US Dollar Outlook: GBP/USD

GBP/USD trades near the weekly low (1.2629) following a larger-than-expected slowdown in the UK’s Consumer Price Index (CPI), but the exchange rate may stage further attempts to test the August high (1.2842) as it continues to trade within the ascending channel from earlier this year.

US Dollar Forecast: GBP/USD Ascending Channel Remains Intact

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

GBP/USD appears to be stuck in a narrow range as it pares the advance following the Federal Reserve interest rate decision, but fresh data prints coming out of the US may prop up the exchange rate as the Personal Consumption Expenditure (PCE) Price Index is anticipated to show slowing inflation.

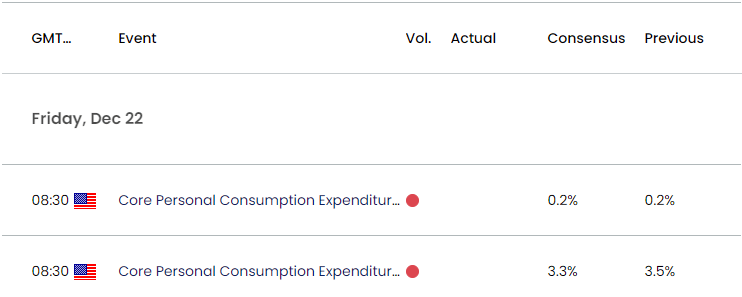

US Economic Calendar

The core PCE, the Fed’s preferred gauge for inflation, is seen narrowing to 3.3% in November from 3.5% per annum the month prior, and evidence of easing price growth may generate a bearish reaction in the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to unwind the restrictive policy sooner rather than later.

However, an above-forecast core PCE print may drag on GBP/USD as it encourages the Fed to keep US interest rates higher for longer, and the exchange rate may fall back towards channel support if it fails to hold above the weekly low (1.2629).

With that said, the range-bound price action in GBP/USD may end up being short lived as it continues to trade within the ascending channel from earlier this year, and the exchange rate may stage further attempts to test the August high (1.2842) should it track the positive slope in the 50-Day SMA (1.2413).

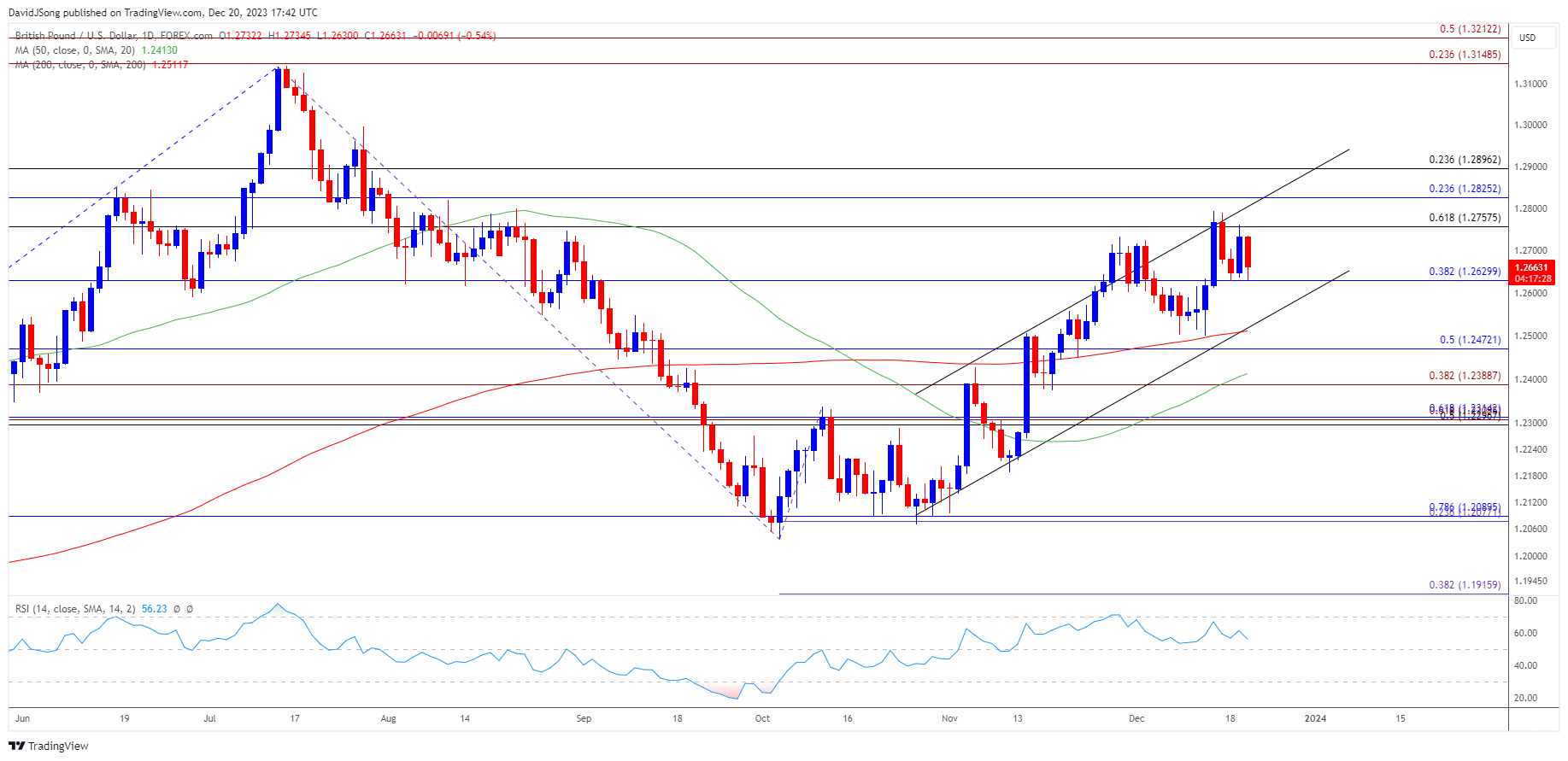

GBP/USD Price Chart –Daily

Chart Prepared by David Song, Strategist; GBP/USD on TradingView

- GBP/USD appears to be stuck in a narrow range after struggling to break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) region, but failure to hold above 1.2630 (38.2% Fibonacci retracement) may negate the ascending channel from earlier this year.

- A breach of the monthly low (1.2500) opens up 1.2470 (50% Fibonacci retracement), with the next area of interest coming in around 1.2300 (50% Fibonacci retracement) to 1.2390 (38.2% Fibonacci extension).

- Nevertheless, GBP/USD may continue to trade within the ascending channel should it hold above the weekly low (1.2629), and the exchange rate may retrace the decline from the monthly high (1.2794) should it track the positive slope in the 50-Day SMA (1.2413).

- Need break/close above the 1.2760 (61.8% Fibonacci retracement) to 1.2830 (23.6% Fibonacci retracement) area to bring the August high (1.2842) back on the radar, with the next region of interest coming in around the 1.2900 (23.6% Fibonacci retracement) handle.

Additional Market Outlooks

US Dollar Forecast: USD/JPY Rebound Pulls RSI Out of Oversold Zone

US Dollar Forecast: USD/CAD Post-Fed Selloff Stalls Ahead of August Low

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong