US Dollar Outlook: EUR/USD

EUR/USD may attempt to retrace the decline following the Federal Reserve interest rate decision as it no longer carves a series of lower highs and lows, but the US Retail Sales report may drag on the exchange rate as the update is anticipated to show a rise in household spending.

US Dollar Forecast: EUR/USD Susceptible to Test of May Low

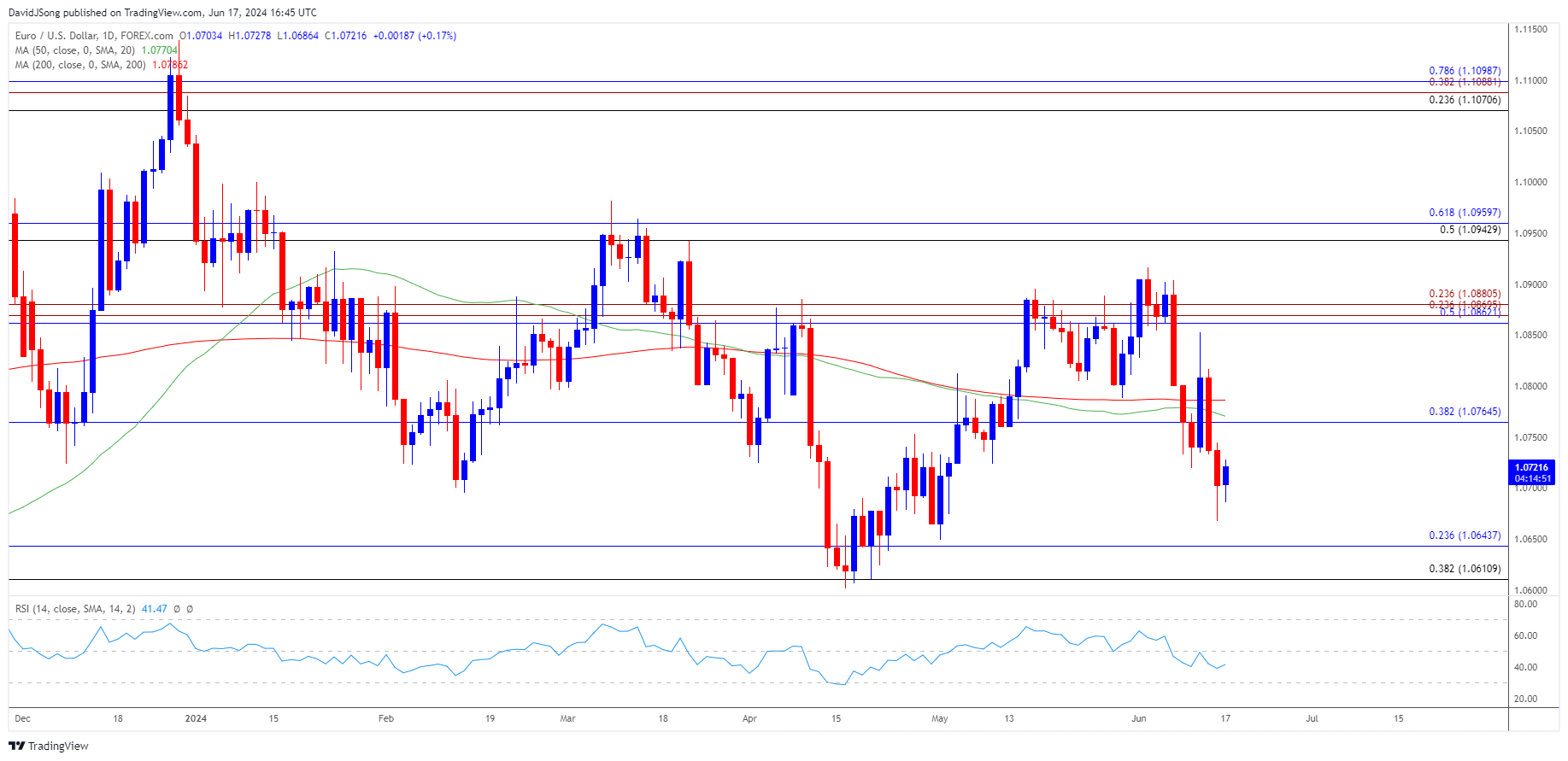

Keep in mind, EUR/USD slipped below the 50-Day SMA (1.0770) as it failed to defend the opening range for June, and the exchange rate may struggle to retain the rebound from the May low (1.0650) as the Federal Open Market Committee (FOMC) remains reluctant to alter the course for monetary policy.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Meanwhile, the European Central Bank (ECB) may further support the Euro Area as the Governing Council cuts interest rates for the first time since 2019, and the diverging paths between the ECB and FOMC may continue to influence EUR/USD as President Christine Lagarde and Co. warn that ‘the risks to economic growth are balanced in the near term but remain tilted to the downside over the medium term.’

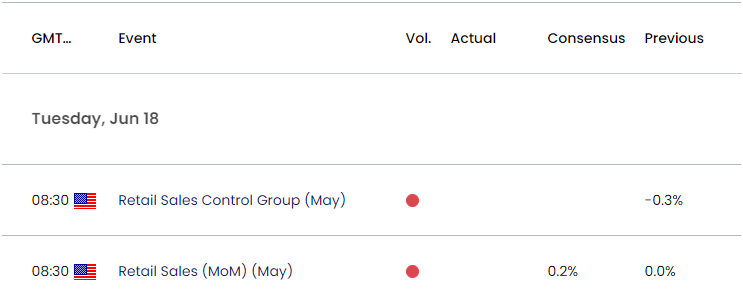

US Economic Calendar

In contrast, the FOMC may further combat inflation as Retail Sales are projected to increase 0.2% in May after holding flat during the month prior, and a positive development may produce a bullish reaction in the US Dollar as it raises the Fed’s scope to keep US interest rates higher for longer.

At the same time, a weaker-than-expected Retail Sales report may put pressure on the FOMC to adopt a less restrictive policy, and signs of a slowing economy may produce headwinds for the Greenback as it fuels speculation for a Fed rate cut in 2024.

With that said, EUR/USD may extend the rebound from the monthly low (1.0668) as it no longer carves a series of lower highs and lows, but the exchange rate may continue to give back the advance from the May low (1.0650) if it struggles to push back above the 50-Day SMA (1.0770).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may trade within a defined range amid the flattening slope in the 50-Day SMA (1.0770), with a move above 1.0770 (38.2% Fibonacci retracement) bringing the 1.0860 (50% Fibonacci retracement) to 1.00880 (23.6% Fibonacci extension) region on the radar.

- Next area of interest comes in around the monthly high (1.0916), but the rebound from the monthly low (1.0668) may unravel if EUR/USD struggles to trade back above the moving average.

- Failure to defend the May low (1.0650) may push EUR/USD towards the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (1.0640 (23.6% Fibonacci retracement) area, with a breach below the April low (1.0601) opening up the November low (1.0517).

Additional Market Outlooks

USD/JPY Reverses Ahead of June High with Fed and BoJ on Tap

USD/CAD Clears May High with Fed Expected to Retain Restrictive Policy

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong