US Dollar Outlook: USD/CAD

USD/CAD remains under pressure following the softer-than-expected US Non-Farm Payrolls (NFP) report to register a fresh monthly low (1.3629), and the exchange rate may continue to give back the advance October low (1.3562) if it no longer responds to the positive slope in the 50-Day SMA (1.3630).

US Dollar Forecast: USD/CAD Tests Positive Slope in 50-Day SMA

USD/CAD extends the decline from the start of the month as the Greenback struggles to hold its ground against most of its major counterparts, and the exchange rate may continue to carve a series of lower highs and lows as signs of slowing job growth in the US encourages the Federal Reserve to stay on the sidelines.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

As a result, fresh remarks from Fed Chairman Jerome Powell may sway foreign exchange markets as the central bank seems to be at or nearing the end of its hiking-cycle, and the Greenback may face headwinds ahead of the next interest rate decision on December 13 amid speculation of seeing US interest rates unchanged over the remainder of the year.

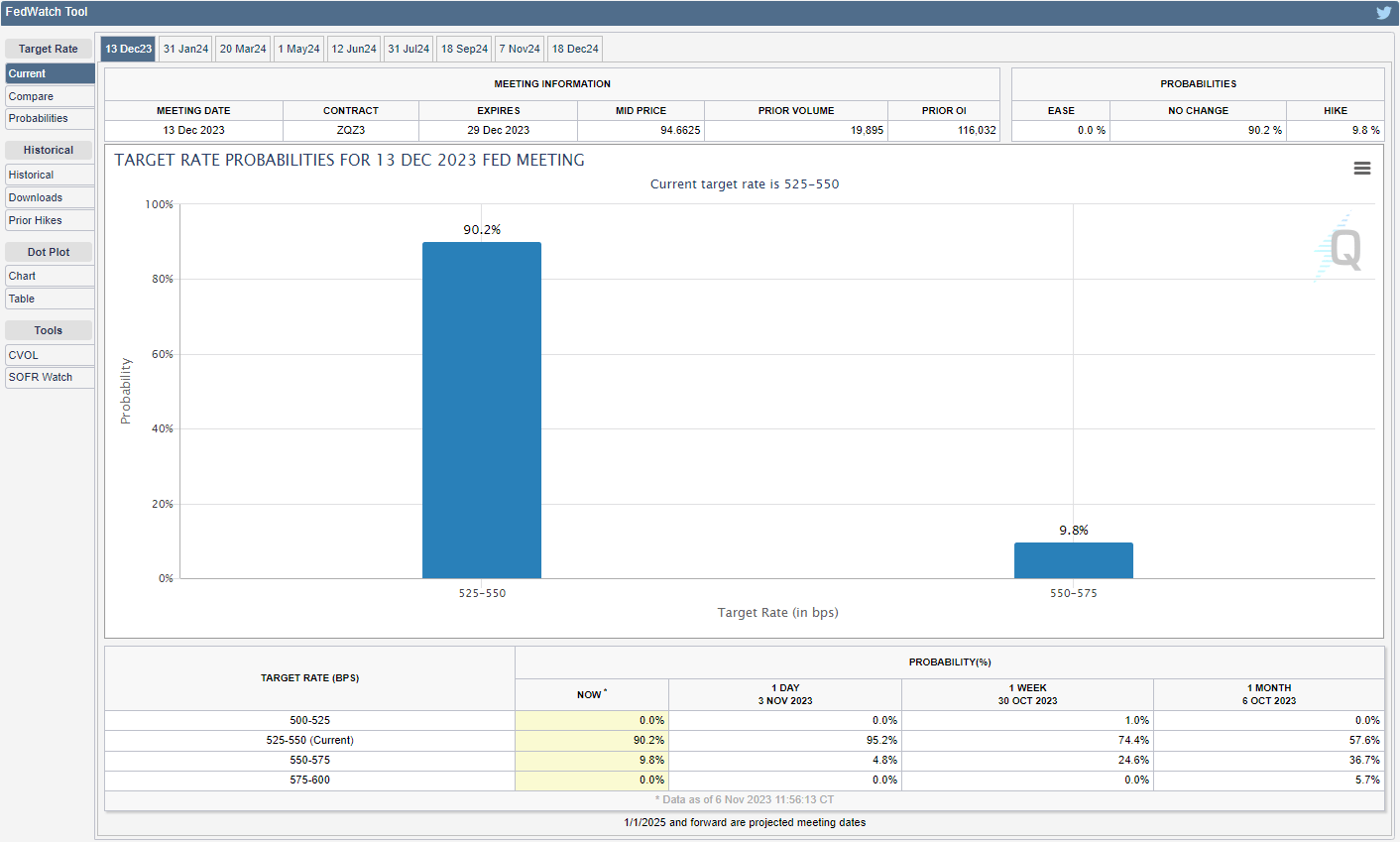

CME FedWatch Tool

Source: CME

The CME FedWatch Tool currently reflects a 90% probability the Federal Open Market Committee (FOMC) will stick to the status quo at its last meeting for 2023, and little hints of another Fed rate-hike may drag on USD/CAD as market participants brace for a looming change in regime.

However, Chairman Powell may keep the door open to pursue a more restrictive policy as the ‘process of getting inflation sustainably down to 2 percent has a long way to go,’ and USD/CAD may attempt to retrace the decline from the start of the month should it clear the bearish price series carried over from last week.

With that said, speculation for higher US interest rates may prop up USD/CAD should Chairman Powell offer a hawkish forward guidance for monetary policy, but the exchange rate may continue to give back the advance from the October low (1.3562) if it no longer responds to the positive slope in the 50-Day SMA (1.3630).

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD carves a series of lower highs and lows after registering a fresh yearly high (1.3899) at the start of the month, with a break/close below 1.3630 (38.2% Fibonacci retracement) raising the scope for a test of the October low (1.3562).

- Next area of interest comes in around 1.3440 (23.6% Fibonacci retracement), but USD/CAD may try to mirror the price action from earlier this year if it tracks the positive slope in the 50-Day SMA (1.3630).

- Failure to break/close below 1.3630 (38.2% Fibonacci retracement) may curb the bearish price series in USD/CAD, with a move above 1.3810 (161.8% Fibonacci extension) bringing the monthly high (1.3899) on the radar.

Additional Market Outlooks

Euro Forecast: EUR/USD Clears October Range on Soft US NFP Report

GBP/USD Forecast: Former Support Zone Back in Focus

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong