US Dollar Outlook: USD/CAD

USD/CAD registered a fresh weekly low (1.3413) as Canada’s Employment report shows a 37.3K rise in January versus forecasts for a 15.0K print, but failure to close below the 50-Day SMA (1.3430) may curb the recent decline in the exchange rate amid the lack of response to the negative slope in the moving average.

US Dollar Forecast: USD/CAD Fails to Close Below 50-Day SMA

USD/CAD seems to be defending the advance following the stronger-than-expected US Non-Farm Payrolls (NFP) report as it attempts to hold above the moving average, and the exchange rate may retrace the decline from the December high (1.3620) after clearing the January high (1.3542) earlier this month.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

However, the update to the US Consumer Price Index (CPI) may drag on USD/CAD as both the headline and core reading for inflation are anticipated to show slowing inflation, and evidence of easing price pressures may encourage the Federal Reserve to gradually alter its forward guidance for monetary policy as officials forecast lower interest rates in 2024.

At the same time, a higher-than-expected CPI print may generate a bullish reaction in the Greenback as it raises the Fed’s scope to keep US interest rates higher for longer, and the Federal Open Market Committee (FOMC) may retain a wait-and-see approach over the coming months as Chairman Jerome Powell tames speculation for a rate cut in March.

With that said, USD/CAD may extend the rebound from the weekly low (1.3413) amid the lack of respond to the negative slope in the 50-Day SMA (1.3430), and exchange rate may attempt to retrace the decline from the December high (1.3620) amid the lack of momentum to close below the moving average.

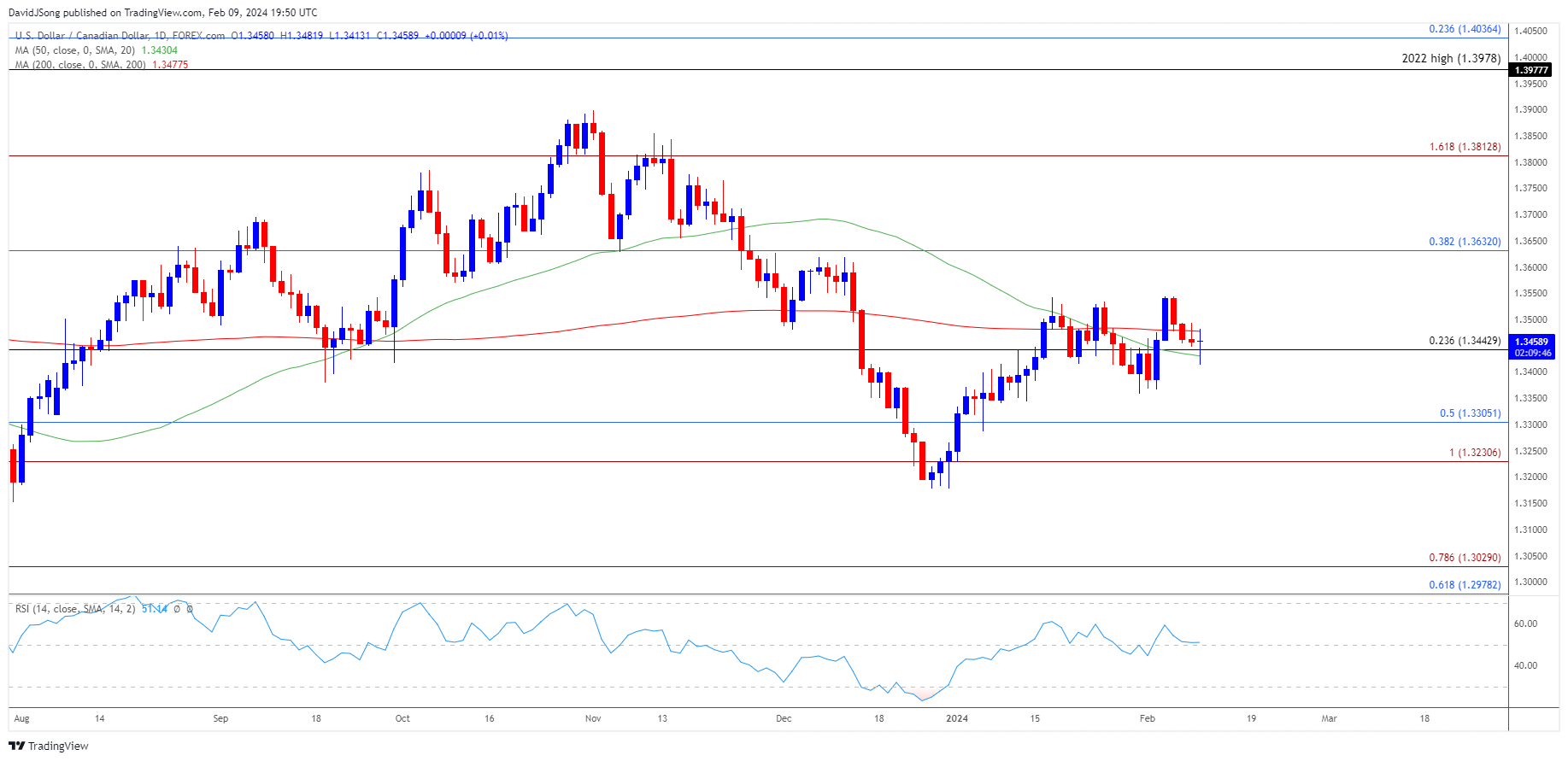

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD may track the December range amid the lack of response to the negative slope in the 50-Day SMA (1.3430), and failure to close below the moving average may push the exchange rate back towards the monthly high (1.3545).

- Nevertheless, a breach above the December high (1.3620) brings 1.3630 (38.2% Fibonacci retracement) on the radar, with the next area of interest coming in around 1.3810 (161.8% Fibonacci extension).

- At the same time, a close below 1.3440 (23.6% Fibonacci retracement) may lead to a test of the monthly low (1.3366), with the next region of interest coming in around 1.3230 (100% Fibonacci extension) to 1.3310 (50% Fibonacci retracement), which sits just above the January low (1.3229).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Struggles to Trade Back Above 50-Day SMA

US Dollar Forecast: USD/JPY Attempts to Breakout of Bull Flag Pattern

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong