US Dollar Outlook: USD/CAD

USD/CAD continues to hold above the 50-Day SMA (1.3418) following the larger-than-expect slowdown in Canada’s Consumer Price Index (CPI), and the exchange rate may attempt to retrace the decline from the monthly high (1.3586) amid the lack of response to the negative slope in the moving average.

US Dollar Forecast: USD/CAD Coils Above 50-Day SMA

USD/CAD trades within the confines of the monthly range as Canada’s CPI prints at 2.9% in January versus forecasts for a 3.3% reading, and signs of slowing inflation may push the Bank of Canada (BoC) to gradually alter the course for monetary policy as ‘the economy now looks to be operating in modest excess supply.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Meanwhile, the Federal Reserve appears to be in no rush to switch gears as Chairman Jerome Powell tames speculation for an imminent rate cut, and the Federal Open Market Committee (FOMC) may keep US interest rates on hold throughout the first half of 2024 as ‘most participants noted the risks of moving too quickly to ease the stance of policy.’

As a result, USD/CAD may continue to track the broad range from the second half of 2023 as both the BoC and FOMC seem to be at the end of their hiking-cycle, and it remains to be seen if the Fed will adjust its forward guidance at its next rate decision on March 20 as the US Consumer Price Index (CPI) points to stick inflation.

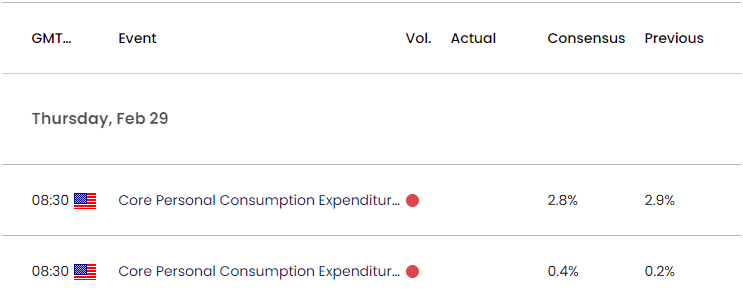

US Economic Calendar

However, the update to the Personal Consumption Expenditure (PCE) Price Index may sway the FOMC as the core rate, the Fed’s preferred gauge for inflation, is seen narrowing to 2.8% in January from 2.9% per annum the month prior.

Another downtick in the core PCE may produce headwinds for the Greenback as it put pressure on the FOMC to unwind its restrictive policy, but a stronger-than-expected print may keep USD/CAD afloat as Chairman Powell and Co. continue to combat inflation.

With that said, USD/CAD may attempt to retrace the decline from the monthly high (1.3586) amid the lack of response to the negative slope in the 50-Day SMA (1.3418), and the exchange rate may continue to track the broad range from the second half of 2023 as it holds above the moving average.

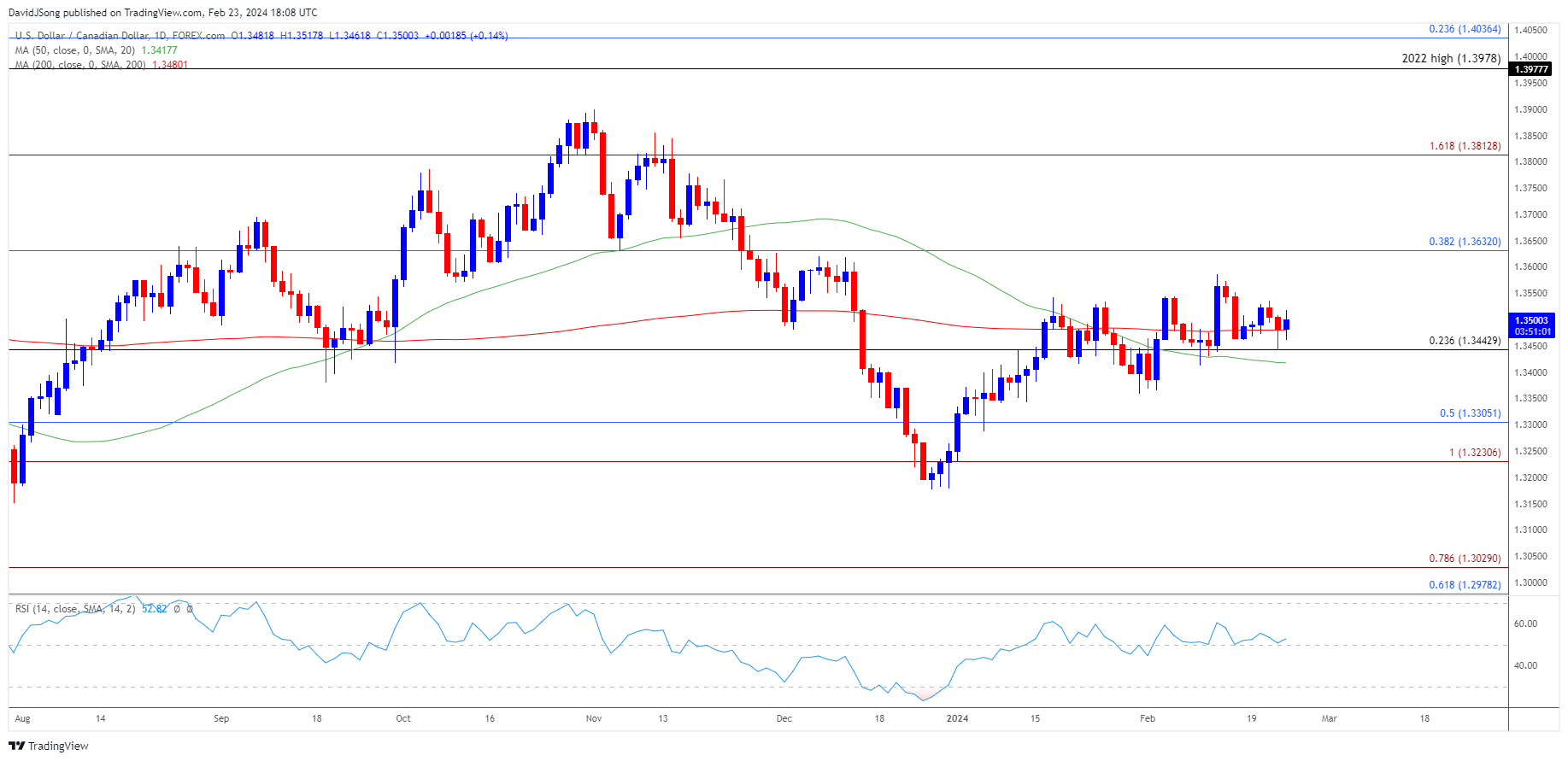

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD appears to be trading within a narrowing range amid the failed attempts to close below 1.3440 (23.6% Fibonacci retracement), but the exchange rate may attempt to retrace the decline from the monthly high (1.3586) amid the lack of response to the negative slope in the 50-Day SMA (1.3418).

- A break above the monthly range may push USD/CAD towards the December high (1.3620), with a break/close above 1.3630 (38.2% Fibonacci retracement) opening up 1.3810 (161.8% Fibonacci extension).

- However, failure to clear the monthly high (1.3586) may keep USD/CAD within a defined range, with a close below 1.3440 (23.6% Fibonacci retracement) bringing the monthly low (1.3366) on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Rate Eyes Monthly High

US Dollar Forecast: EUR/USD Recovery Fizzles Ahead of Monthly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong