US Dollar Outlook: USD/CAD

USD/CAD rebounds ahead of the weekly low (1.3359) following the stronger-than-expected US Non-Farm Payrolls (NFP) report, but the exchange rate may track the negative slope in the 50-Day SMA (1.3443) if it struggles to hold above the moving average.

US Dollar Forecast: USD/CAD Trades Back Above 50-Day SMA on Upbeat NFP

USD/CAD may attempt to retrace the decline from the January high (1.3542) as the 353K rise in US Non-Farm Payrolls (NFP) widens the Federal Reserve’s scope to further combat inflation, and the Federal Open Market Committee (FOMC) may retain its restrictive policy at the next interest rate decision on March 20 as Chairman Jerome Powell tames speculation for an imminent rate cut.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Until then, data prints coming out of the US and Canada may sway USD/CAD as both the Fed and Bank of Canada (BoC) seem to at the end of their hiking-cycle, and it remains to be seen if Governor Tiff Macklem and Co. will further adjust the forward guidance for monetary policy as the central bank anticipates growth to ‘remain close to zero through the first quarter of 2024.’

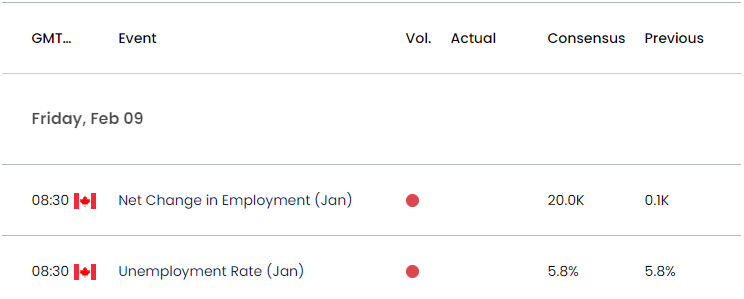

Canada Economic Calendar

Looking ahead, the update to Canada’s Employment report may sway USD/CAD as the economy is projected to add 20.0K jobs in January following the 0.1K rise the month prior, and a positive development may generate a bullish reaction in the Canadian Dollar as it encourages the BoC to keep interest rates on hold.

However, a weaker-than-expected employment report may drag on the Canadian Dollar as it puts pressure on the BoC to switch gears, and the central bank may prepare Canadian households and businesses for a less restrictive policy at its next meeting on March 6 as ‘the economy now looks to be operating in modest excess supply.’

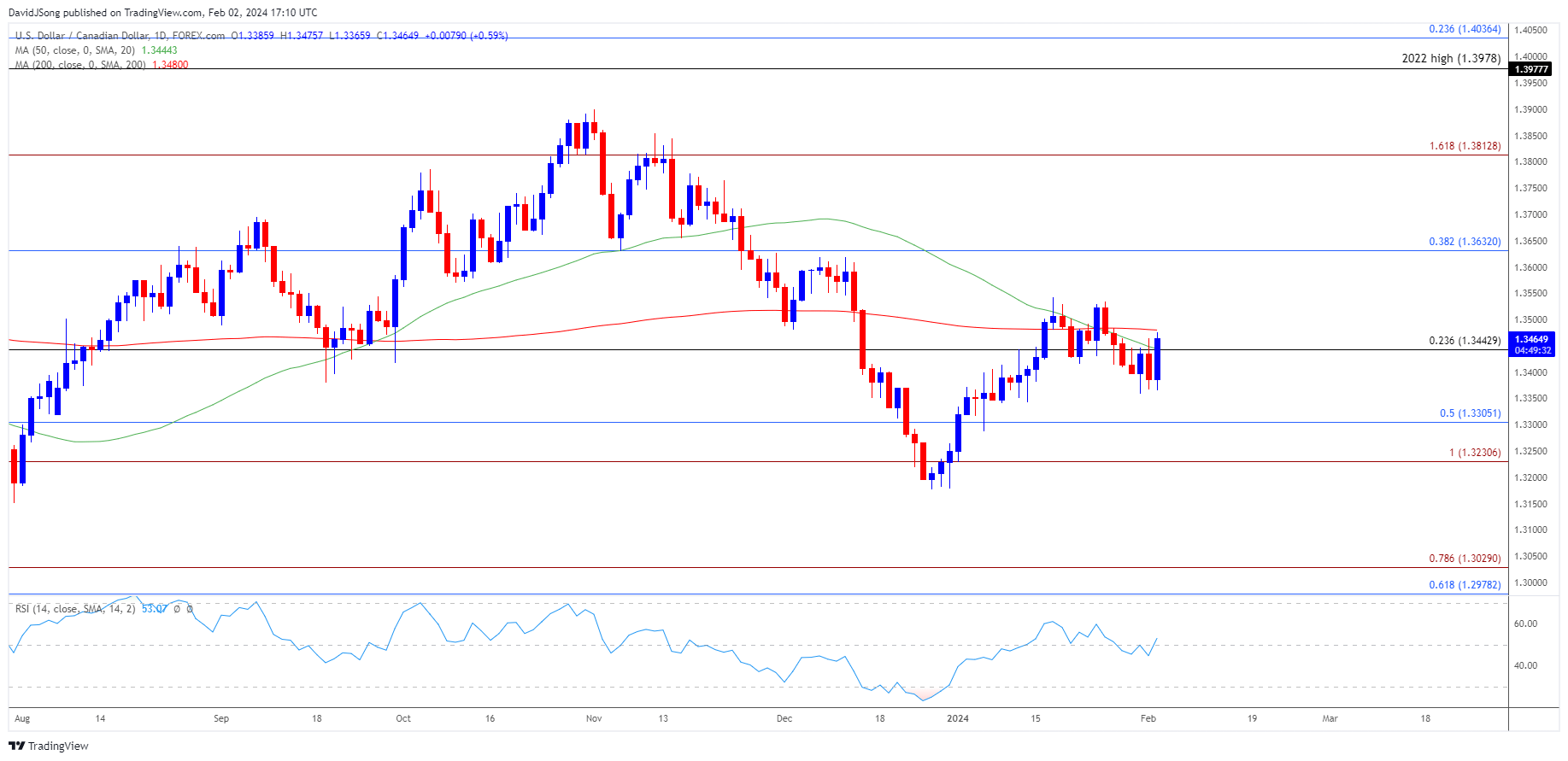

With that said, the opening range for February is in focus for USD/CAD as it attempts to trade back above the 50-Day SMA (1.3444), but the exchange rate struggle to retain the advance from the January low (1.3229) should it track the negative slope in the moving average.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD bounces back ahead of the weekly low (1.3359) to trade back above the 50-Day SMA (1.3444), with a breach above the January high (1.3542) raising the scope for a move towards the December high (1.3620).

- A break/close above 1.3630 (38.2% Fibonacci retracement) opens up 1.3810 (161.8% Fibonacci extension), but USD/CAD may struggle to retain the advance from the January low (1.3229) should it track the negative slope in the moving average.

- A break/close below the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) region brings the December low (1.3177) on the radar, with the next area of interest coming in around the 2023 low (1.3093).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Vulnerable on Close Below 50-Day SMA

US Dollar Forecast: USD/JPY Bull Flag Under Threat with Fed on Tap

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong