US Dollar Outlook: GBP/USD

GBP/USD struggles to retain the advance following the US Consumer Price Index (CPI) amid signs of slowing inflation in the UK, and the exchange rate may give back the rally from the start of the week as the Relative Strength Index (RSI) appears to be reversing ahead of overbought territory.

US Dollar Forecast: GBP/USD Rally Stalls to Keep RSI Below 70

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

GBP/USD registered the largest one-day advance for this year as the slowdown in the US CPI curbs speculation for a Federal Reserve rate-hike, and growing expectations for a looming change in regime may continue to drag on the US Dollar even though Federal Reserve Chairman Jerome Powell keeps the door open to pursue a more restrictive policy.

However, the RSI may show the bullish momentum abating amid the failed attempt to push above 70, and the Bank of England (BoE) may face a similar fate to its US counterpart as the UK CPI prints at 4.6% in October versus forecasts for a 4.8% reading.

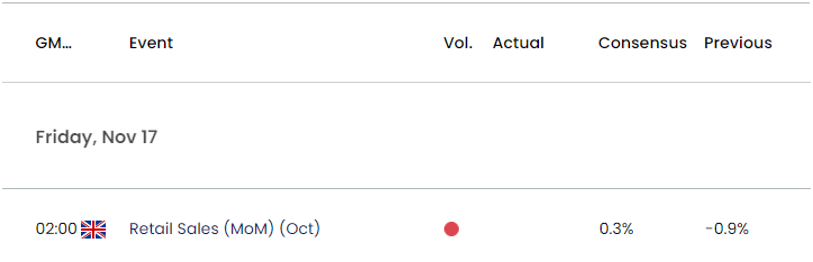

UK Economic Calendar

Nevertheless, the UK Retail Sales report may push the BoE to further combat inflation as household spending is expected to rebound in October, and a positive development may spark a bullish reaction in the British Pound as Governor Andrew Bailey and Co. acknowledge that ‘further tightening in monetary policy would be required if there were evidence of more persistent inflationary pressures.’

However, an unexpected decline in private-sector spending may lead to another 6 to 3 vote within the Monetary Policy Committee (MPC) to keep UK interest rates on hold, and British Pound may face headwinds ahead of the next BoE meeting on December 14 should the retail sales report reflect a slowing economy.

With that said, failure to extend the recent series of higher highs and lows may keep GBP/USD within the weekly range, but the Relative Strength Index (RSI) may show the bullish momentum abating as it appears to be reversing ahead of overbought territory.

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD registered a fresh monthly high (1.2506) following the largest one-day rally for the year, and the exchange rate may no longer track the negative slope in the 50-Day SMA (1.2259) as it extends the advance from the start of November.

- Need a break/close above 1.2630 (38.2% Fibonacci retracement) to open up the September high (1.2713), with the next area of interest coming in around 1.2760 (61.8% retracement) to 1.2830 (23.6% Fibonacci retracement).

- However, failure to extend the recent series of higher highs and lows may lead to a near-term pullback in GBP/USD, and the Relative Strength Index (RSI) may highlight a similar dynamic as it appears to be reversing ahead of overbought territory.

- In turn, the RSI may show the bullish momentum abating, with a break/close below the 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension) area in GBP/USD raising the scope for a move towards the monthly low (1.2096).

Additional Market Outlooks

USD/CAD Forecast: November High in Focus Following Test of 50-Day SMA

US Dollar Forecast: USD/JPY on Cusp of Testing Yearly High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong