US Dollar Outlook: EUR/USD

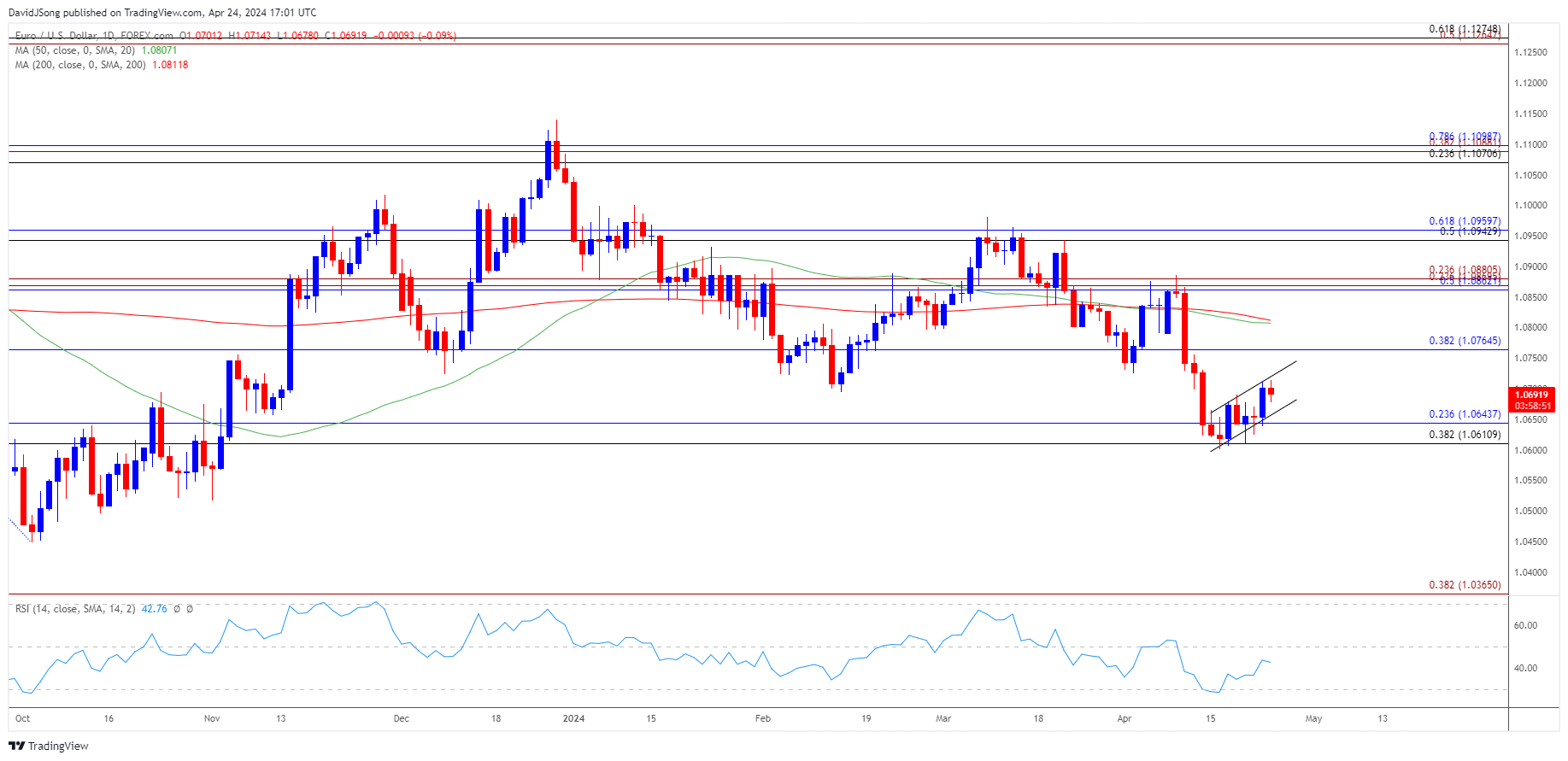

EUR/USD trades in an ascending channel after failing to test the November low (1.0517), but a bear-flag formation may unfold if the exchange rate fails to hold above the monthly low (1.0601).

US Dollar Forecast: EUR/USD Susceptible to Bear Flag Formation

EUR/USD seems to be unfazed by the 2.6% rise in US Durable Goods Orders as the recent series of higher highs and lows remain intact, and the exchange rate may further retrace the decline from the monthly high (1.0885) as the Relative Strength Index (RSI) continues to move away from oversold territory.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

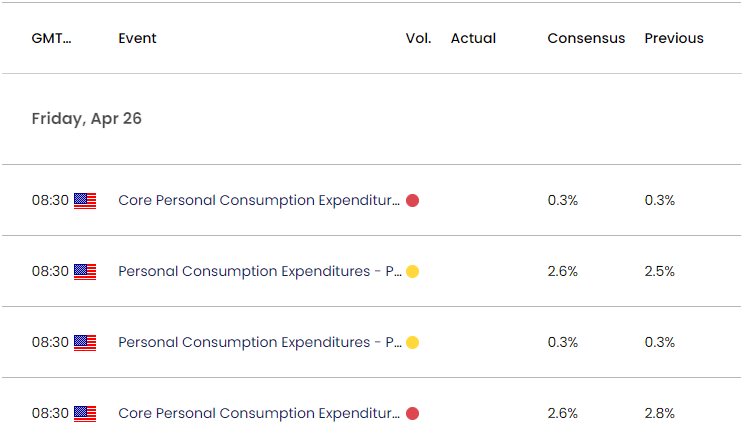

Looking ahead, it remains to be seen if the update to the US Personal Consumption Expenditure (PCE) Price index will sway EUR/USD as Federal Reserve officials acknowledge the lack of progress in bringing down inflation towards the 2% target, but signs of easing price growth may keep the exchange rate afloat as it raises the central bank’s scope to pursue a less restrictive policy.

US Economic Calendar

In turn, a marked slowdown in the core PCE, the Fed’s preferred gauge for inflation, may produce headwinds for the US Dollar as it fuels speculation for lower US interest rates, and EUR/USD may stage a larger recovery ahead of the Federal Open Market Committee (FOMC) rate decision on May 1 as it preserves the recent series of higher highs and lows.

However, a higher-than-expected core PCE print may drag on EUR/USD as it puts pressure on the Federal Open Market Committee (FOMC) to retain a restrictive policy, and the exchange rate may face increased volatility during the Fed’s blackout period as the central bank promotes a data-dependent approach in managing monetary policy.

With that said, EUR/USD may attempt to further retrace the decline from the monthly high (1.0885) as it bounces back ahead of the November low (1.0517), but a bear-flag formation may unfold if the exchange rate fails to hold above the monthly low (1.0601).

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD trades in an ascending channel after failing to test the November low (1.0517), and the recent series of higher highs and lows may push the exchange rate towards 1.0770 (38.2% Fibonacci retracement).

- A move above the 50-Day SMA (1.0807) may lead to a test of the monthly high (1.0885), but EUR/USD may track the negative slope in the moving average if the exchange rate struggles to hold within the ascending channel.

- As a result, a bear-flag formation may unfold if EUR/USD fails to hold above the monthly low (1.0601), with a close below the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region bringing the November low (1.0517) on the radar.

Additional Market Outlooks

US Dollar Forecast: AUD/USD Rebound Persists Ahead of Australia CPI

USD/JPY Forecast: RSI Holds in Overbought Zone Ahead of BoJ Meeting

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong