US Dollar Outlook: USD/CAD

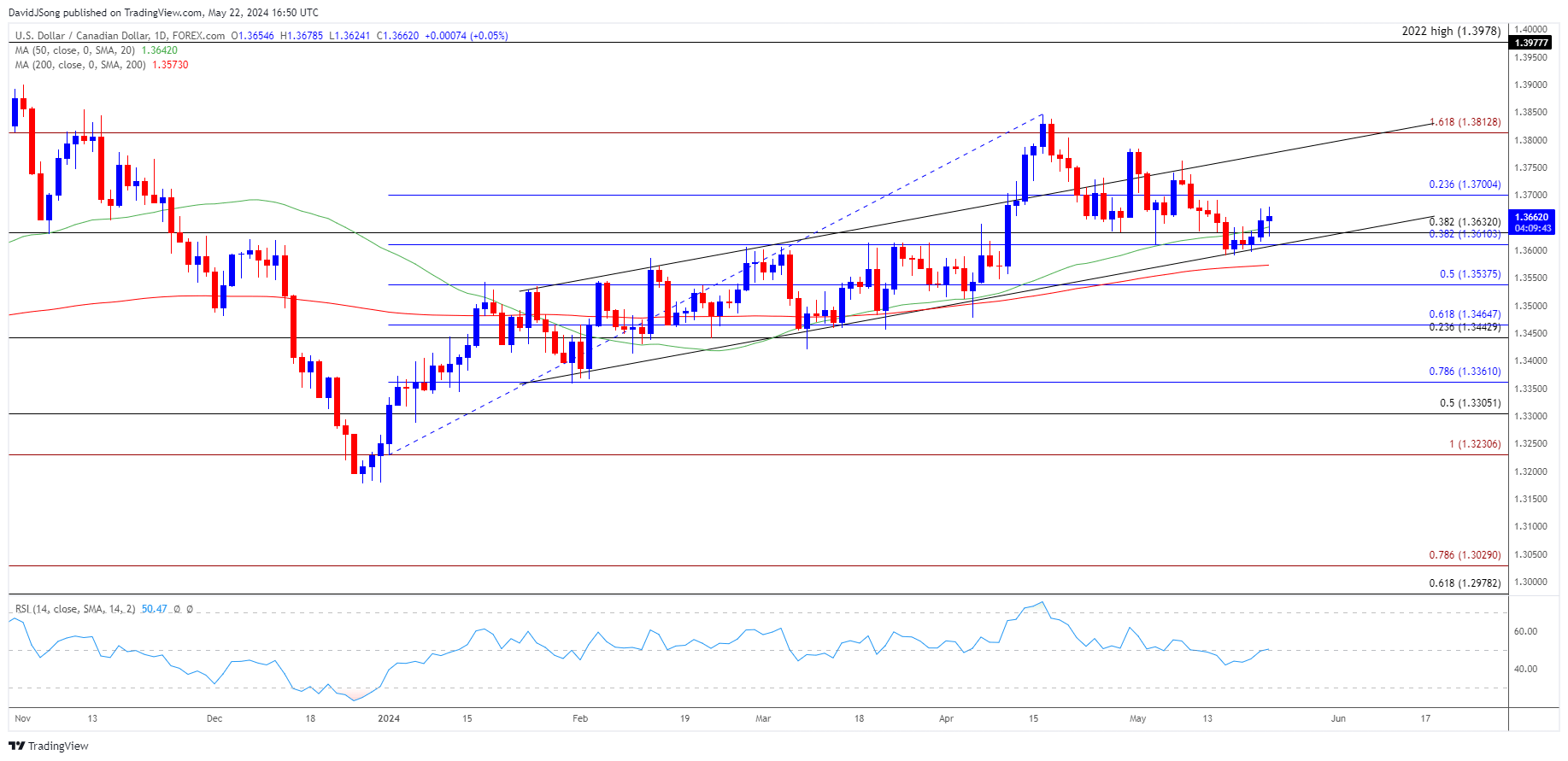

USD/CAD trades back above the 50-Day SMA (1.3642) as it continues to trade within the ascending channel from earlier this year, but the exchange rate may hold within the April range if it struggles to retrace the decline from the monthly high (1.3784).

US Dollar Forecast: USD/CAD Rebounds Within Ascending Channel

USD/CAD extends the advance from the start of the week as Canada’ Consumer Price Index (CPI) showed the core rate narrowing to 1.6% in April from 2.0% per annum the month prior, and the exchange rate may appreciate ahead of the Bank of Canada (BoC) meeting on June 5 should it track the positive slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It remains to be seen if the BoC will respond to the recent data print as the ‘Bank expects CPI inflation to be close to 3% during the first half of this year,’ but Governor Tiff Macklem and Co. may prepare Canadian households and businesses for a less restrictive policy as the Retail Sales report is anticipated to show household spending holding flat in March after contracting 0.1% the previous month.

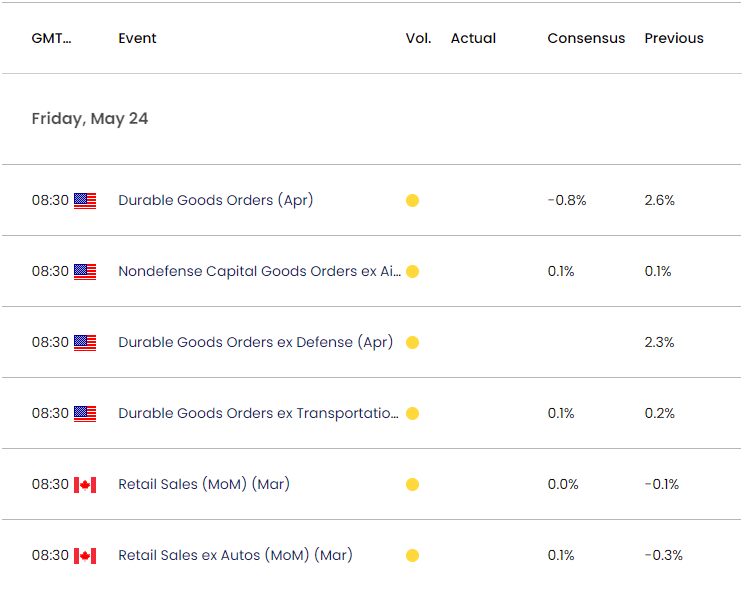

North America Economic Calendar

At the same time, US Durable Goods Orders are projected to 0.8% in April following the 2.6% expansion during the previous period, and USD/CAD may trend sideways over the remainder of the month as both the BoC and Federal Reserve carry out a data-dependent approach in managing monetary policy.

With that said, USD/CAD may continue to threaten the ascending channel from earlier this year if it struggles to retrace the decline from the monthly high (1.3784), but the exchange rate may track the positive slope in the 50-Day SMA (1.3642) as it extends the series of higher highs and lows from the start of the week.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD came up against channel support as it failed to defend the opening range for May, and the exchange rate may continue to threaten the bullish trend if it struggles to retrace the decline from the monthly high (1.3784).

- In turn, USD/CAD may hold within the April range over the remainder of the month, but the exchange rate may track the positive slope in the 50-Day SMA (1.3642) as it trades back above the moving average.

- Need a break/close above 1.3700 (23.6% Fibonacci retracement) to bring the monthly high (1.3784) on the radar, with a breach above 1.3810 (161.8% Fibonacci extension) opening up the April high (1.3846).

Additional Market Outlooks

US Dollar Forecast: USD/JPY Rate Mirrors Weakness in US Yields

US Dollar Forecast: GBP/USD Clears April High Ahead of UK CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong