US Dollar Outlook: GBP/USD

GBPUSD appears to have reversed ahead of the February high (1.2772) as it falls back below the 50-Day SMA (1.2674), but the exchange rate may trade within last month’s range should it track the flattening slope in the moving average.

US Dollar Forecast: GBP/USD Rate Fails to Test February High

The opening range for March is in focus for GBP/USD as it carves a series of lower highs and lows, and developments coming out of the US may sway the exchange rate as Federal Reserve Chairman Jerome Powell is scheduled to testify in front of Congress.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

It remains to be seen if Chairman Powell will continue to rule out a March rate-cut in front of Congress as the US Personal Consumption Expenditure (PCE) Price Index shows another downtick in the core rate, the Fed’s preferred gauge for inflation, but more of the same from at the semi-annual testimony may generate a bullish reaction in the Greenback as the Federal Open Market Committee (FOMC) appears to be in no rush to switch gears.

At the same time, signs of slowing inflation may encourage the Fed to gradually adjust its forward guidance for monetary policy as officials forecast lower interest rates for 2024, and the recent decline in GBP/USD may end up short lived should Chairman Powell show a greater willingness to implement a less restrictive policy over the coming months.

With that said, GBP/USD may trade within the February range should it track the flattening slope in the 50-Day SMA (1.2674), but failure to hold above the moving average may lead to a further decline in the exchange rate as it carves a series of lower highs and lows.

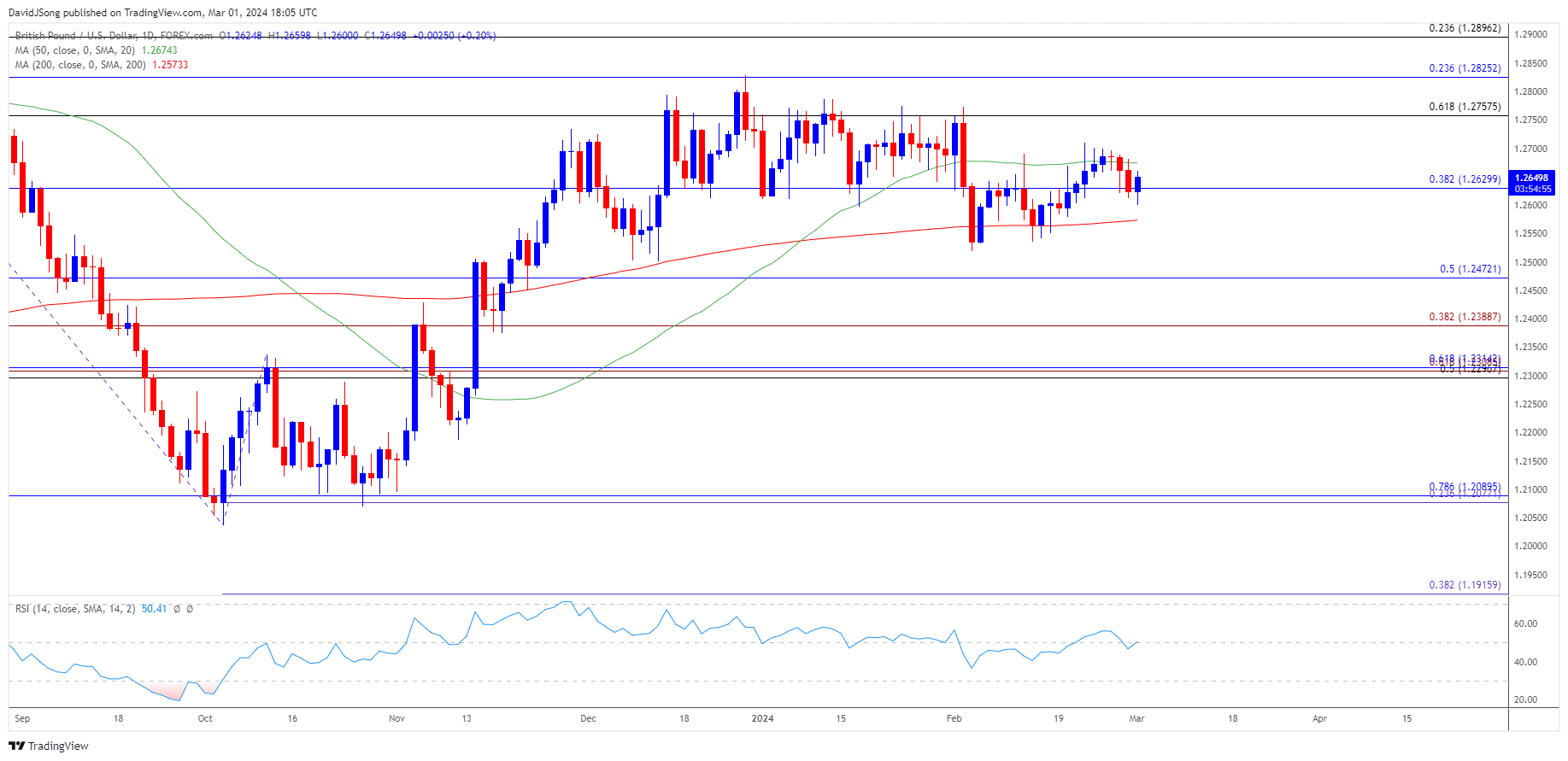

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD trades back below the 50-Day SMA (1.2674) following the failed attempts to test the February high (1.2772), with the opening range for March in focus as the exchange rate carves a series of lower highs and lows.

- Failure to defend the February low (1.2518) opens up the December low (1.2500), with a break/close below 1.2470 (50% Fibonacci retracement) opening up 1.2390 (38.2% Fibonacci extension).

- Nevertheless, GBP/USD may track the flattening slope in the moving average if it continues to defend the February low (1.2518), with a move above the indicator bringing the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region back on the radar.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Ascending Triangle Takes Shape

Australian Dollar Forecast: AUD/USD Reverses Ahead of Monthly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong