US Dollar Outlook: USD/CAD

USD/CAD appears to be defending the May low (1.3590) as it retains the advance following Canada’s Employment report, but the exchange rate may continue to reflect a change in trend as it no longer trades within the ascending channel from earlier this year.

US Dollar Forecast: USD/CAD Defends May Low Ahead of Fed Testimony

USD/CAD may hold within the opening range for July as the 1.4K decline in Canada Employment puts pressure on the Bank of Canada (BoC) to pursue a less restrictive policy, and Governor Tiff Macklem and Co. may prepare households and businesses for another rate-cut as ‘recent data has increased our confidence that inflation will continue to move towards the 2% target.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, USD/CAD may stage a larger recovery ahead of the next BoC meeting on July 24 as the Federal Reserve remains reluctant to shift gears, and the 206K rise in US Non-Farm Payrolls (NFP) may keep the central bank on the sidelines as the Fed carries out a data-dependent approach in managing monetary policy.

US Economic Calendar

As a result, the semi-annual testimony from Fed Chairman Jerome Powell may generate a limited reaction should he endorses a wait-and-see approach in front of US lawmakers, but the update to the Consumer Price Index (CPI) may sway the near-term outlook for USD/CAD as the Federal Open Market Committee (FOMC) continues to combat inflation.

In turn, signs of persistent price growth may keep USD/CAD afloat as it puts pressure on the FOMC to keep US interest rates higher for longer, but a slowdown in both the headline and core CPI may drag on the exchange rate as it fuels speculation for an imminent Fed rate-cut.

With that said, USD/CAD may struggle to retain the advance from the monthly low (1.3603) as it no longer trades within the ascending channel from earlier this year, but the exchange rate may hold within the opening range for July as it appears to be defending the May low (1.3590).

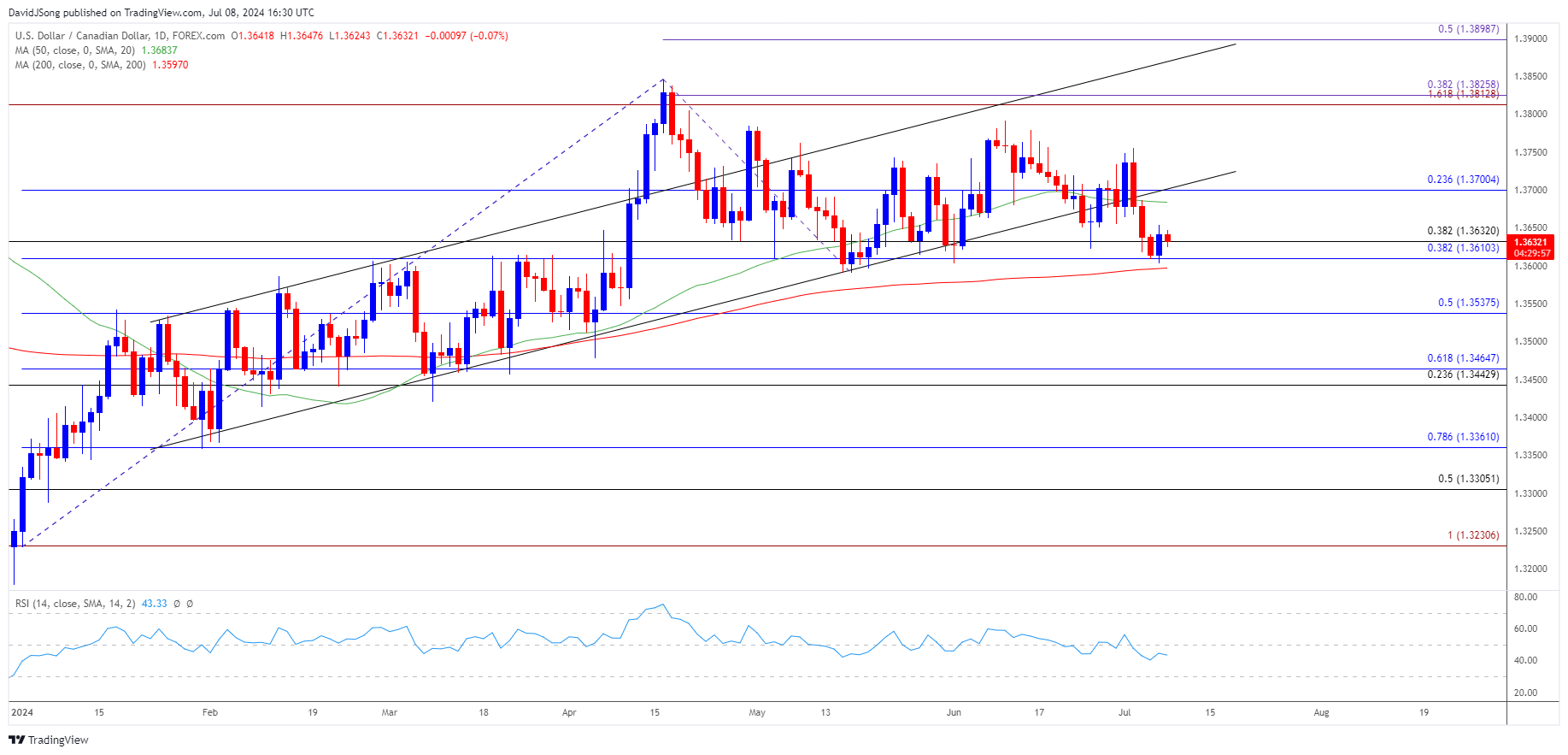

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be defending the May low (1.3590) amid the failed attempts to close below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region, with a move above 1.3700 (23.6% Fibonacci retracement) bringing the monthly high (1.3755) on the radar.

- A breach above the June high (1.3792) opens up the 1.3810 (161.8% Fibonacci extension) to 1.3830 (38.2% Fibonacci extension) area but USD/CAD may continue to reflect a change in trend as it no longer trades within the ascending channel from earlier this year.

- Failure to defend the May low (1.3590) may lead to a close below the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region, with the next area of interest coming in around 1.3540 (50% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Recovers amid Failure to Test June Low

US Dollar Forecast: AUD/USD 50-Day SMA Maintains Positive Slope

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong