US Dollar Outlook: USD/CAD

USD/CAD fails to defend the opening range for May as the update to the US Consumer Price Index (CPI) reveals slowing inflation, but the exchange rate may track the ascending channel from earlier this year if it struggles to close below the 50-Day SMA (1.3627).

US Dollar Forecast: USD/CAD Post-CPI Drop Threatens Ascending Channel

USD/CAD registers a fresh monthly low (1.3591) as the US CPI narrows to 3.4% in April from 3.5% the month prior, while the Retail Sales report shows household spending holding flat during the same period amid forecasts for a 0.4% rise.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Developments coming out of the US may continue to sway USD/CAD as the Federal Reserve promotes a data-dependent approach in managing monetary policy, and it remains to be seen if the central bank will respond to the slowdown in consumer price growth as Chairman Jerome Powell and Co. ‘do not expect that it will be appropriate to reduce the target range for the federal funds rate until we have gained greater confidence that inflation is moving sustainably toward 2 percent.’

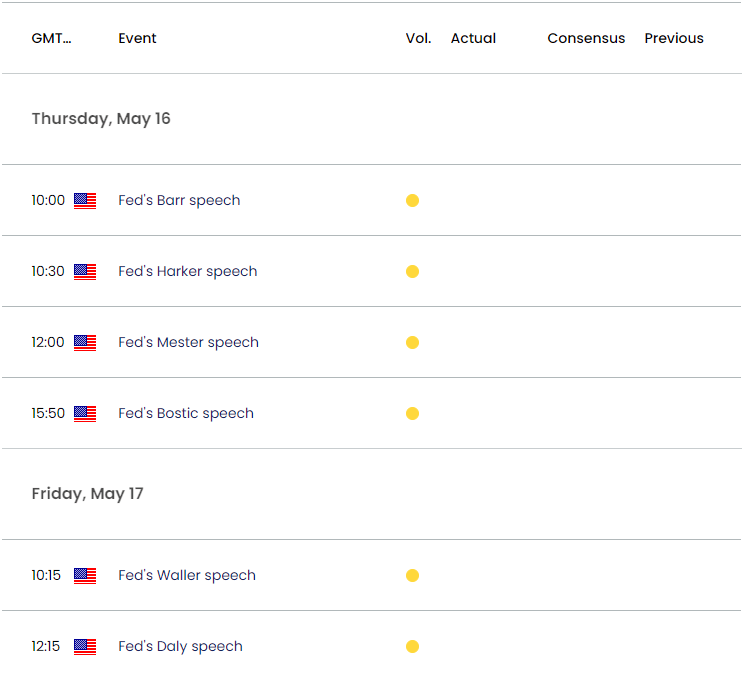

US Economic Calendar

In turn, the upcoming speeches from Fed officials may sway USD/CAD as the Federal Open Market Committee (FOMC) plans to ‘make decisions meeting by meeting,’ and the US Dollar may appreciate against its Canadian counterpart should the monetary authorities show a greater willingness to keep US interest rates higher for longer.

However, Fed officials may prepare US households and businesses for a less restrictive policy as the central bank prepares to ‘slow the pace of decline in our securities holdings,’ and a slew of dovish remarks may produce headwind for the Greenback amid expectations for lower US interest rates.

With that said, USD/CAD may continue to give back the advance from the April low (1.3478) as it struggles to hold above the former-resistance zone around the December high (1.3620), but the exchange rate may track the ascending channel from earlier this year if it fails to close below the 50-Day SMA (1.3627).

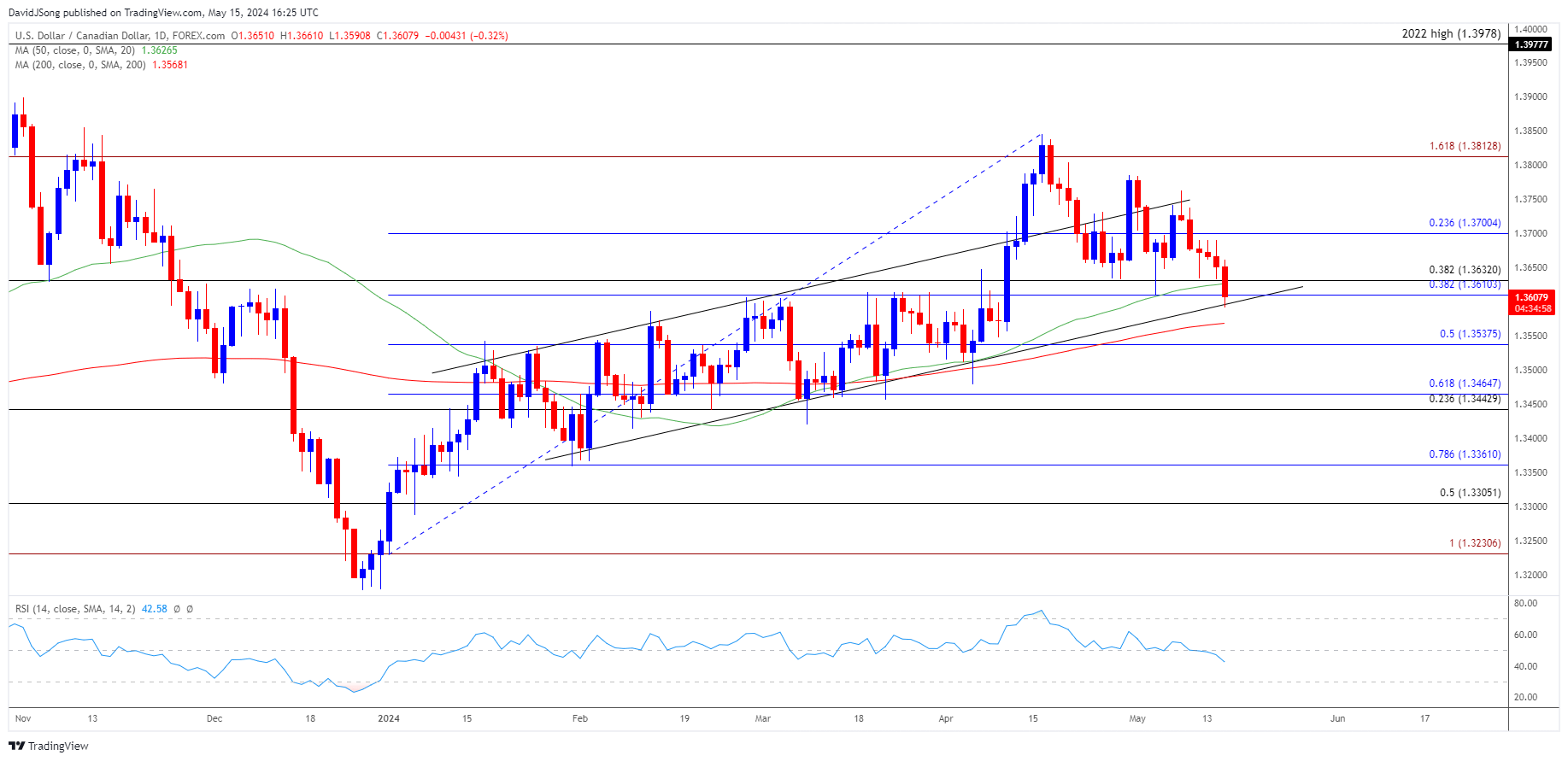

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD threatens the ascending channel from earlier this year as it fails to defend the opening range for May, with the recent weakness in the exchange rate pushing the Relative Strength Index (RSI) to its lowest level since January.

- A close below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region raises the scope for a move towards 1.3540 (50% Fibonacci retracement), with the next area of interest comes in around the April low (1.3478).

- However, lack of momentum to close below the 50-Day SMA (1.3627) may keep USD/CAD within the ascending channel, with a break/close above 1.3700 (23.6% Fibonacci retracement) bringing the monthly high (1.3784) on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Extends Rebound from 50-Day SMA

US Dollar Forecast: GBP/USD Eyes 50-Day SMA Ahead of US CPI

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong