US Dollar Outlook: GBP/USD

GBP/USD may face range bound conditions over the remainder of the month as it appears to be reversing ahead of the October high (1.2338), but the exchange rate may track the negative slope in the 50-Day SMA (1.2389) if it fails to defend the monthly low (1.2037).

US Dollar Forecast: GBP/USD Stalls Again at Former Support Zone

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

GBP/USD pulls back from a fresh weekly high (1.2289) after showing a limited reaction to the smaller-than-expected decline in UK Employment, and the exchange rate may struggle to retain the recent series of higher highs and lows amid the failed attempts to trade back above the former support zone around the May low (1.2308).

US Economic Calendar

Nevertheless, data prints coming out of the US may keep GBP/USD afloat as the core Personal Consumption Expenditure (PCE) Price Index, the Federal Reserve’s preferred gauge for inflation, is expected to narrow to 3.7% in September from 3.9% per annum the month prior.

Signs of slowing price growth may produce headwinds for the US Dollar as it encourages the Federal Open Market Committee (FOMC) to keep US interest rates on hold, but a higher-than-expected core PCE print may drag on GBP/USD as it puts pressure on Chairman Jerome Powell and Co. to further combat inflation.

With that said, GBP/USD may face range bound conditions over the remainder of the month as it pulls back ahead of the October high (1.2338), but the exchange rate may track the negative slope in the 50-Day SMA (1.2389) amid the failed attempts to trade back above the former support zone around the May low (1.2308).

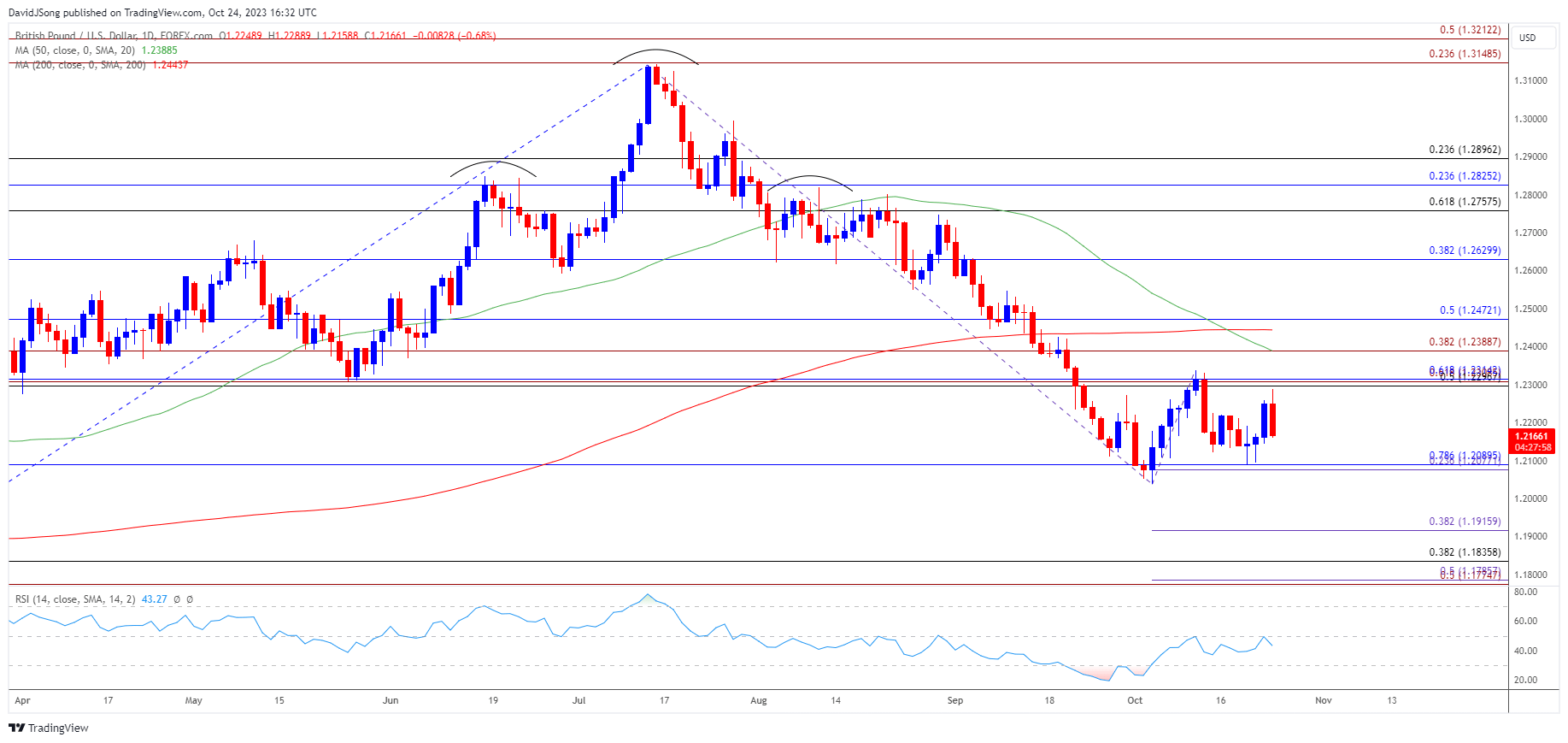

GBP/USD Price Chart – Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD carves a series of higher highs and lows after testing the 1.2090 (78.6% Fibonacci retracement) region, but the exchange rate may face range bound conditions as it pulls backs ahead of the monthly high (1.2338).

- The failed attempts to push above the former support zone around the May low (1.2308) may keep GBP/USD within a defined range, and the 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension) area may continue to offer resistance as there seems to be a change in trend.

- Nevertheless, a breach of the monthly low (1.2037) opens up the 1.1780 (50% Fibonacci extension) to 1.1840 (38.2% Fibonacci retracement) zone, which incorporates the yearly low (1.1803), with the next area of interest coming in around 1.1920 (38.2% Fibonacci extension).

- At the same time, break/close above the 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension) area opens up 1.2470 (50% Fibonacci retracement), but the exchange rate may track the negative slope in the 50-Day SMA (1.2389) if it snaps the monthly range.

Additional Market Outlooks

Australian Dollar Forecast: AUD/USD Rebounds Ahead of Australia CPI

EUR/USD Forecast: All Eyes on ECB Interest Rate Decision

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong