US Dollar Outlook: USD/CAD

USD/CAD registers a fresh monthly high (1.3443) as the update to the US Consumer Price Index (CPI) reveals sticky inflation, and the exchange rate may attempt to retrace the decline from the December high (1.3620) as it appears to have reversed course ahead of the July low (1.3093).

US Dollar Forecast: USD/CAD Rallies as US CPI Reveals Sticky Inflation

USD/CAD extends the advance from the start of the month as the US CPI climbs to 3.4% in December from 3.1% per annum the month prior, with the core rate of inflation printing at 3.9% during the same period versus forecasts for a 3.8% reading.

Signs of persistent inflation could force the Federal Reserve to keep US Interest rates higher for longer especially as New York Fed President John Williams, a permanent voting-member on the Federal Open Market Committee (FOMC), emphasizes that ‘we still have a ways to go to get inflation back to the FOMC’s longer-run goal of 2 percent.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The speech by Williams suggests the FOMC is in no rush to switch gears as the central bank is ‘committed to achieving our 2 percent longer-run inflation goal,’ and USD/CAD may stage a further advance ahead of the update to Canada’s Consumer Price Index (CPI) as it breaks out of the range bound price action from earlier this week.

Canada Economic Calendar

Until then, USD/CAD may track the broad range from the second half of 2023 as both the Fed and Bank of Canada (BoC) endorse a data-dependent approach in managing monetary policy, and the exchange rate may attempt to retrace the decline from the December high (1.3620) as it appears to have reversed course ahead of the July low (1.3093).

With that said, developments coming out of Canada may sway USD/CAD ahead of the BoC meeting on January 24 as Governor Tiff Macklem and Co. remain ‘prepared to raise the policy rate further if needed,’ but recent price action may lead to a further advance in the exchange rate as it clears the range bound price action from earlier this week.

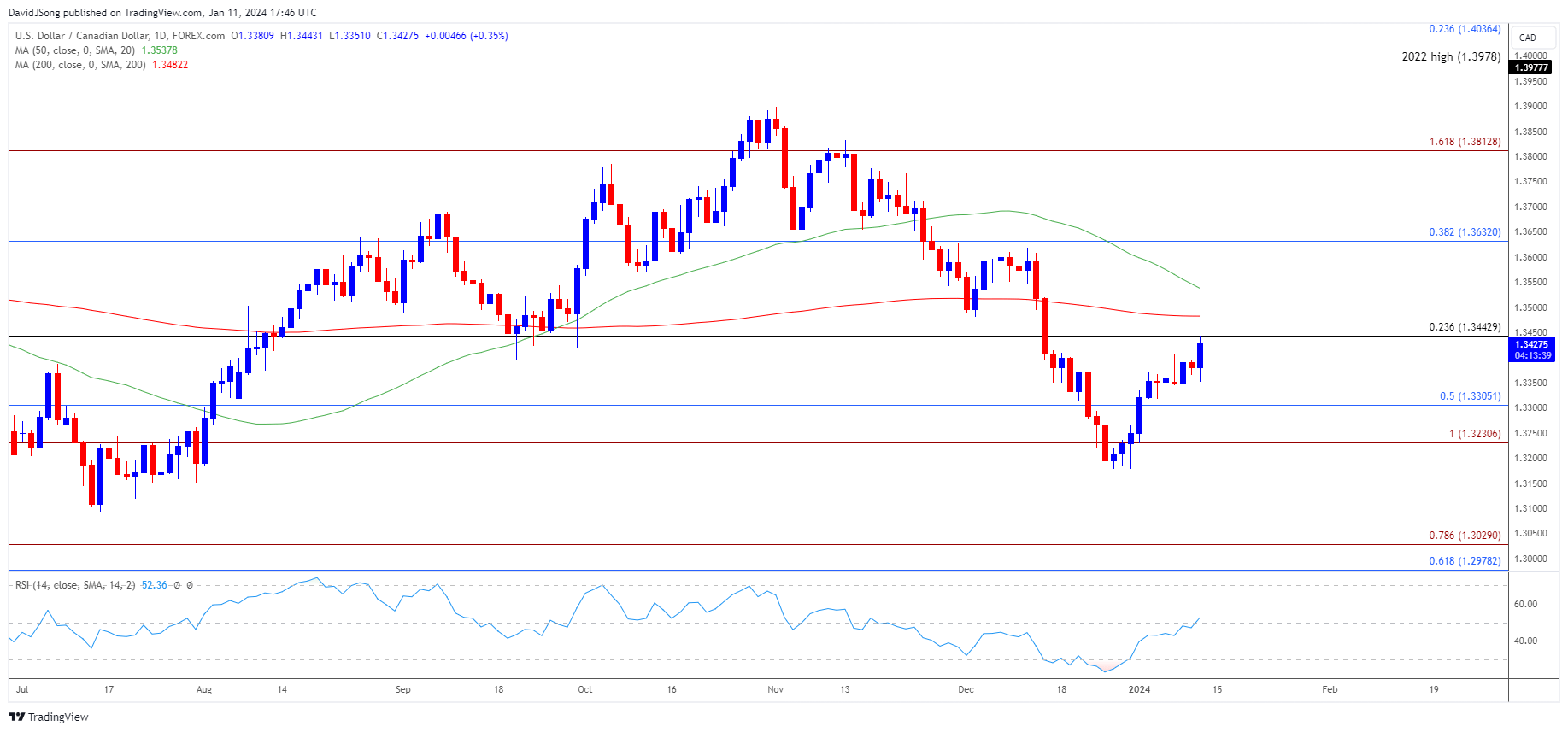

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to have reversed course ahead of the July low (1.3093) as it extends the rally from the start of the month, with a close above 1.3440 (23.6% Fibonacci retracement) raising the scope for a move towards the December high (1.3620).

- Need a break/close above 1.3630 (38.2% Fibonacci retracement) to open up 1.3810 (161.8% Fibonacci extension), but USD/CAD may struggle to retrace the decline from the December high (1.3620) if it responds to the negative slope in the 50-Day SMA (1.3538).

- Failure to trade back above the moving average may curb the recent advance in USD/CAD, with a break/close below the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) region bringing the December low (1.3177) on the radar.

Additional Market Outlooks

US Dollar Forecast: EUR/USD 2024 Opening Range Break in Focus

US Dollar Forecast: AUD/USD Susceptible to Test of 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong