US Dollar Outlook: EUR/USD

EUR/USD extends the rebound from last week’s low (1.0788) to clear the May high (1.0895), but the exchange rate may struggle to retain the advance from the start of the week as the European Central Bank (ECB) is expected to alter the course for monetary policy.

US Dollar Forecast: EUR/USD Vulnerable to ECB Rate Cut

EUR/USD appears to have bounced back ahead of the 50-Day SMA (1.0775) as it carves a series of higher highs and lows, and the exchange rate may attempt to further retrace the decline from the March high (1.0981) as the moving average no longer reflects a negative slope.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

However, the ECB meeting may sway EUR/USD as the central bank discusses when ‘it would be appropriate to reduce the current level of monetary policy restriction,’ and recent remarks from Governing Council member Philip Lane suggest the ECB is preparing to switch gears as ‘further disinflation can be expected in the course of 2025.’

Lane goes onto say that ‘the future rate path will also be guided by our management of the two-sided risks in proceeding through the next phase,’ and it remains to be seen if the ECB will embark on a rate-cutting cycle as Lane pledges to ‘follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction.’

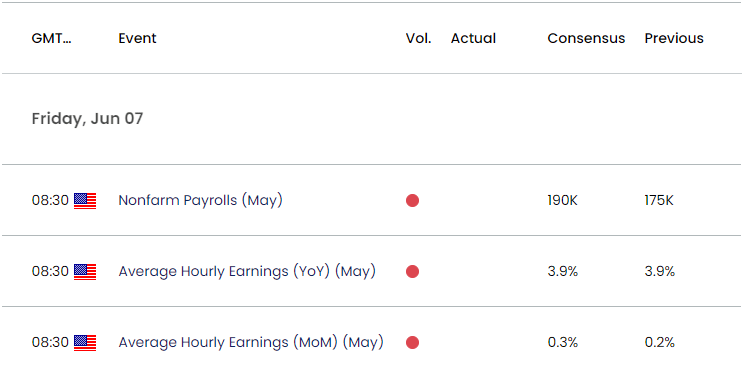

Euro Area Economic Calendar

As a result, a 25bp rate cut along with a dovish forward guidance may drag on EUR/USD as market participants brace for a further reduction in Eura Area interest rates, but the exchange rate may show a bullish reaction to the ECB meeting if President Christine Lagarde and Co. stick to the current policy.

In turn, EUR/USD may face increased volatility ahead of the US Non-Farm Payrolls (NFP) report, and the figures coming out of the Bureau of Labor Statistics (BLS) may also influence the exchange rate as the update is anticipated to show another rise in employment.

US Economic Calendar

The US is projected to add 190K jobs in May following the 175K expansion the month prior, and signs of a resilient the labor market may generate a bullish reaction in the Greenback as it raises the Federal Reserve’s scope to further combat inflation.

However, a weaker-than-expected NFP print may produce headwinds for the Greenback as it puts pressure on the Federal Open Market Committee (FOMC) to adopt a less restrictive policy, and EUR/USD may continue to register fresh weekly highs as it carves a series of higher highs and lows.

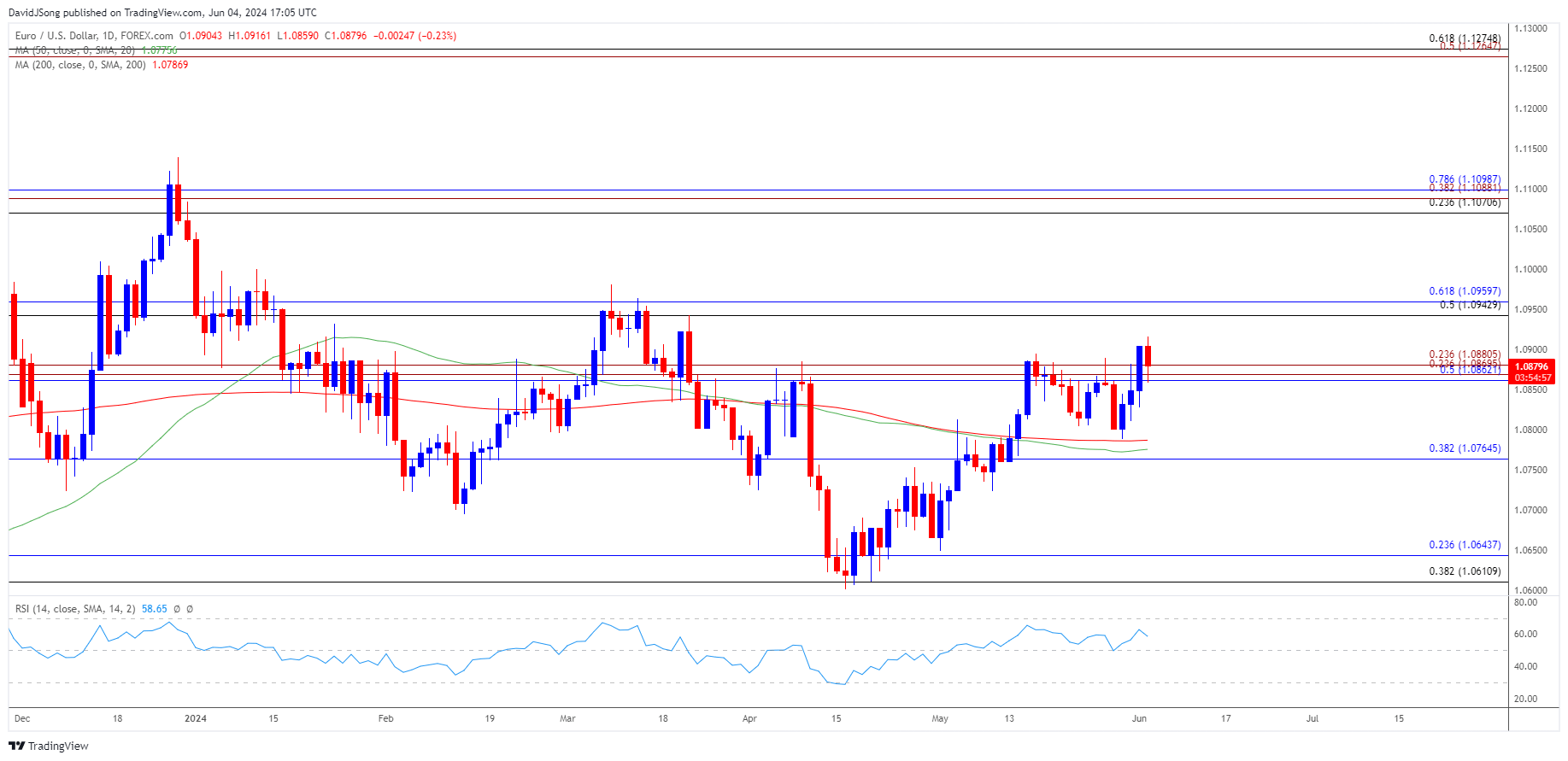

With that said, the opening range for June is in focus for EUR/USD as it bounces back ahead of the 50-Day SMA (1.0775), but the exchange rate may face range bound conditions if it struggles to test the March high (1.0981).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD holds above the 50-Day SMA (1.0775) as it extends the advance from last week’s low (1.0788), with the moving average no longer reflecting a negative slope.

- A break/close above the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) region brings the March high (1.0981) on the radar, with the next area of interest coming in around the January high (1.1046).

- However, lack of momentum to test the March high (1.0981) may curb the series of higher highs and lows in EUR/USD, with a breach below 1.0770 (38.2% Fibonacci retracement) opening up the May low (1.0650).

Additional Market Outlooks

US Dollar Forecast: GBP/USD Struggles to Push RSI into Overbought Zone

Crude Oil Price Under Pressure Going into June OPEC+ Meeting

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong