US Dollar Outlook: GBP/USD

GBP/USD slips below the 50-Day SMA (1.2637) to register a fresh monthly low (1.2618), and the exchange rate may continue to give back the advance from the May low (1.2446) amid the limited response to the positive slope in the moving average.

US Dollar Forecast: GBP/USD Falls to Fresh Monthly Low Ahead of US PCE

GBP/USD fails to retrace the decline following the Bank of England (BoE) rate decision as it snaps the recent series of higher highs and lows, but data prints coming out of the US may prop up the exchange rate as the US Personal Consumption Expenditure (PCE) Price Index is anticipated to show slowing inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

US Economic Calendar

The core PCE, the Federal Reserve’s preferred gauge for inflation, is seen narrowing to 2.6% in May from 2.8% per annum the month prior, and evidence of easing price pressures may fuel the recent advance in GBP/USD as it raises the Fed’s scope to implement lower interest rates in 2024.

However, a higher-than-expected core PCE print may force the Federal Open Market Committee (FOMC) to retain a restrictive policy, and signs of persistent inflation may curb the recent rebound in GBP/USD as market participants push out bets for a Fed rate-cut.

With that said, GBP/USD may continue to give back the advance from the May low (1.2446) amid the limited response to the positive slope in the 50-Day SMA (1.2637), but the exchange rate may consolidate over the remainder of the month if it struggles to close below the moving average.

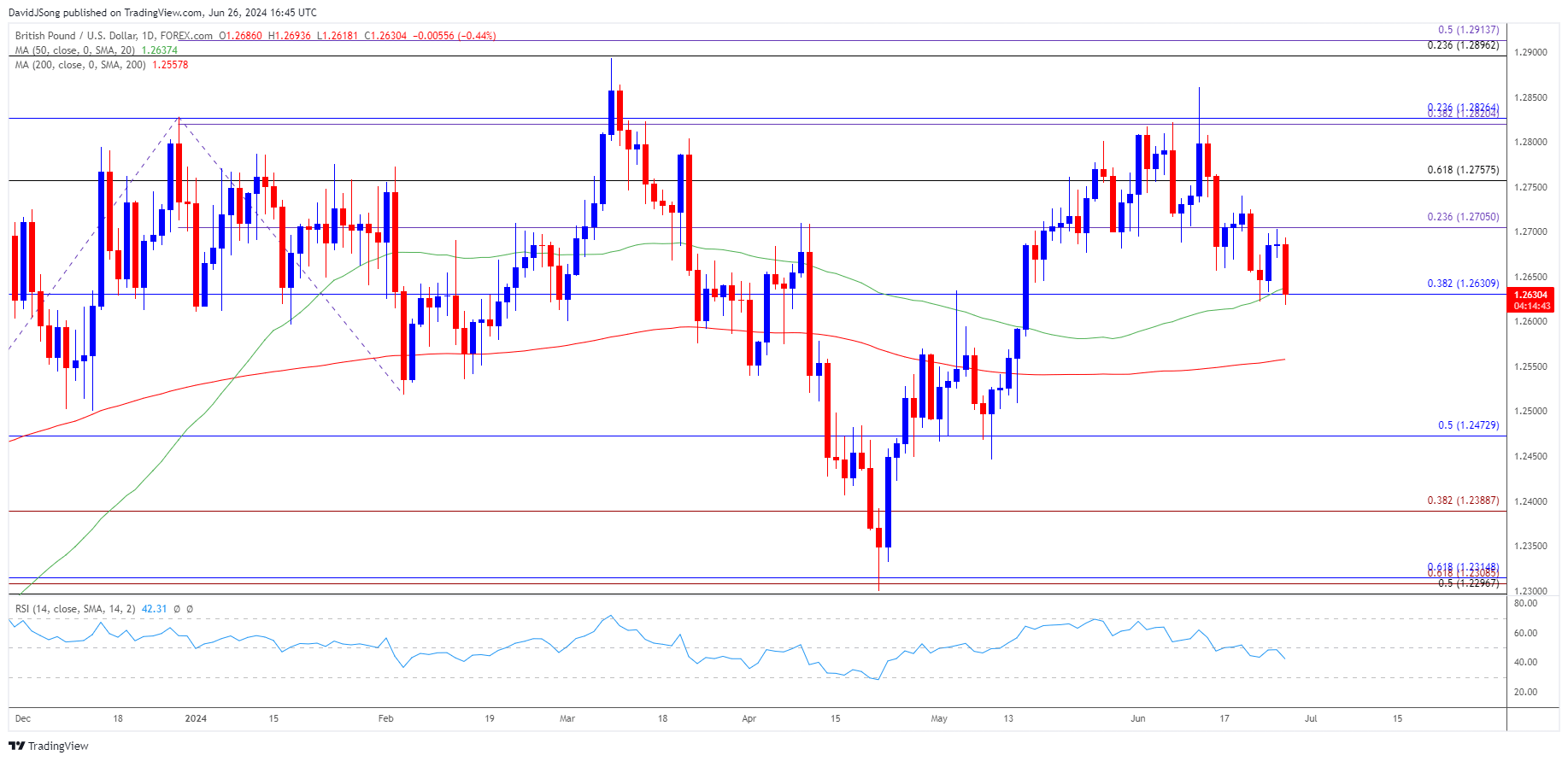

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD snaps the recent series of higher highs and lows to register a fresh monthly low (1.2618), with a close below 1.2630 (38.2% Fibonacci retracement) raising the scope for a move towards the 200-Day SMA (1.2558).

- A break/close below 1.2470 (50% Fibonacci retracement) opens up the May low (1.2446) on the radar but GBP/USD may consolidate over the remainder of the month if it struggles to close below the moving average.

- Need a move above 1.2710 (23.6% Fibonacci extension) to bring the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region back on the radar, with the next area of interest coming in around the monthly high (1.2861).

Additional Market Outlooks

USD/CAD Negates Ascending Channel amid Uptick in Canada Inflation

US Dollar Forecast: EUR/USD Bounces Back Ahead of Monthly Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong