US Dollar Outlook: USD/CAD

USD/CAD recovers after clearing the August low (1.3184), with the recent rebound in the exchange rate pulling the Relative Strength Index (RSI) above 30 to indicate a textbook buy signal.

US Dollar Forecast: USD/CAD Recovery Pulls RSI Out of Oversold Zone

USD/CAD extends the rebound from the December low (1.3177) to stage a five-day rally, and the exchange rate may continue to retrace the decline following the Federal Reserve interest rate decision as the RSI moves away from oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, USD/CAD may continue to carve a series of higher highs and lows ahead of the employment reports coming out of the US and Canada, and it remains to be seen if the data prints will sway the exchange rate as the Federal Open Market Committee (FOMC) and Bank of Canada (BoC) endorse a wait-and-see approach in managing monetary policy.

US/Canada Economic Calendar

Until then, the opening range for 2024 is in focus for USD/CAD as both the US and Canada are anticipated to add jobs in December, but the exchange rate may track the broad range from the second half of 2023 as it reverses course ahead of the July low (1.3093).

With that said, USD/CAD may extend the advance from the start of 2024 as it reflects a bullish price series, and the exchange rate may attempt to retrace the decline from the December high (1.3620) as the Relative Strength Index (RSI) recovers from oversold territory.

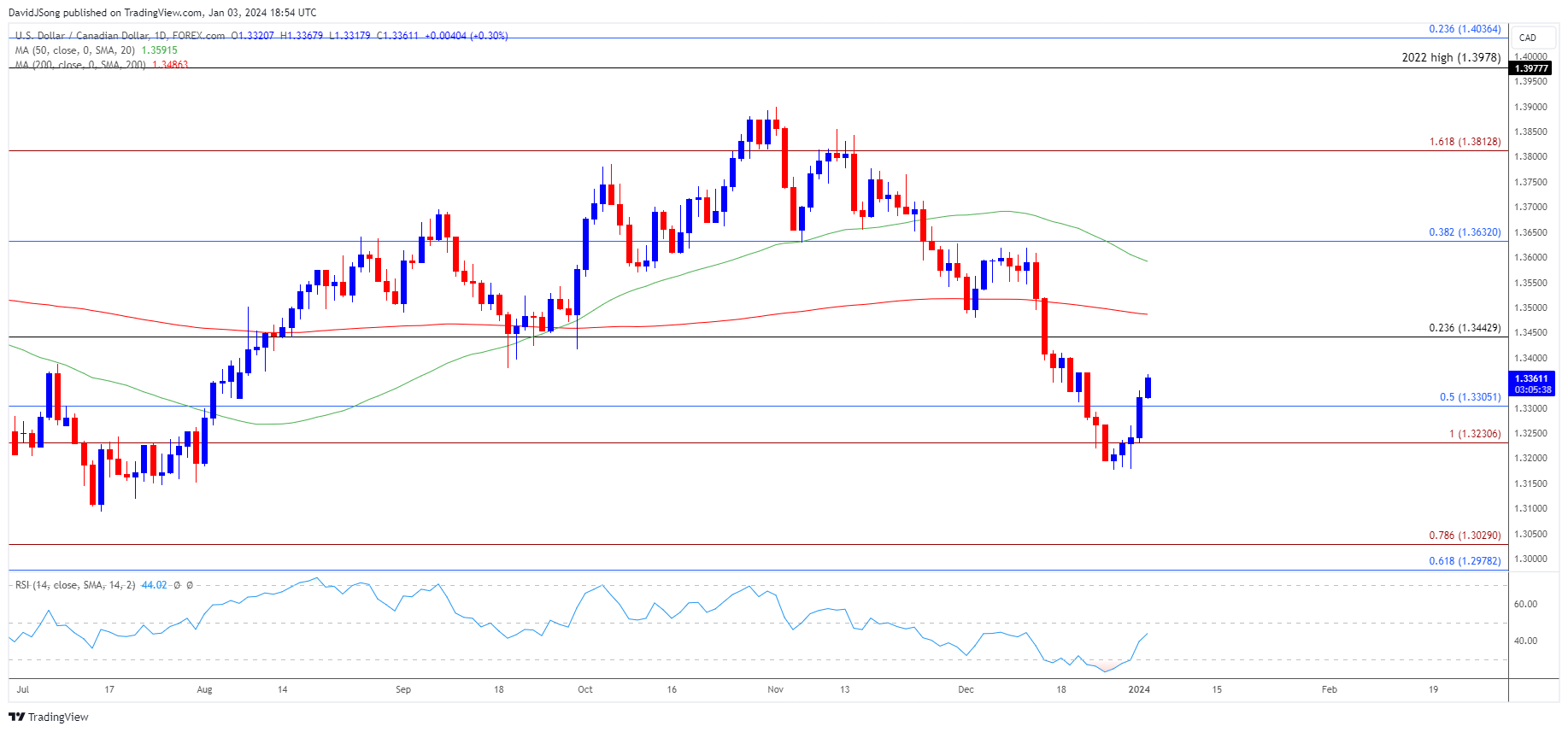

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD seems to have reversed ahead of the July low (1.3093) as the recent recovery in the exchange rate pulls the Relative Strength Index (RSI) out of oversold territory, with the opening range for 2024 in focus as the exchange rate carves a series of higher highs and lows.

- Need a move above 1.3440 (23.6% Fibonacci retracement) to bring the December high (1.3620) on the radar, with a break/close above 1.3630 (38.2% Fibonacci retracement) opening up 1.3810 (161.8% Fibonacci extension).

- Nevertheless, failure to breach 1.3440 (23.6% Fibonacci retracement) may curb the bullish price action in USD/CAD, with a move below the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) region raising the scope for a test of the December low (1.3177).

Additional Market Outlooks

Central Bank 2024 Outlook Preview

US Dollar Forecast: EUR/USD Eyes Positive Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong