/CAD consolidates after struggling to test the December high (1.3620), but the exchange rate may attempt to break out of its recent range as it seems to be trading within an ascending channel.

US Dollar Forecast: USD/CAD Trades in Ascending Channel Ahead of BoC

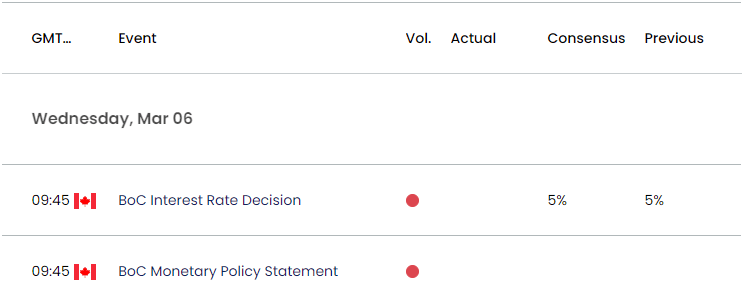

USD/CAD may face range bound conditions ahead of the Bank of Canada (BoC) rate decision as the central bank is expected to retain the status quo, and more of the same from the central bank may keep the exchange rate within the February range as the ‘Council is still concerned about risks to the outlook for inflation.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Canada Economic Calendar

In turn, the BoC may continue to tame speculation for an imminent change in regime as the ‘Governing Council wants to see further and sustained easing in core inflation,’ but an adjustment in the forward guidance for monetary policy may drag on the Canadian Dollar should Governor Tiff Macklem and Co. may gradually prepare Canadian households and businesses for lower interest rates.

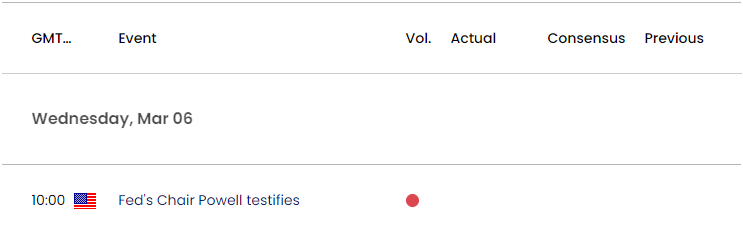

US Economic Calendar

In addition, the semi-annual Fed testimony may sway USD/CAD as Chairman Jerome Powell is schedule to speak in front of Congress, and it remains to be seen if Powell will continue to rule out a March rate as Fed officials forecast a less restrictive policy in 2024.

With that said, USD/CAD may track the February range amid the failed attempt to test the December high (1.3620), but the range bound price action may end up short lived as the exchange rate appears to be trading within an ascending channel.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- Keep in mind, USD/CAD registered the February high (1.3606) as it coiled above the 50-Day SMA (1.3441), and the exchange rate appears to be trading within an ascending channel as the moving average now reflects a positive slope.

- A break/close above 1.3630 (38.2% Fibonacci retracement) opens up 1.3810 (161.8% Fibonacci extension), with the next area of interest coming in around the 2023 high (1.3899).

- However, USD/CAD may track the February range if it fails to hold within the ascending channel, with a break/close below 1.3440 (23.6% Fibonacci retracement) bringing the monthly low (1.3366) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rate Fails to Test February High

US Dollar Forecast: EUR/USD Vulnerable to Negative Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong