US Dollar Outlook: GBP/USD

GBP/USD fails to clear the weekly high (1.2775) even as the US Personal Consumption Expenditure (PCE) Price Index shows a larger-than-expected slowdown in inflation, and the exchange rate may face range bound conditions ahead of the Federal Reserve interest rate decision on January 31 as it struggles to trade back within the ascending channel from last year.

US Dollar Forecast: GBP/USD Steady Ahead of Fed Rate Decision

At the same time, GBP/USD may track the positive slope in the 50-Day SMA (1.2656) as it continues to trade above the moving average, and the exchange rate may attempt to retrace the decline from the monthly high (1.2787) as signs of slowing inflation raises the Fed’s scope to unwind its restrictive policy sooner rather than later.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

As a result, the Federal Open Market Committee (FOMC) may continue to adjust the forward guidance for monetary policy, and the Fed rate decision may produce headwinds for the Greenback should the central bank prepare households and businesses a change in regime.

However, the stronger-than-expected 4Q Gross Domestic Product (GDP) report may encourage the FOMC to further combat inflation, and more of the same from Chairman Jerome Powell and Co. may generate a bullish reaction in the Dollar if the Fed shows a greater willingness to keep US interest rates higher for longer.

With that said, the Fed rate decision may sway GBP/USD ahead of the Bank of England (BoE) meeting on February 1, but the exchange rate may face range bound conditions in the days ahead as it struggles to trade back within the ascending channel from last year.

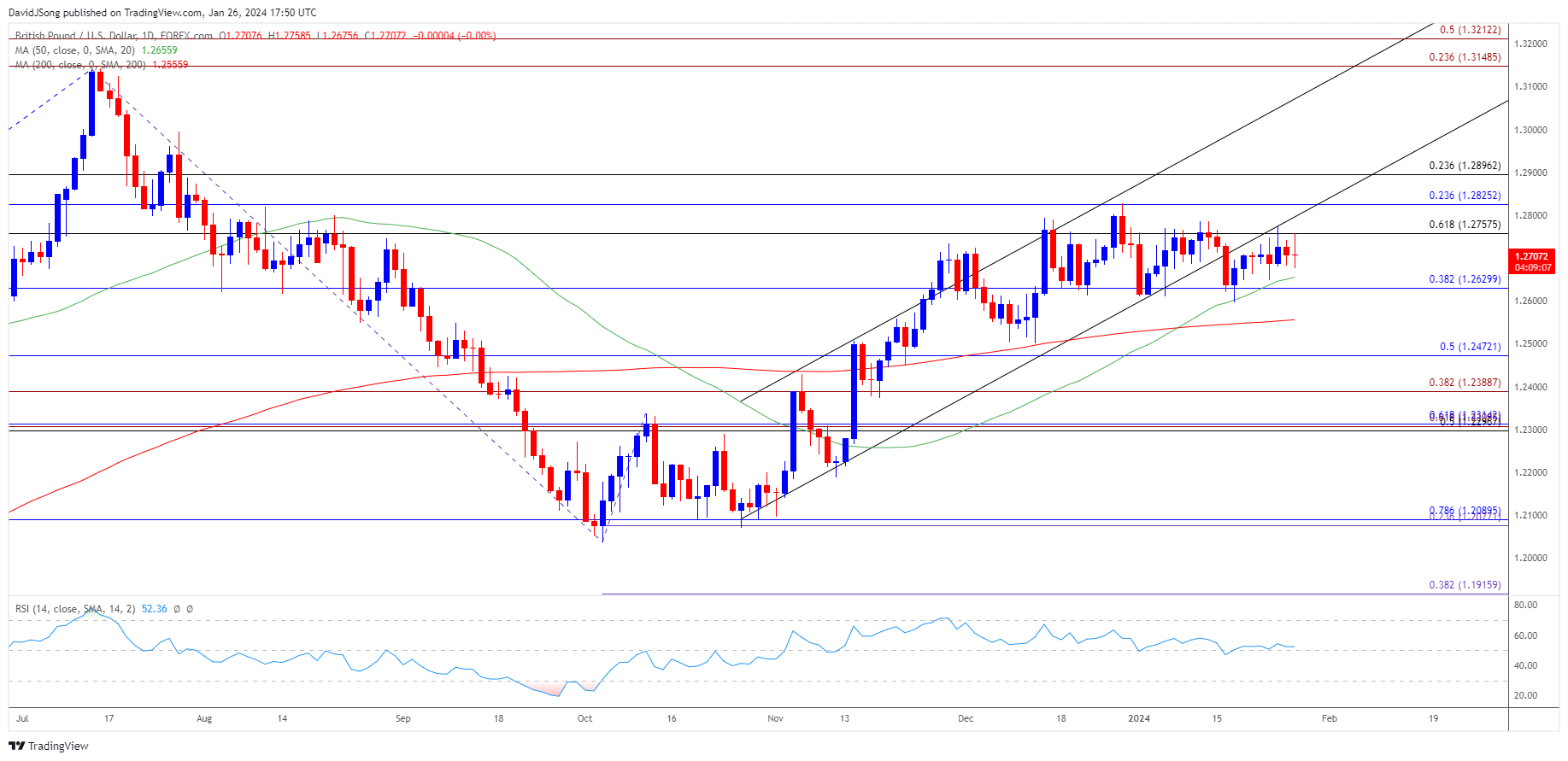

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD may retrace the decline from the monthly high (1.2787) if it continues to track the positive slope in the 50-Day SMA (1.2656), with a breach above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region raising the scope for a test of the December high (1.2828).

- Next area of interest comes in around 1.2900 (23.6% Fibonacci retracement), but GBP/USD may struggle to hold above the moving average as it no longer trades within the ascending channel from last year.

- A break/close below 1.2630 (38.2% Fibonacci retracement) brings the monthly low (1.2597) on the radar, with the next area of interest coming in around the December low (1.2500).

Additional Market Outlooks

EUR/USD Post-ECB Decline Vulnerable to Test of December Low

US Dollar Forecast: USD/JPY Falls amid Struggle to Test Monthly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong