US Dollar Outlook: GBP/USD

GBP/USD bounces back from a fresh weekly low (1.2625) amid the ongoing dissent within the Bank of England (BoE), but the exchange rate may fall towards the January low (1.2597) on a close below the 50-Day SMA (1.2674).

US Dollar Forecast: GBP/USD Vulnerable on Close Below 50-Day SMA

GBP/USD may trade within the confines of the January range as two BoE members vote for a 25bp rate hike, and it seems as though the majority of the Monetary Policy Committee (MPC) is in no rush to switch gears as ‘monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, the opening range for February is in focus for GBP/USD as the Federal Reserve tames speculation for a rate cut at its next meeting in March, and it remains to be seen if the US Non-Farm Payrolls (NFP) report will influence the exchange rate as the update is anticipated to show another rise in employment.

US Economic Calendar

The US economy is projected to add 180K jobs in January following the 216K expansion the month prior, and a positive development may generate a bullish reaction in the Greenback as it raises the Fed’s scope to keep US interest rates higher for longer.

However, a weaker-than-expected NFP print may drag on the US Dollar as it encourages the Federal Open Market Committee (FOMC) to pursue a less restrictive policy, and GBP/USD may continue to trade within a defined range as it no longer trades within the ascending channel from last year.

With that said, the opening range for February is in focus as GBP/USD consolidates, but the exchange rate may attempt to test the January low (1.2597) if it closes below the 50-Day SMA (1.2674).

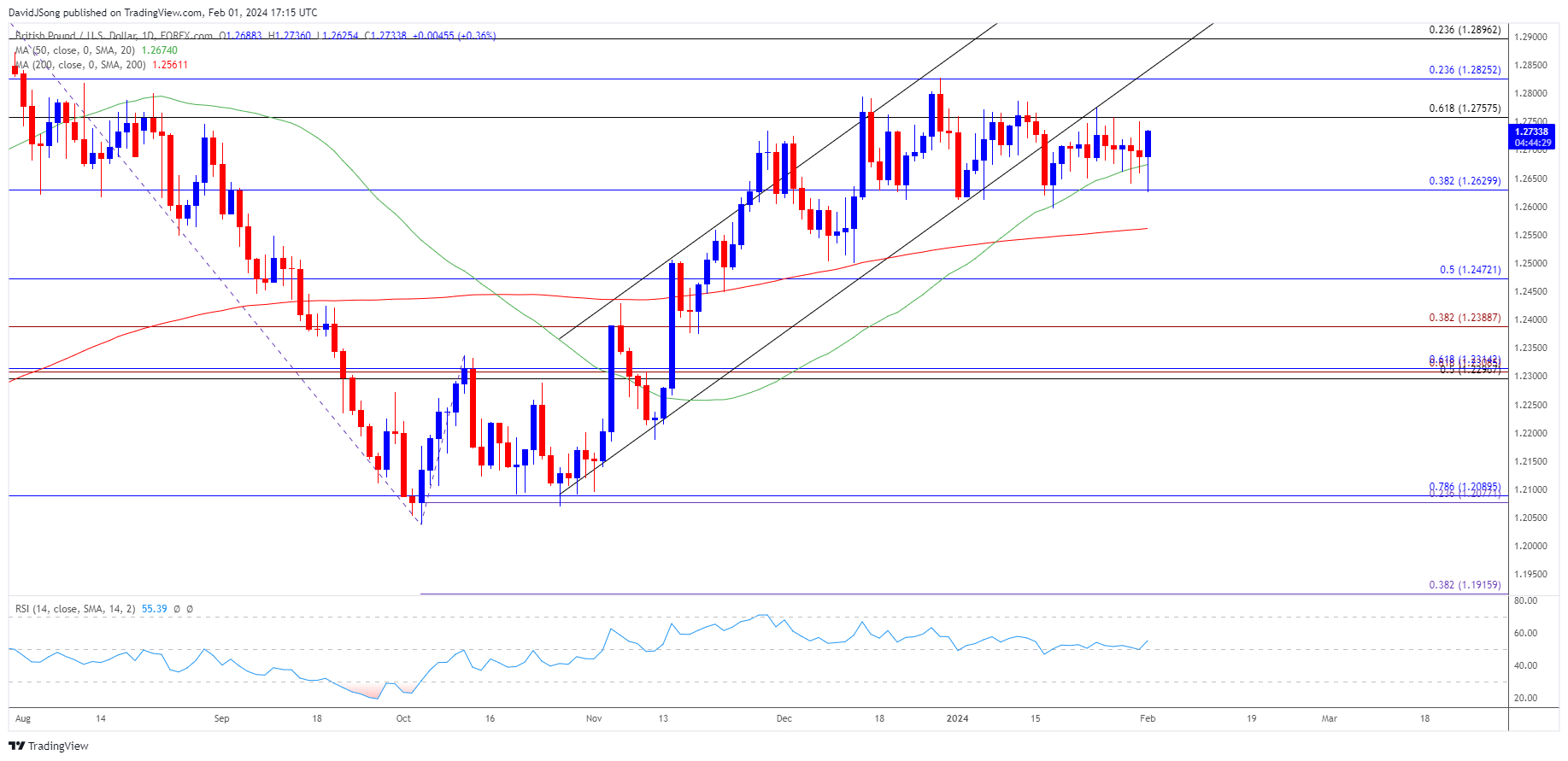

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD may track the January range as it bounces back from a fresh weekly low (1.2625), with near-term resistance coming in around the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region.

- Nevertheless, GBP/USD may track the positive slope in the 50-Day SMA (1.2674) as long as it continues to close above the moving average, with a break above the December high (1.2828) bringing 1.2900 (23.6% Fibonacci retracement) on the radar.

- However, a close below the moving average may push GBP/USD towards the January low (1.2597), with a breach below the December low (1.2500) opening up 1.2470 (50% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: USD/JPY Bull Flag Under Threat with Fed on Tap

US Dollar Forecast: AUD/USD Struggles to Trade Back Above 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong