US Dollar Outlook: USD/CAD

USD/CAD holds within the opening range for October after failing to test the yearly high (1.3862), but the exchange rate may track the positive slope in the 50-Day SMA (1.3543) if it continues to hold above the monthly low (1.3562).

US Dollar Forecast: USD/CAD Defends Monthly Low Ahead of US CPI

The recent rally in USD/CAD unravels after failing to push the Relative Strength Index (RSI) into overbought territory, and the exchange rate may struggle to retain the advance from the September low (1.3380) should it fails to hold above the moving average.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, USD/CAD may hold within the yearly range if it no longer responds to the positive slope in the moving average, and developments coming out of the US may drag on the exchange rate as the US Consumer Price Index (CPI) is anticipated to show slowing inflation.

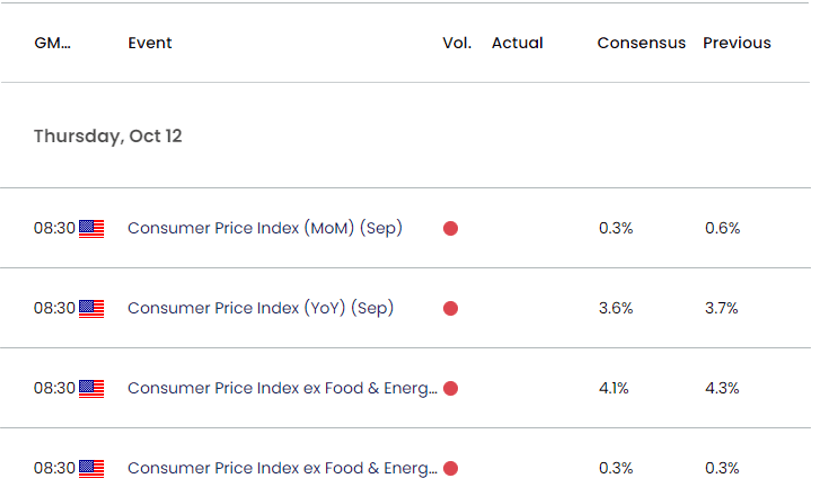

US Economic Calendar

The update from the Bureau of Labor Statistics (BLS) is anticipated to show the headline and core CPI narrowing in September, and signs of easing price pressures may produce headwinds for the US Dollar as it encourages the Federal Reserve to keep US interest rates on hold.

However, a set of stronger-than-expected data prints may spark a bullish reaction in the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to further combat inflation, and the exchange rate may track the positive slope in the 50-Day SMA (1.3543) as Chairman Jerome Powell and Co. show a greater willingness to keep US interest rates higher for longer.

With that said, the update to the US CPI may sway the near-term outlook for USD/CAD as the Bank of Canada (BoC) seems to be at or nearing the end of its hiking-cycle, but the exchange rate may continue to give back the advance from the September low (1.3380) if it fails to defend the monthly opening range.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- The recent rally in USD/CAD failed to push the Relative Strength Index (RSI) into overbought territory as it reversed ahead of the yearly high (1.3862), and failure to defend the opening range for October may push the exchange rate towards the 50-Day SMA (1.3543).

- A break/close below 1.3440 (23.6% Fibonacci retracement) opens up the September low (1.3380), but USD/CAD may track the positive slope in the moving average if it holds above the monthly low (1.3562).

- A close above 1.3630 (38.2% Fibonacci retracement) bringing the monthly low (1.3562) on the radar, with a break/close above 1.3810 (161.8% Fibonacci extension) opening up the yearly high (1.3862).

Additional Market Outlooks

GBP/USD Forecast: Test of Former Support Zone Looms

AUD/USD Outlook Hinges on Reaction to Negative Slope in 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong