US Dollar Outlook: GBP/USD

GBP/USD extends the rebound from earlier this week following the failed attempt to test the June low (1.2613), and the exchange rate may stage a larger recovery as it the 50-Day SMA (1.2663) now reflects a positive slope.

US Dollar Forecast: GBP/USD Recovers amid Failure to Test June Low

GBP/USD climbs to a fresh weekly high (1.2777) as the US ADP Employment report shows a 150K rise in June versus forecasts for a 160K print, and the exchange rate may attempt to retrace the decline from the June high (1.2861) as Federal Reserve Chairman Jerome Powell acknowledges that the economy is ‘now showing signs of resuming its disinflationary trend’ while speaking at the European Central Bank (ECB) Forum on Central Banking.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Powell reiterates that an unexpected weakening in the labor market ‘could call for a reaction’ amid the renewed progress towards price stability, and the Federal Open Market Committee (FOMC) may continue to prepare US households and businesses for a less restrictive policy as ‘the median participant projects that the appropriate level of the federal funds rate will be 5.1 percent at the end of this year.’

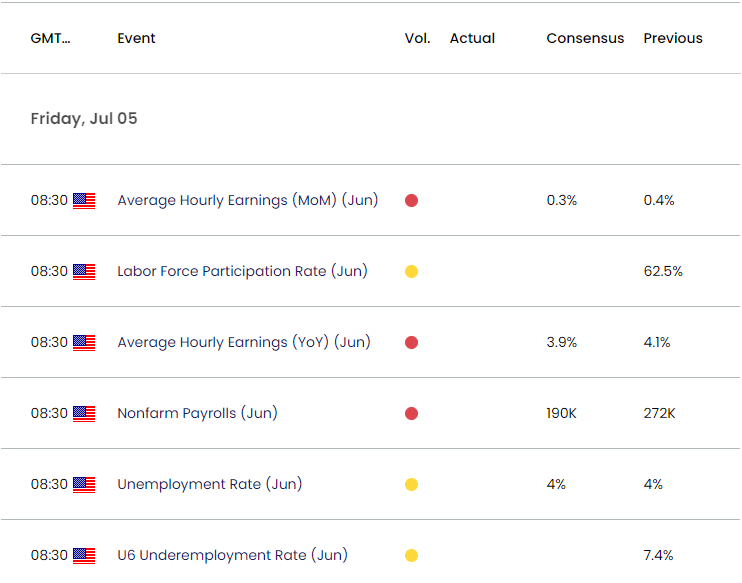

US Economic Calendar

However, the update to the US Non-Farm Payrolls (NFP) report may encourage the FOMC to further combat inflation as the economy is projected to add 190K jobs in June, and a positive development may generate a bullish reaction in the US Dollar as it raises the Fed’s scope to keep US interest rates higher for longer.

At the same time, a weaker-than-expected NFP print may put pressure on the FOMC to alter the course for monetary policy, and signs of slowing job growth may produce headwinds for the Greenback as it fuels speculation for a looming Fed rate-cut.

With that said, GBP/USD may track the positive slope in the 50-Day SMA (1.2664) as it initiates a series of higher highs and lows, but the exchange rate may face range bound conditions if it struggles to retrace the decline from the June high (1.2861).

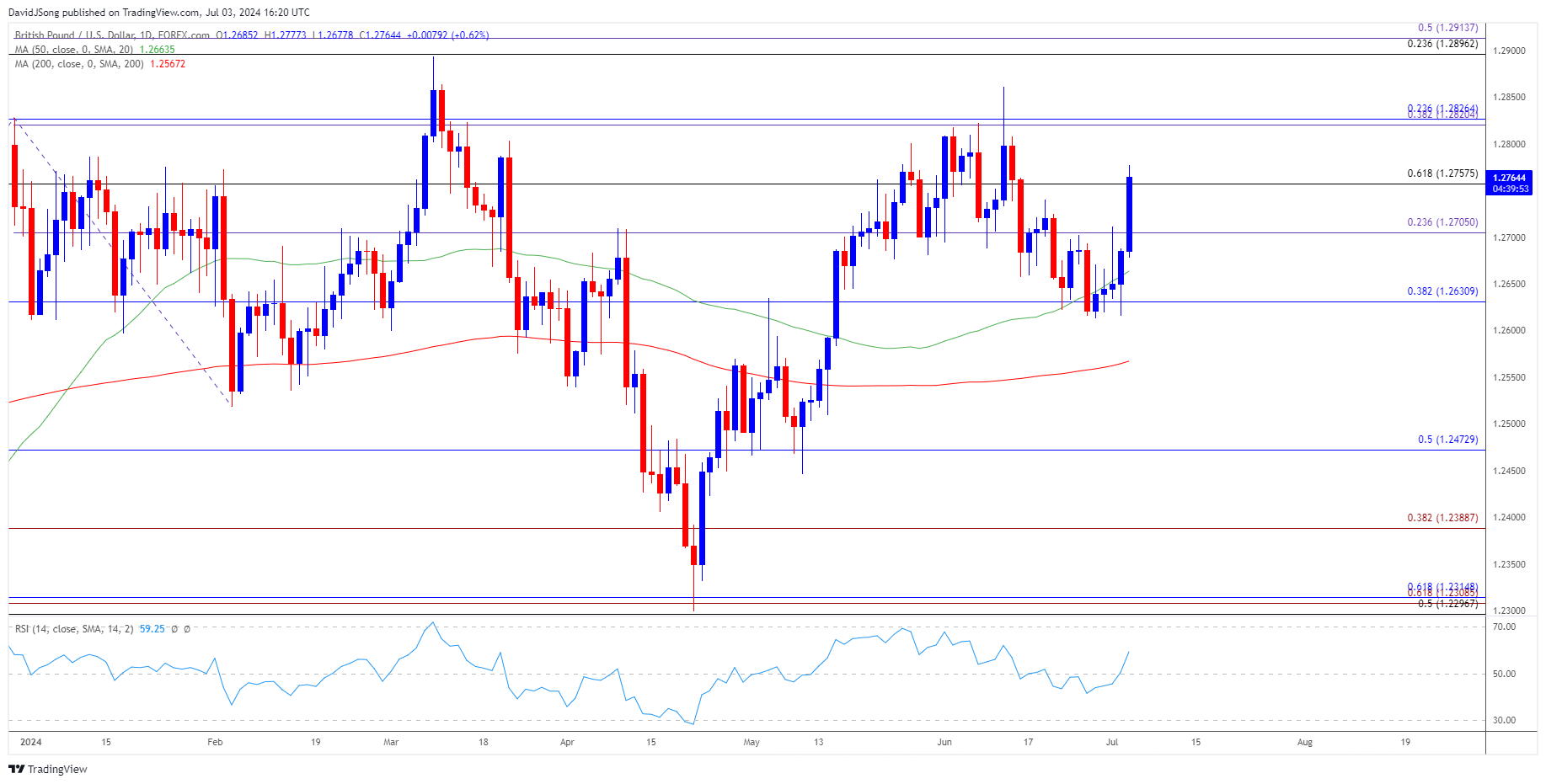

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD bounces back ahead of the June low (1.2613) to extend the advance from earlier this week, with a move above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region bringing the June high (1.2861) on the radar.

- Next area of interest comes in around the March high (1.2894) but GBP/USD may face range bound conditions if it struggles to extend the recent series of higher highs and lows.

- Failure to hold above 1.2710 (23.6% Fibonacci extension) may push GBP/USD back towards 1.2630 (38.2% Fibonacci retracement), with the next area of interest coming in around the June low (1.2613).

Additional Market Outlooks

US Dollar Forecast: AUD/USD 50-Day SMA Maintains Positive Slope

Euro Forecast: EUR/USD Vulnerable to Slowing Euro Area Inflation

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong