US Dollar Outlook: GBP/USD

GBP/USD extends the advance from monthly low (1.2446) to carve a series of higher highs and lows, but the recent recovery in the exchange rate may unravel if it responds to the negative slope in the 50-Day SMA (1.2596).

US Dollar Forecast: GBP/USD Eyes 50-Day SMA Ahead of US CPI

Keep in mind, GBP/USD failed to defend the opening range for May as the Bank of England (BoE) voted 7 to 2 to keep the Bank Rate at 5.25%, and it seems as though the majority are in no rush to switch gears as ‘monetary policy will need to remain restrictive for sufficiently long to return inflation to the 2% target sustainably in the medium term.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

As a result, GBP/USD may face range bound conditions as the Monetary Policy Committee (MPC) ‘remains prepared to adjust monetary policy as warranted by economic data to return inflation to the 2% target sustainably,’ but data prints coming out of the UK may lead to a greater dissent within the BoE as the Employment Change report is anticipated to show another rise in claims for unemployment benefits.

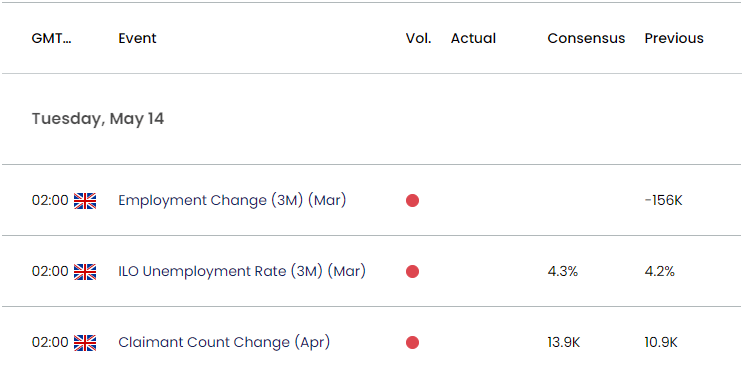

UK Economic Calendar

The UK Claimant Count rate is expected to print at 13.9K in April following the 10.9K reading the month prior while the Unemployment Rate is seen widening to 4.3% from 4.2% during the same period, and signs of a weakening labor market may produce headwinds for the British Pound as it puts pressure on the BoE to adopt a less restrictive policy.

However, a better-than-expected UK Employment report may generate a bullish reaction in GBP/USD as it raises the BoE’s scope to further combat inflation, and the exchange rate may stage a larger recovery ahead of the update to the US Consumer Price Index (CPI) as it carves a series of higher highs and lows.

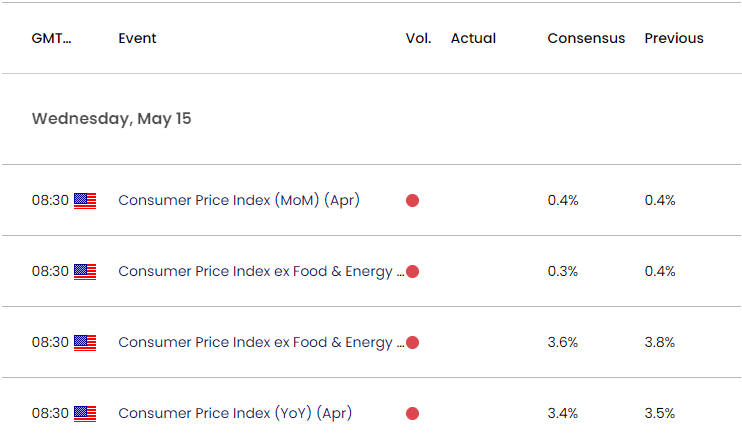

US Economic Calendar

Looking ahead, the US CPI may also sway GBP/USD as both the headline and core reading are anticipated to show slowing inflation, and evidence of easing price growth may spark a bearish reaction in the Greenback as it reinforces expectations for a rate cut in 2024.

At the same time, a stronger-than-expected CPI report may curb the recent recovery in GBP/USD as it puts pressure on the Federal Reserve to keep US interest rates higher for longer, and the exchange rate may struggle to retain the advance from the monthly low (1.2446) should it snaps the recent series of higher highs and lows.

With that said, GBP/USD may respond to the negative slope in the 50-Day SMA (1.2596) if it struggles to trade/close back above the moving average, but the exchange rate may track the April range as both the BoE and Fed endorse a data-dependent approach in managing monetary policy.

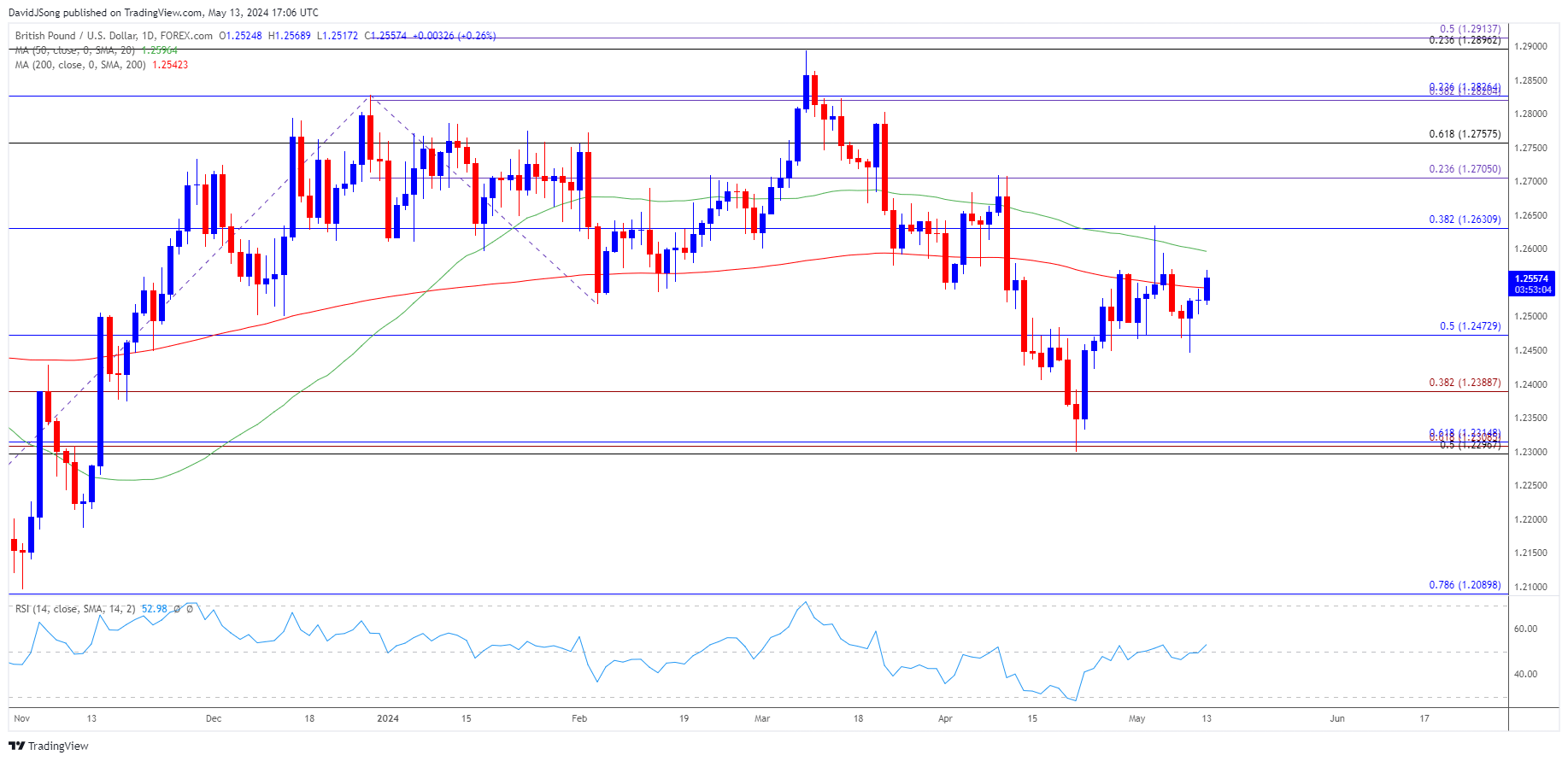

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD approaches the 50-Day SMA (1.2596) as it extends the rebound from the monthly low (1.2446), with a break/close above 1.2630 (38.2% Fibonacci retracement) opening up the April high (1.2710).

- Next area of interest comes in around 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement), but GBP/USD may respond to the negative slope in the moving average if it struggles to test the monthly high (1.2635).

- A close below 1.2470 (50% Fibonacci retracement) may push GBP/USD towards 1.2390 (38.2% Fibonacci extension), with the next region of internet coming in around 1.2300 (50% Fibonacci retracement) to 1.2320 (61.8% Fibonacci retracement), which incorporates the yearly low (1.2300).

Additional Market Outlooks

US Dollar Forecast: EUR/USD Negates Bear Flag Formation

US Dollar Forecast: USD/CAD Ascending Channel Remains Intact

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong