US Dollar Outlook: USD/CAD

USD/CAD rebounds from a fresh weekly low (1.3417) as the US Personal Consumption Expenditure (PCE) Price Index points to sticky inflation, and the exchange rate may track the positive slope in the 50-Day SMA (1.3474) as it attempts to hold above the moving average.

US Dollar Forecast: USD/CAD Recovers Ahead of September Low

The opening range for October is in focus for USD/CAD as it bounces back ahead of the September low (1.3380), and the slew of US data prints on tap for next week may sway the exchange rate as the economy shows little indications of a recession.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

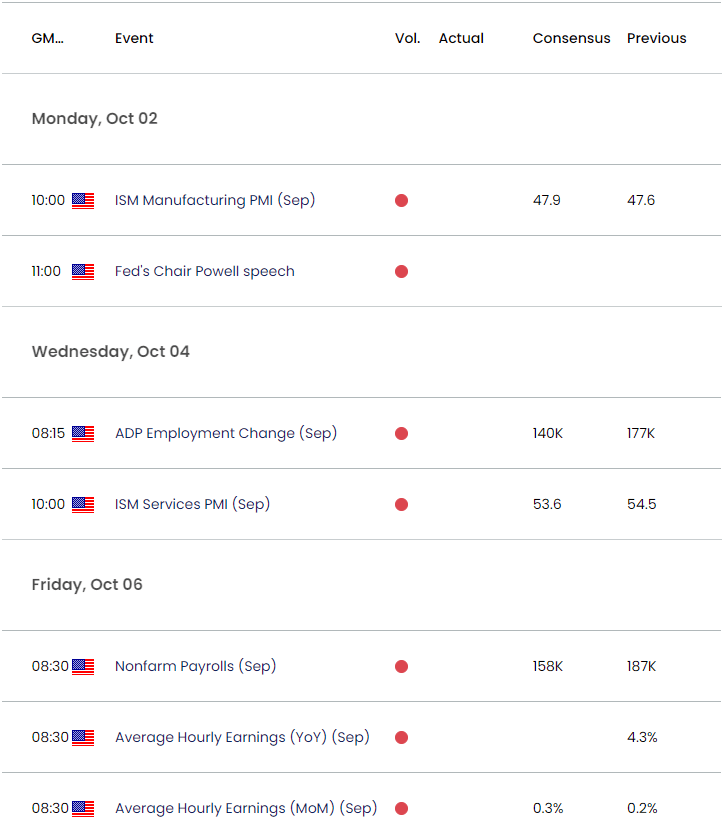

US Economic Calendar

Even though the ISM Purchasing Manager Index (PMI) for manufacturing is expected to hold in contraction territory (below 50), the gauge for service-based activity is anticipated to show an ongoing expansion in September, albeit at a slower pace as the figure is expected to narrow to 53.6 from 54.5 in August.

In addition, the Non-Farm Payrolls (NFP) report is projected to increase 158K in September after expanding 187K the month prior, and signs of a resilient economy may keep USD/CAD afloat as it raises the Federal Reserve’s scope to further combat inflation.

However, a series of weaker-than-expected US data prints may produce headwinds for the Greenback as it encourages the Federal Open Market Committee (FOMC) to keep interest rates on hold, and USD/CAD may come under pressure if it fails to defend the September low (1.3380).

With that said, the opening range for October is in focus amid the slew of key data prints on tap over the coming days, but USD/CAD may track the positive slope in the 50-Day SMA (1.3474) as it attempts to hold above the moving average.

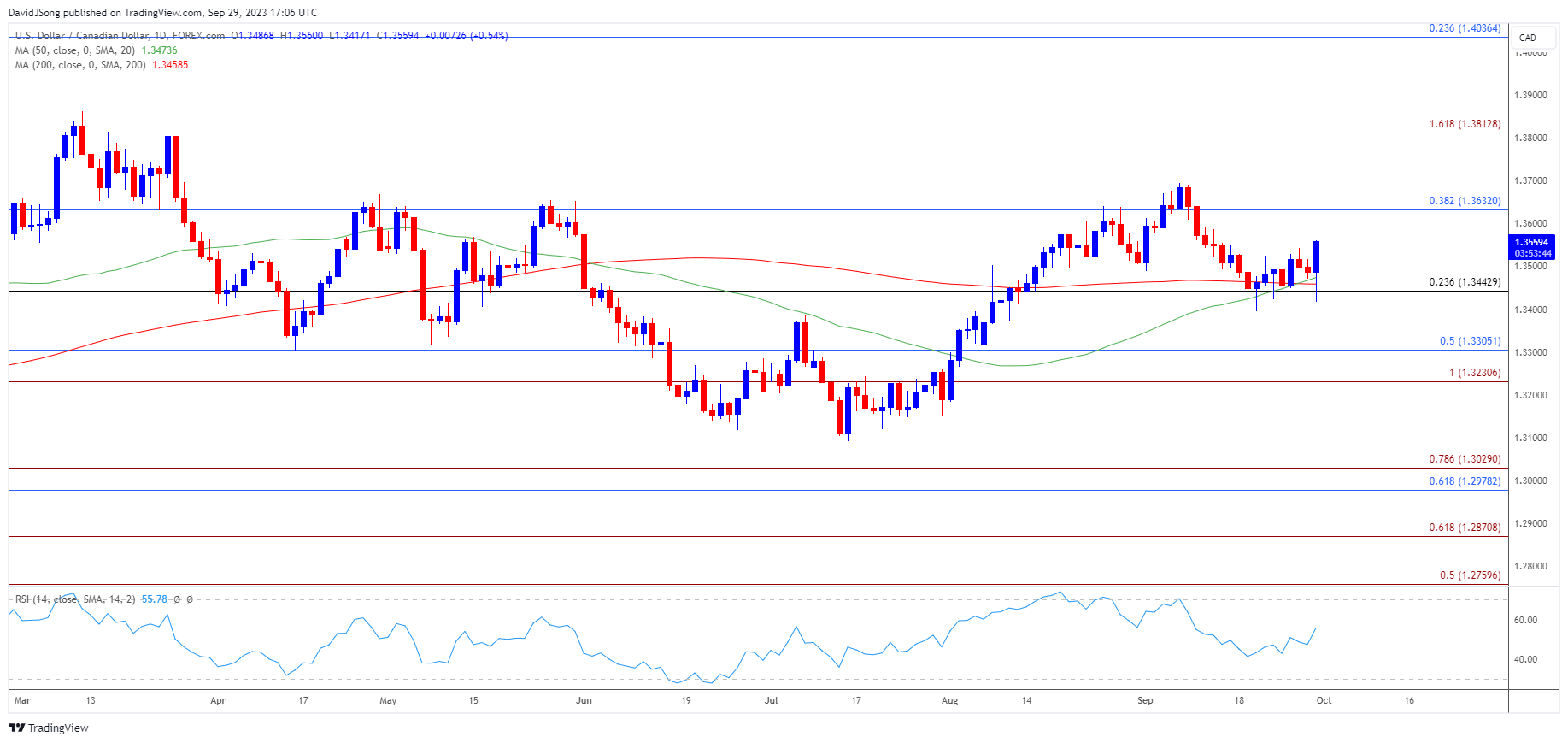

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD bounces back ahead of the monthly low (1.3380) to hold above the 50-Day SMA (1.3474), and the exchange rate may attempt to track the positive slope in the moving average amid the string of failed attempts to close below 1.3440 (23.6% Fibonacci retracement).

- Need a break/close above 1.3630 (38.2% Fibonacci retracement) to bring the September high (1.3695) on the radar, with the next area of interest coming in around 1.3810 (161.8% Fibonacci expansion).

- However, lack of momentum to hold above the moving average may spur another run at the monthly low (1.3380), with a close below 1.3440 (23.6% Fibonacci retracement) opening up the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) area.

Additional Market Outlooks

GBP/USD Forecast: RSI Attempts to Climb Out from Oversold Territory

Australian Dollar Forecast: AUD/USD Range Breaks Down

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong