US Dollar Outlook: GBP/USD

GBP/USD slips below the opening range for June as it extends the decline following the better-than-expected US Non-Farm Payrolls (NFP) report, and the Federal Reserve interest rate decision may keep the exchange rate under pressure as the central bank is expected to retain a restrictive policy.

US Dollar Forecast: GBP/USD Slips Below June Opening Range Ahead of Fed

GBP/USD appears to have reversed ahead of the March high (1.2894) to keep the Relative Strength Index (RSI) out of overbought territory, and the exchange rate may continue to trade to fresh monthly lows as it initiates a series of lower highs and lows.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

UK Economic Calendar

Nevertheless, data prints coming out of the UK may sway GBP/USD prior to the Fed rate decision as the Unemployment Rate is expected to hold steady at 4.3% in April, and a positive development may curb the recent decline in the exchange rate as it encourages the Bank of England (BoE) to retain the current policy.

However, signs of a weakening labor market may produce headwinds for the British Pound as it fuels speculation for a BoE rate cut, and GBP/USD may extend the recent series of lower highs and lows as the Federal Open Market Committee (FOMC) appears to be in no rush to alter the path for monetary policy.

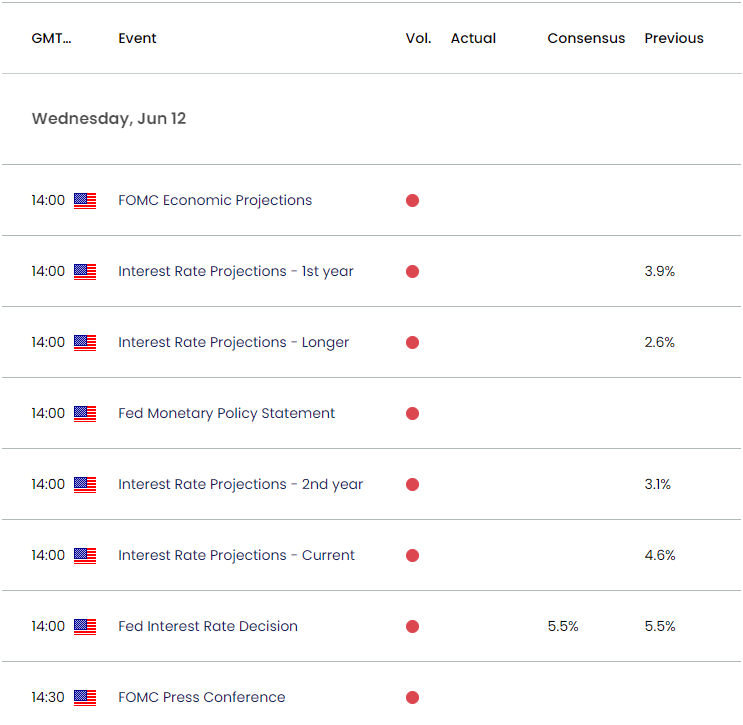

US Economic Calendar

In turn, market participants may pay increased attention to the forward guidance for monetary policy as the FOMC is slated to update the Summary of Economic Projections (SEP), and the fresh forecasts from Fed officials may produce a bullish reaction in the Greenback if Chairman Jerome Powell and Co. show a greater willingness to keep US interest rates higher for longer.

At the same time, the FOMC may prepare US households and businesses for a less restrictive policy in an effort to avoid a recession, and GBP/USD may attempt to retrace the decline from the monthly high (1.2822) should the Fed’s SEP continue to reflect lower interest rates in 2024.

With that said, GBP/USD may face increased volatility ahead of the Fed rate decision as it slips below the opening range for June, and the failed attempt to test the March high (1.2894) may lead to a larger pullback in the exchange rate as the Relative Strength Index (RSI) moves away from overbought territory.

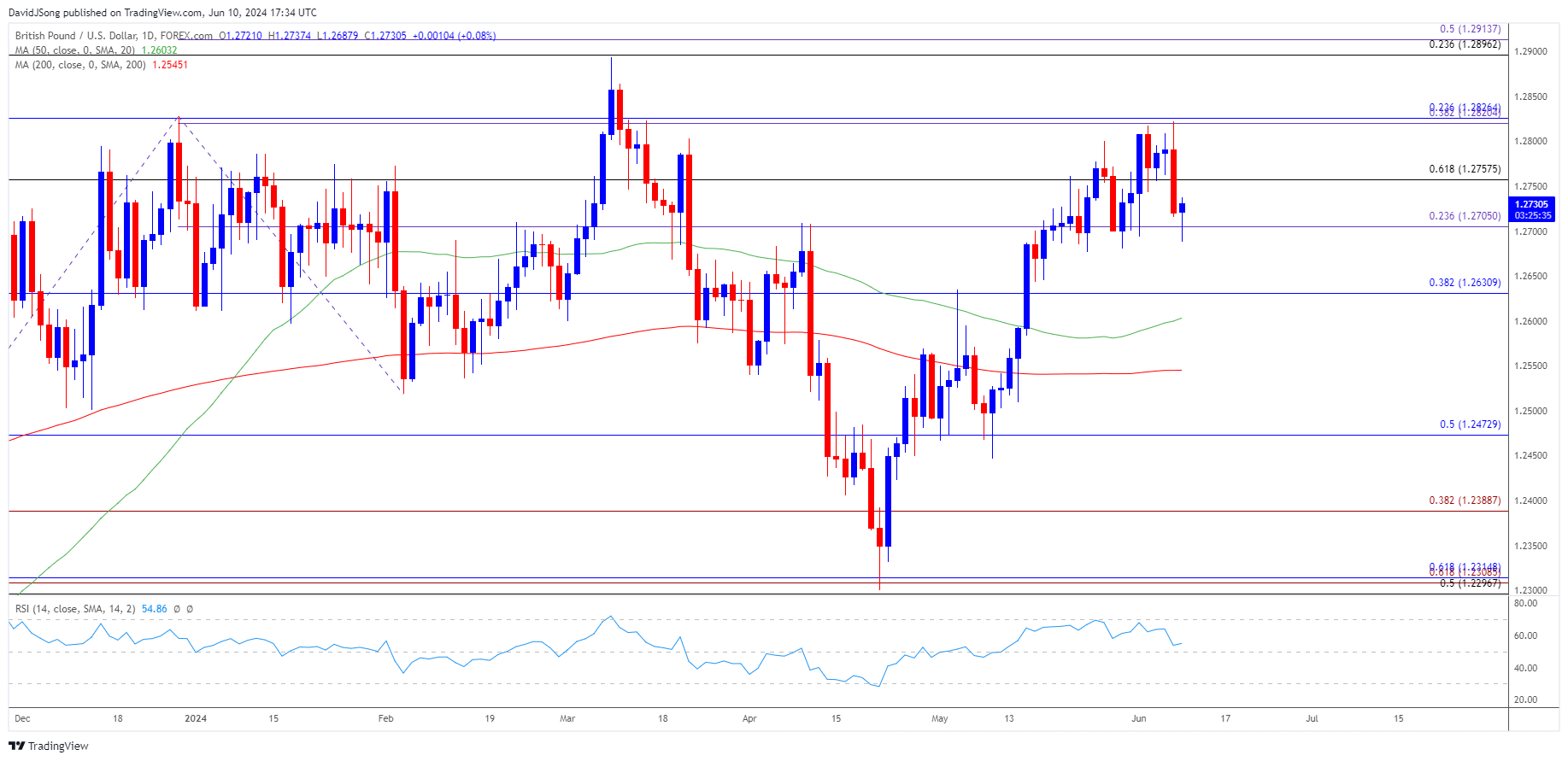

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD seems to have reversed ahead of the March high (1.2894) as it slips below the opening range for June, and the Relative Strength Index (RSI) may show the bullish momentum abating as it moves away from overbought territory.

- A close below 1.2710 (23.6% Fibonacci extension) may push GBP/USD back towards 1.2630 (38.2% Fibonacci retracement), with a break/close below 1.2470 (50% Fibonacci retracement) bringing the May low (1.2446) on the radar.

- Nevertheless, the recent series of lower highs and lows may unravel should GBP/USD struggle to close below 1.2710 (23.6% Fibonacci extension) but need a break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region to open up the March high (1.2894).

Additional Market Outlooks

Gold Price Outlook Hinges on Fed Rate Decision

US Dollar Forecast: USD/JPY Rebounds from 50-Day SMA Ahead of US NFP

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong