US Dollar Outlook: USD/CAD

USD/CAD appears to have reversed ahead of the November high (1.3899) as it weakens for the third consecutive day, and the exchange rate may continue to give back the advance from the monthly low (1.3478) as the Relative Strength Index (RSI) falls back from overbought territory.

US Dollar Forecast: USD/CAD Reverses Ahead of November High

Keep in mind, the recent decline in USD/CAD has generated a sell signal in the RSI as the oscillator pushed below 70, but the exchange rate may continue to trade within the ascending channel from earlier this year if it tracks the positive slope in the 50-Day SMA (1.3569).

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the pullback in USD/CAD may end up short lived as Federal Reserve officials show a greater willingness to retain a restrictive policy, and developments coming out of the US may sway the exchange rate ahead of the Fed rate decision on May 1 as the central bank carries out a data dependent approach in managing monetary policy.

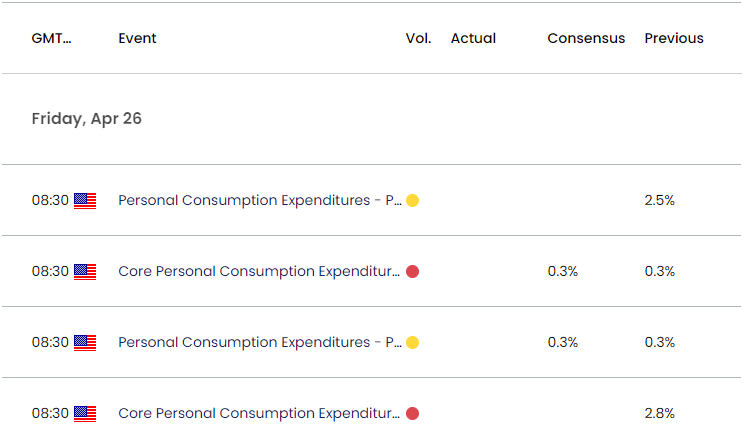

US Economic Calendar

As a result, the update to the US Personal Consumption Expenditure (PCE) Price Index may influence USD/CAD as the Federal Open Market Committee (FOMC) continues to combat inflation, and indications of persistent price growth may spark a bullish reaction in the Greenback as it puts pressure on Chairman Jerome Powell and Co. to keep US interest rates higher for longer.

At the same time, a downtick in the core PCE, the Fed’s preferred gauge for inflation, may produce headwinds for the US Dollar as it raises the central bank’s scope to pursue a less restrictive policy, and the FOMC may further adjust its forward guidance over the coming months as the committee starts to discuss ‘issues related to slowing the pace of decline in our securities holdings.’

Until then, USD/CAD face a larger pullback amid the failed attempt to test the November high (1.3899), and the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it falls back from overbought territory.

With that said, USD/CAD may continue to give back the advance from the monthly low (1.3478) as a RSI sell signal materializes, but exchange rate may continue to trade within the ascending channel from earlier this year if it continues to track the positive slope in the 50-Day SMA (1.3569).

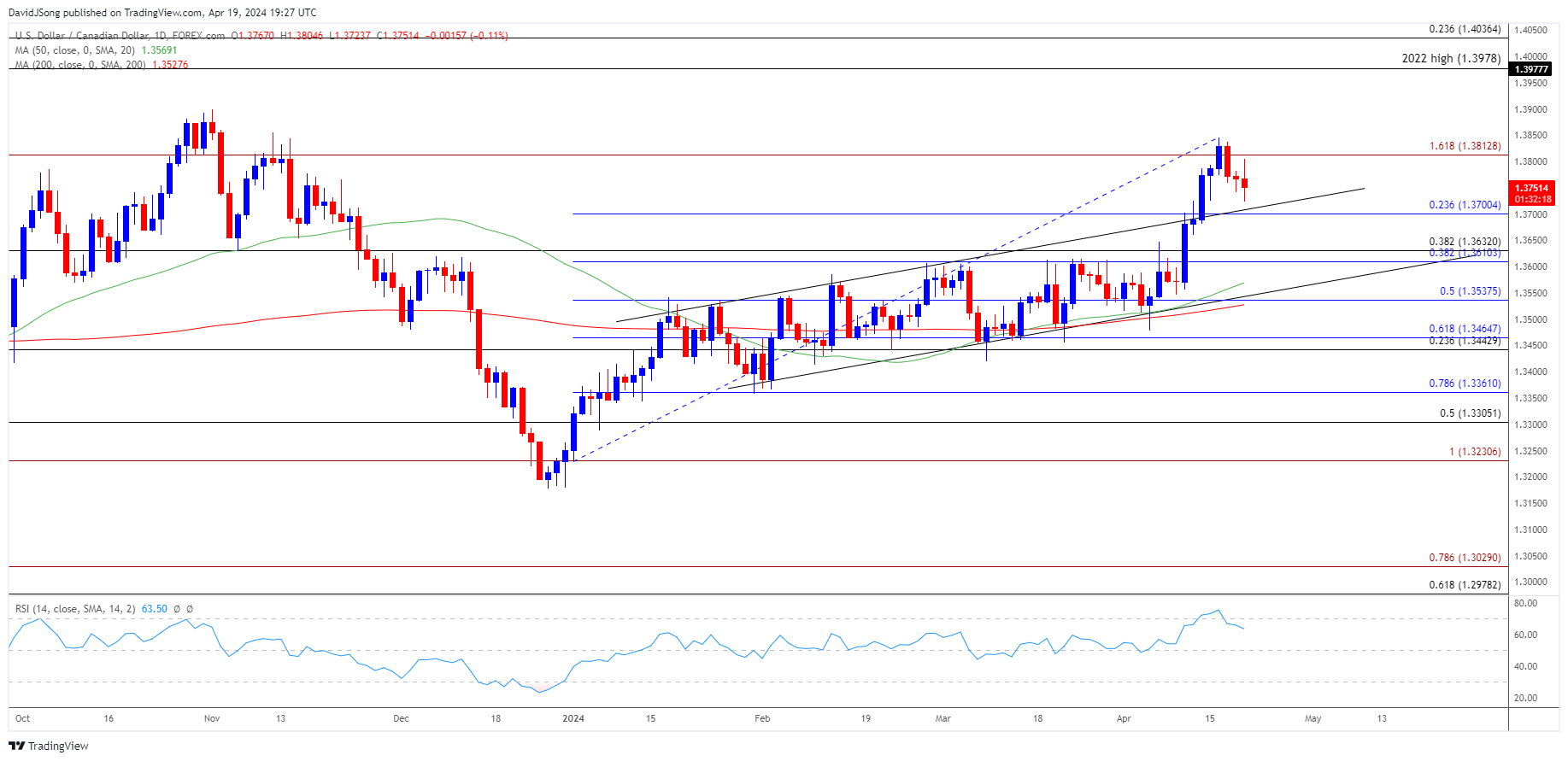

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appeared to be on track to test the November high (1.3899) as the recent advance in the exchange rate pushed the Relative Strength Index (RSI) above 70 for the first time this year, but lack of momentum to hold above 1.3810 (161.8% Fibonacci extension) may lead to a further pullback in the exchange rate as the oscillator moves away from overbought territory.

- A break/close below 1.3700 (23.6% Fibonacci retracement) may push USD/CAD towards the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region, with the next area of interest coming in around 1.3540 (50% Fibonacci retracement).

- However, USD/CAD may continue to trade within the ascending channel from earlier this year if it tracks the positive slope in the 50-Day SMA (1.2569), with a breach above the November high (1.3899) opening up the 2022 high (1.3978).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rebound Keeps RSI Out of Oversold Zone

US Dollar Forecast: AUD/USD Takes Out February Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong