US Dollar Outlook: USD/CAD

USD/CAD trades to a fresh weekly high (1.3742) as the Bank of Canada (BoC) delivers a 25bp rate-cut, and the exchange rate may test the May high (1.3784) as it continues to trade within the ascending channel from earlier this year.

US Dollar Forecast: Post-BoC USD/CAD Rally Eyes May High Ahead of NFP

USD/CAD appears to have reversed ahead of the May low (1.3590) as it carves a series of higher highs and lows, and the Canadian Dollar may continue to depreciate against its US counterpart as the BoC acknowledges that ’with further and more sustained evidence underlying inflation is easing, monetary policy no longer needs to be as restrictive.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The BoC goes onto say that ‘if inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate, but it remains to be seen if Governor Tiff Macklem and Co. will implement another rate cut at their next meeting on July 24 as the central bank pledges to take ‘our interest rate decisions one meeting at a time.’

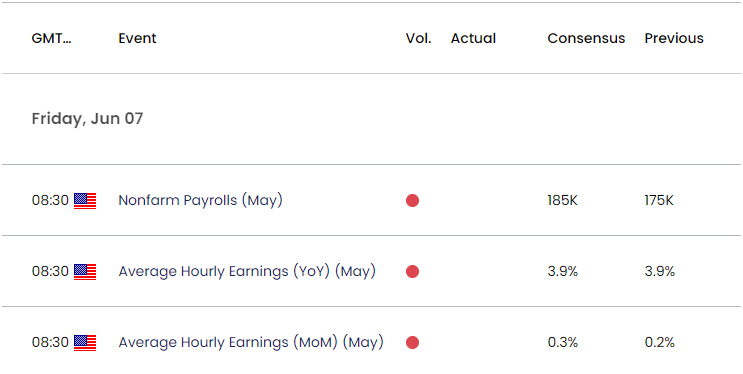

US Economic Calendar

Until then, developments coming out of the US may sway USD/CAD as US Non-Farm Payrolls (NFP) are projected to increase 185K rise in May, and a positive development may generate a bullish reaction in the Greenback as it encourages the Federal Reserve to further combat inflation.

At the same time, a weaker-than-expected NFP print may put pressure on the Federal Open Market Committee (FOMC) to adopt a less restrictive policy, and signs of slowing job growth may produce headwinds for the Greenback as it fuels speculation for a looming change in regime.

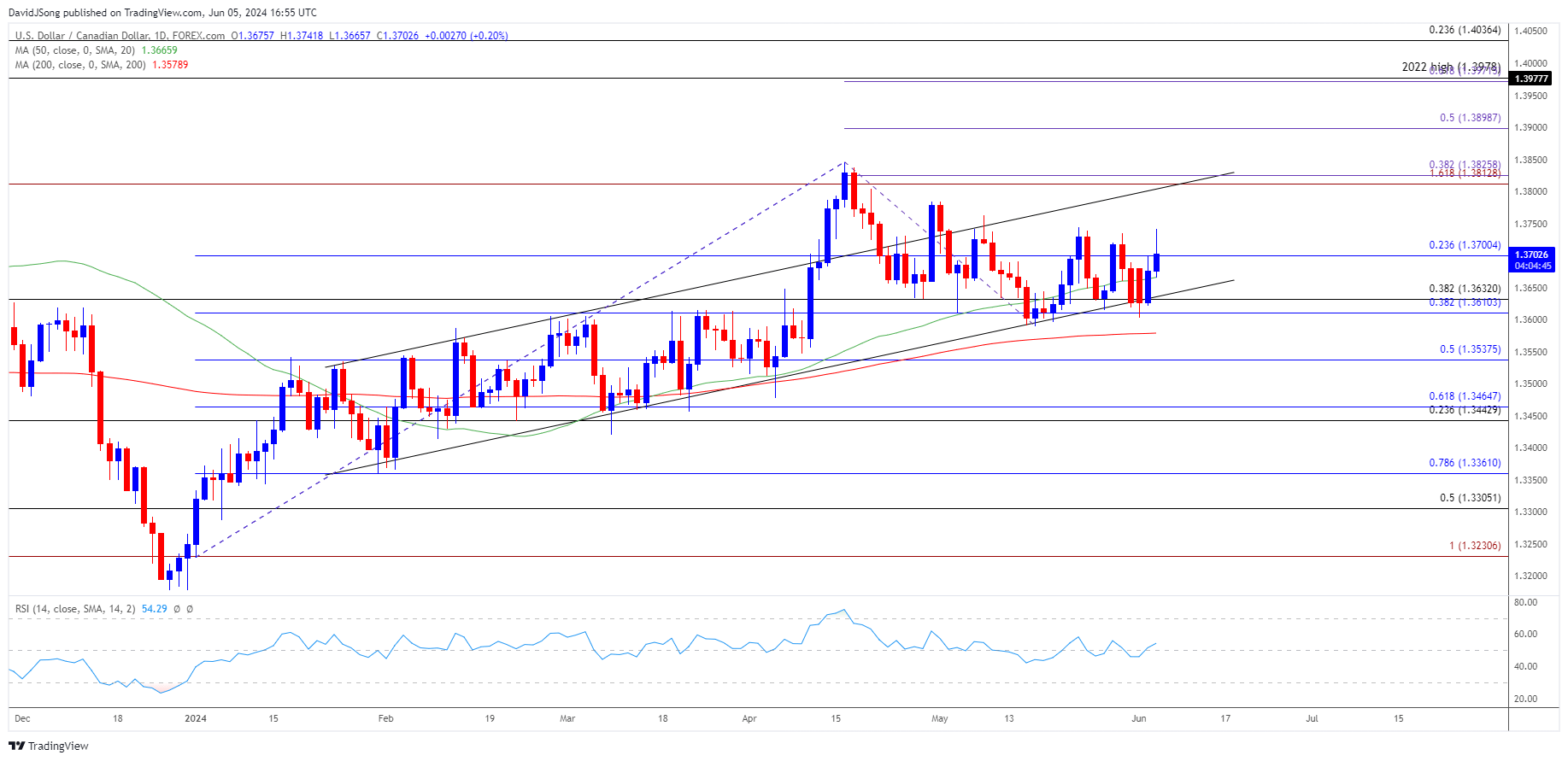

With that said, USD/CAD may face range bound conditions if it struggles to test the May high (1.3784), but the exchange rate may continue to trade within the ascending channel from earlier this year as the 50-Day SMA (1.3666) still reflects a positive slope.

USD/CAD Price Chart –Daily

Chart Prepared by David Song, Strategist; USD/CAD Price on TradingView

- USD/CAD bounces back ahead of the May low (1.3590) to hold within the ascending channel from earlier this year, and a close above 1.3700 (23.6% Fibonacci retracement) may lead to a test of the May high (1.3784) as it carves a series of higher highs and lows.

- Need a break/close above the 1.3810 (161.8% Fibonacci extension) to 1.3830 (38.2% Fibonacci extension) region to bring the April high (1.3846) on the radar, with the next area of interest coming in around 1.3900 (50% Fibonacci extension).

- However, failure to test the May high (1.3784) may keep USD/CAD within a defined range, and lack of momentum to hold above 1.3700 (23.6% Fibonacci retracement) may push USD/CAD back towards the 1.3610 (38.2% Fibonacci retracement) to 1.3630 (38.2% Fibonacci retracement) region.

Additional Market Outlooks

US Dollar Forecast: EUR/USD Vulnerable to ECB Rate Cut

US Dollar Forecast: GBP/USD Struggles to Push RSI into Overbought Zone

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong