US Dollar Outlook: GBP/USD

GBP/USD trades to a fresh monthly high (1.2801) as it carves a series of higher highs and lows, and the exchange rate may further retrace the decline from the March high (1.2894) as the Relative Strength Index (RSI) flirts with overbought territory.

US Dollar Forecast: GBP/USD Rally Pushes RSI Towards Overbought Zone

The recent rally in GBP/USD has pushed the RSI up against overbought territory for the second time this year and a move above 70 in the oscillator is likely to be accompanied by a further advance in the exchange rate like the price action from March.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

In turn, the British Pound may continue to outperform against its US counterpart as the stickiness in the UK Consumer Price Index (CPI) puts pressure on the Bank of England (BoE) to further combat inflation, and the Federal Reserve may face a similar fate as the Personal Consumption Expenditure (PCE) Price Index is expected to hold steady in April.

US Economic Calendar

The core PCE index, the Fed’s preferred gauge for inflation, is projected to print at 2.8% for the third consecutive month, and signs of persistent price growth may generate a bullish reaction in the Greenback as it raises the Federal Open Market Committee’s (FOMC) scope to keep US interest rates higher for longer.

At the same time, a downtick in the core PCE index may produce headwinds for the US Dollar as it encourages Chairman Jerome Powell and Co. to alter the course for monetary policy, and GBP/USD may attempt to further retrace the decline from the March high (1.2894) as it registers fresh monthly highs going into the final days of May.

With that said, a further advance in GBP/USD may push the RSI into overbought territory for the second time this year, but lack of momentum to extend the recent series of higher highs and lows may keep the oscillator below 70.

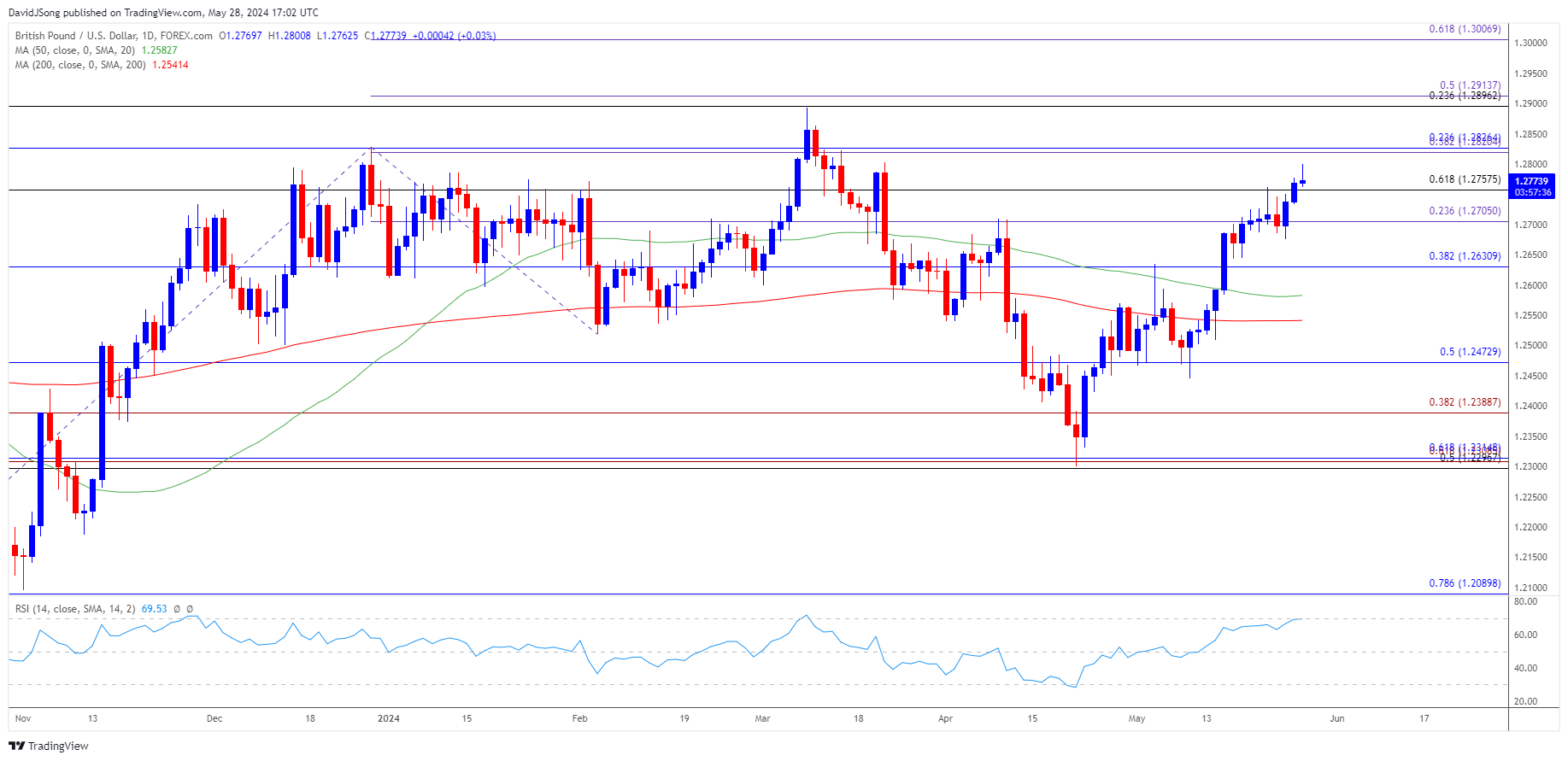

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD carves a series of higher highs and lows to register a fresh monthly high (1.2801), and a further advance in the exchange rate may push the Relative Strength Index (RSI) above 70 for the second time this year.

- A break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region brings the March high (1.2894) on the radar, with the next area of interest coming in around 1.3010 (61.8% Fibonacci extension).

- However, lack of momentum to extend the bullish price series may keep the RSI out of overbought territory, with a move below 1.2710 (23.6% Fibonacci extension) opening up 1.2630 (38.2% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Vulnerable amid Failure to Clear May High

US Dollar Forecast: EUR/USD Stalls Ahead of March High

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong