US Dollar Outlook: USD/CAD

USD/CAD trades back above the 50-Day SMA (1.3469) as it attempts to extend the rebound following the US Non-Farm Payrolls (NFP) report, but the exchange rate may face range bound conditions as it no longer trades within an ascending channel carried over from last month.

US Dollar Forecast: USD/CAD No Longer Trades in Ascending Channel

USD/CAD seems to have reversed ahead of the February low (1.3366) as it bounces back from a fresh monthly low (1.3420), and the exchange rate may further retrace the decline from the monthly high (1.3605) should it track the positive slope in the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

Looking ahead, update to the US Consumer Price Index (CPI) may sway USD/CAD as the report is anticipated to show the core rate narrowing to 3.7% in February from 3.9% per annum the month prior, and evidence of slowing price growth may produce headwinds for the US Dollar as it raises the Federal Reserve’s scope to adopt a less restrictive policy.

At the same time, a higher-than-expected CPI report may fuel the recent rebound in USD/CAD as it puts pressure on the Federal Open Market Committee (FOMC) to further combat inflation, and the central bank may show a greater willingness to keep US interest rates higher for longer amid the ongoing expansion in US employment.

With that said, USD/CAD may stage a larger recovery ahead of the Fed rate decision on March 20 should it track the positive slope in the 50-Day SMA (1.3469), but the exchange rate may face range bound conditions as it no longer trades within the ascending channel carried over from the previous month.

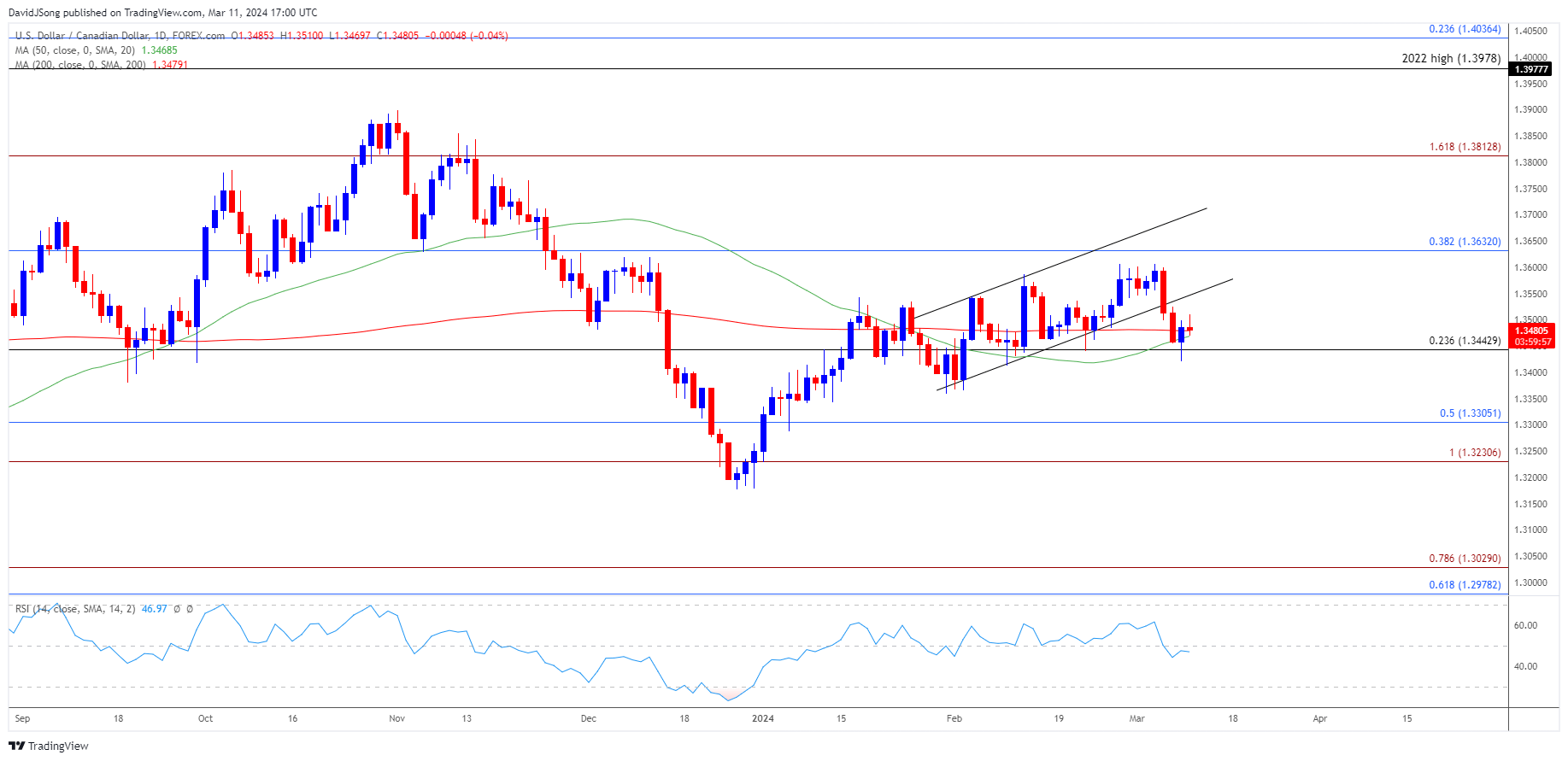

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD trades back above the 50-Day SMA (1.3469) as it rebounds ahead of the February low (1.3366), and the exchange rate may further retrace the decline from the monthly high (1.3605) should it track the positive slope in the moving average.

- A break/close above 1.3630 (38.2% Fibonacci retracement) may push USD/CAD towards 1.3810 (161.8% Fibonacci extension), with the next area of interest coming in around the 2023 high (1.3899).

- However, USD/CAD may trade within a defined range as it no longer trades within an ascending channel, with a close below 1.3440 (23.6% Fibonacci retracement) bringing the February low (1.3368) on the radar.

Additional Market Outlooks

US Dollar Forecast: GBP/USD Rally Eyes December High

US Dollar Forecast: USD/JPY Negates Ascending Triangle

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong