US Dollar Outlook: USD/CAD

USD/CAD clears the opening range for April as the update to the US Consumer Price Index (CPI) reveals persistent inflation, and the exchange rate may continue trade within the ascending channel from earlier this year as it appears to be tracking the positive slope in the 50-Day SMA (1.3527).

US Dollar Forecast: USD/CAD Rallies Within Ascending Channel

Keep in mind, USD/CAD bounced back ahead of the March low (1.3420) to clear the December high (1.3620), and the exchange rate may attempt to further retrace the decline from the November high (1.3899) even as the Bank of Canada (BoC) keeps the benchmark interest rate at 5.00%.

It seems as though the BoC will is in no rush to implement lower interest rates as ‘economic growth is forecast to pick up in 2024,’ and the central bank may retain the current policy over the coming months as ‘the Bank estimates that the nominal neutral rate in Canada has risen to lie within a range of 2.25% to 3.25%, which is 25 basis points higher than in the April 2023 assessment.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The BoC goes onto say that ‘this increase reflects the impacts of an upward revision to the US neutral rate and changes in key Canadian domestic factors,’ and the comments suggest Governor Tiff Macklem and Co. is in no rush to switch gears ahead of the Federal Reserve as the ‘Governing Council is particularly watching the evolution of core inflation.’

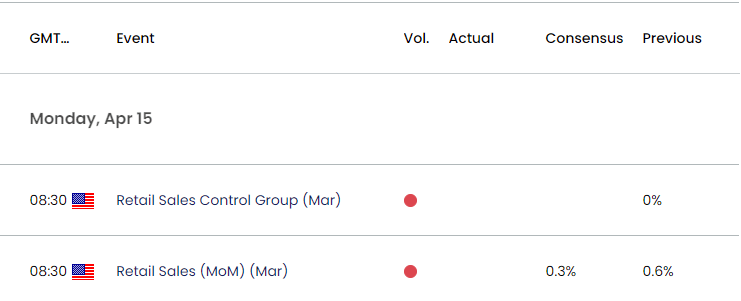

US Economic Calendar

As a result, developments coming out of the US may sway USD/CAD ahead of the Federal Open Market Committee (FOMC) interest rate decision on May 1, and the Retail Sales report may generate a bullish reaction in the Greenback as the update is anticipated to show a 0.3% rise in March.

Ongoing signs of a robust economy may generate may encourage the Fed to further combat inflation especially as the Non-Farm Payrolls (NFP) report continues to reflect a strong labor market, but a weaker-than-expected Retail Sales report may produce headwinds for the Greenback as it raises the FOMC’s scope to implement lower interest rates in 2024.

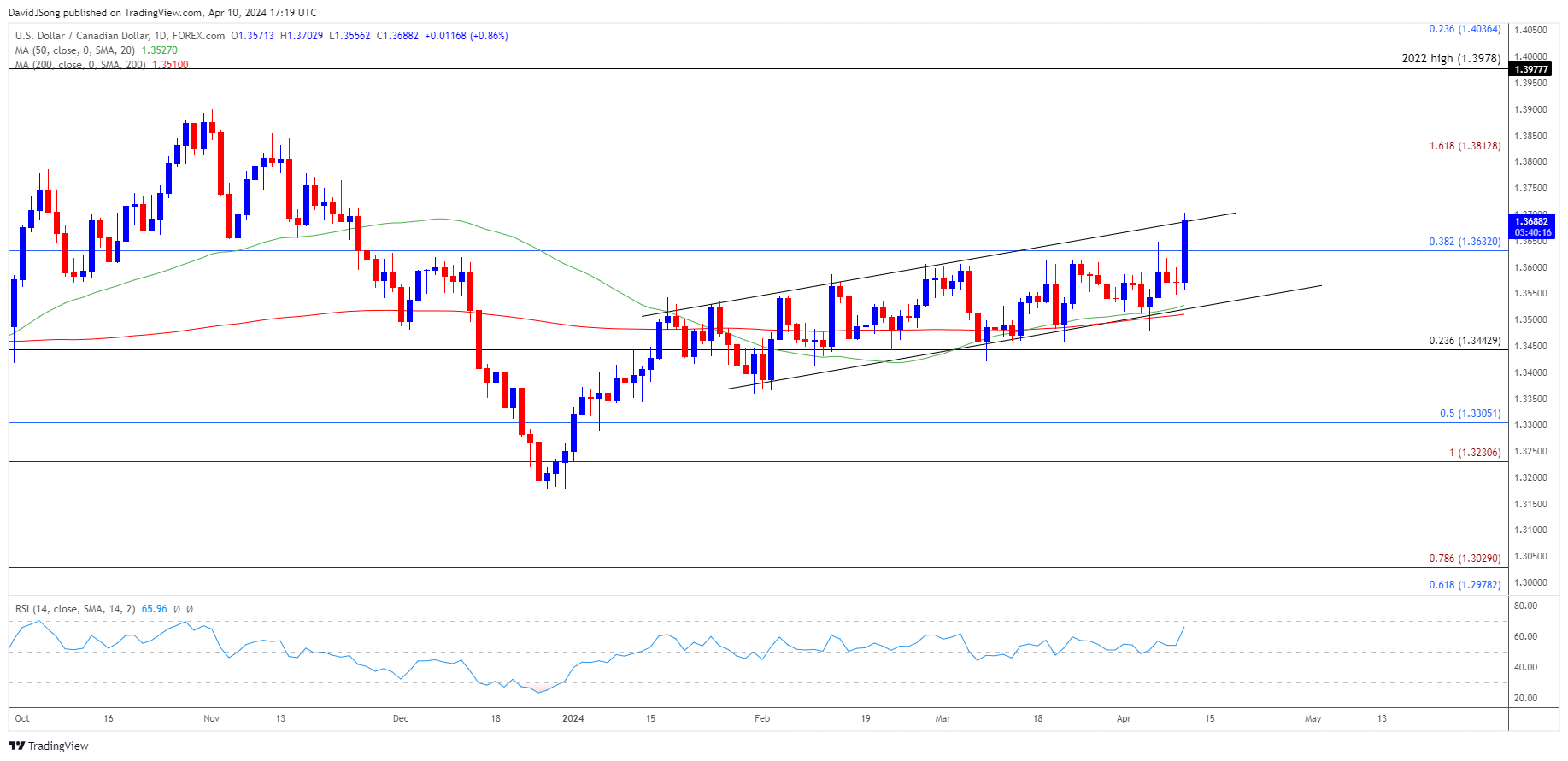

With that said, the break above the opening range for April may lead to a further advance in USD/CAD as it appears to be tracking the positive slope in the 50-Day SMA (1.3527), but lack of momentum to hold above channel resistance may lead to a near-term pullback in the exchange rate as the Relative Strength Index (RSI) holds below overbought territory for now.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may continue to trade within the ascending channel from earlier this year as it appears to be tracking the positive slope in the 50-Day SMA (1.3527), with a break/close above 1.3810 (161.8% Fibonacci extension) bringing the November high (1.3899) on the radar.

- Next area of interest comes in around 1.3978 (2022 high) to 1.4040 (23.6% Fibonacci retracement), but lack of momentum to hold above channel resistance may curb the recent advance in USD/CAD and keep the Relative Strength Index (RSI) below 70.

- Failure to hold above 1.3630 (38.2% Fibonacci retracement) may push USD/CAD back towards channel support, with a breach below the moving average bringing the monthly low (1.3478) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Pushes Above Opening Range for April

USD/JPY Susceptible to Further Attempts to Test July 1990 High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong