US Dollar Outlook: USD/CAD

USD/CAD appears to be reversing ahead of the August low (1.3184) as it halts a three-day selloff, and the Relative Strength Index (RSI) may show the bearish momentum abating should it cross above 30 to indicate a textbook buy signal.

US Dollar Forecast: USD/CAD Post-Fed Selloff Stalls Ahead of August Low

USD/CAD cleared the September low (1.3380) as the Federal Reserve plans to unwind the restrictive policy in 2024, and the Greenback may face headwinds over the remainder of the year as Chairman Jerome Powell and Co. ‘do not view it as likely to be appropriate to raise interest rates further.’

CME FedWatch Tool

Source: CME

As a result, the CME FedWatch Tool now reflects a greater than 90% probability for a Fed rate-cut in May 2024, and expectations for lower US interest rates may keep USD/CAD under pressure as the Bank of Canada (BoC) ‘remains prepared to raise the policy rate further if needed.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

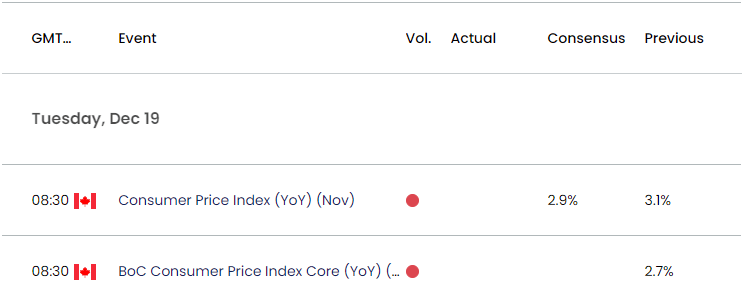

Canada Economic Calendar

However, the update to Canada’s Consumer Price Index (CPI) may curb the recent decline USD/CAD as the report is anticipated to show the headline reading for inflation narrowing to 2.9% in November from 3.1% per annum the month prior.

Signs of easing price growth may keep the BoC on the sidelines as ‘data and indicators for the fourth quarter suggest the economy is no longer in excess demand,’ but a higher-than-expected CPI print may force Governor Tiff Macklem and Co. to keep Canada interest rates higher for longer as ‘Governing Council wants to see further and sustained easing in core inflation.’

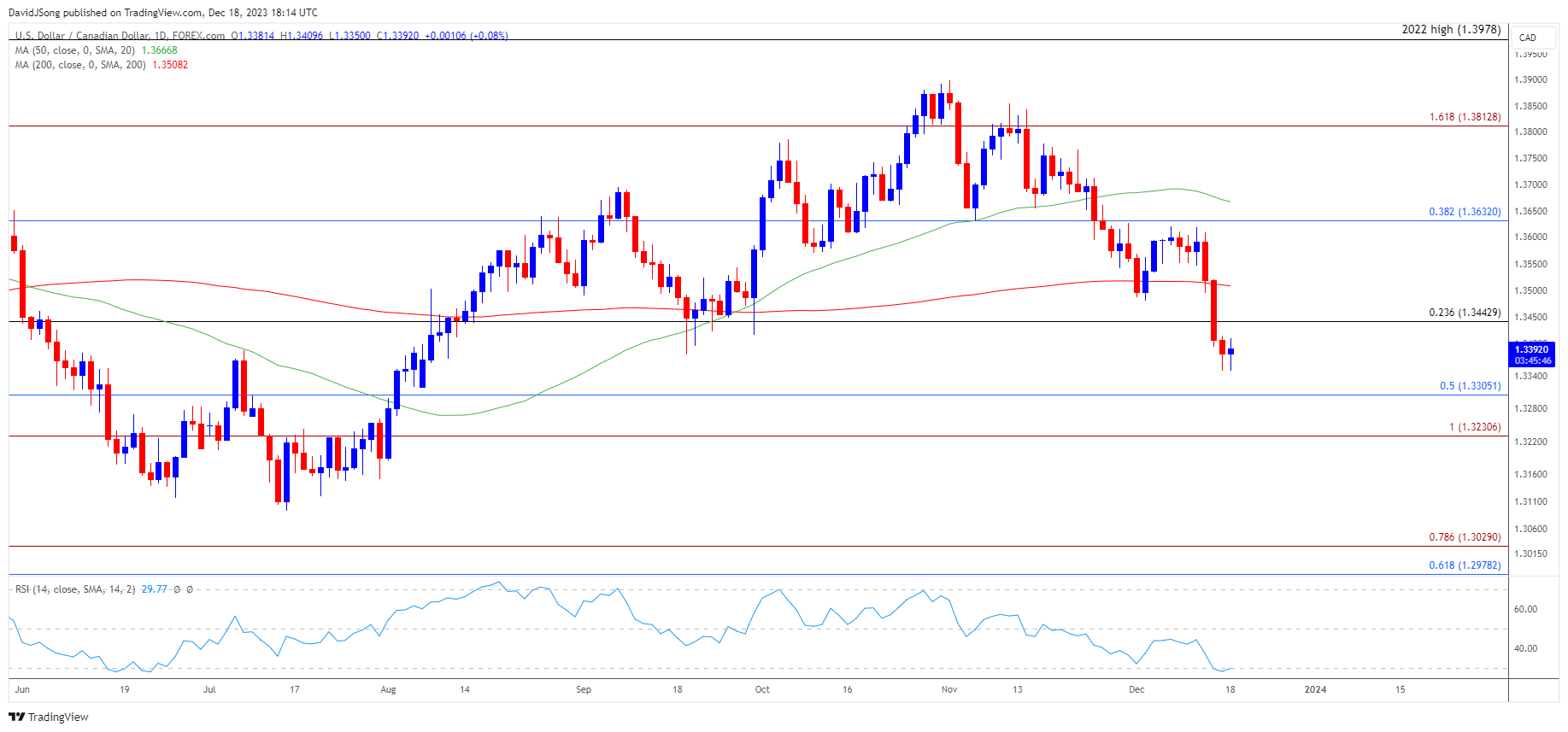

With that said, the breach of the September low (1.3380) may lead to a test of the August low (1.3184), but USD/CAD may attempt to retrace the decline from earlier this month as it no longer carves a series of lower highs and lows.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD holds near the monthly low (1.3350) after failing to defend the opening range for December, with a break/close below the 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement) raising the scope for a test of the August low (1.3184).

- However, the rebound from the monthly low (1.3350) may gather pace as USD/CAD no longer carves a series of lower highs and lows, and the Relative Strength Index (RSI) may show the bearish momentum abating should it recover from oversold territory.

- A move above 30 in the RSI may accompany a near-term rebound USD/CAD liked the price action from earlier this year, with a break/close above 1.3440 (23.6% Fibonacci retracement) bringing the monthly high (1.3620) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Pulls Back from Channel Resistance

US Dollar Forecast: AUD/USD Post-RBA Weakness Persists Ahead of Fed

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong