US Dollar Outlook: EUR/USD

EUR/USD may stage another test of the December low (1.0724) as it halts a four-day rally, but the update to the US Consumer Price Index (CPI) may sway the exchange rate as the report is anticipated to show slowing inflation.

US Dollar Forecast: EUR/USD Susceptible to Another Test of December Low

Keep in mind, EUR/USD registered the monthly low (1.0723) following the failed attempt to trade back above the 50-Day SMA (1.0887), with recent developments in the moving average warning of a potential change in trend as it develops a negative slope.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

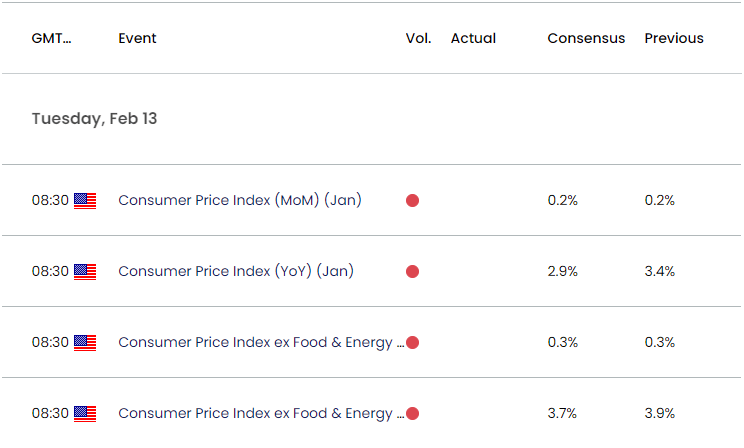

US Economic Calendar

As a result, the weakness from earlier this month may persist as EUR/USD struggles to retrace the decline following the upbeat US Non-Farm Payrolls (NFP) report, but another downtick in the headline and core CPI may produce a bearish reaction in the Greenback as it puts pressure on the Federal Reserve to alter the course for monetary policy.

At the same time, a higher-than-expected CPI report may drag on EUR/USD as Chairman Jerome Powell rules out a rate cut in March, and the exchange rate may stage another test of the December low (1.0724) should the rebound from the monthly low (1.0723) unravel.

With that said, the data prints coming out of the US may influence EUR/USD as the Federal Open Market Committee (FOMC) endorses a data dependent approach in managing monetary policy, but the failed attempt to trade back above the 50-Day SMA (1.0887) could be an indication of a potential change in trend as the moving average develops a negative slope.

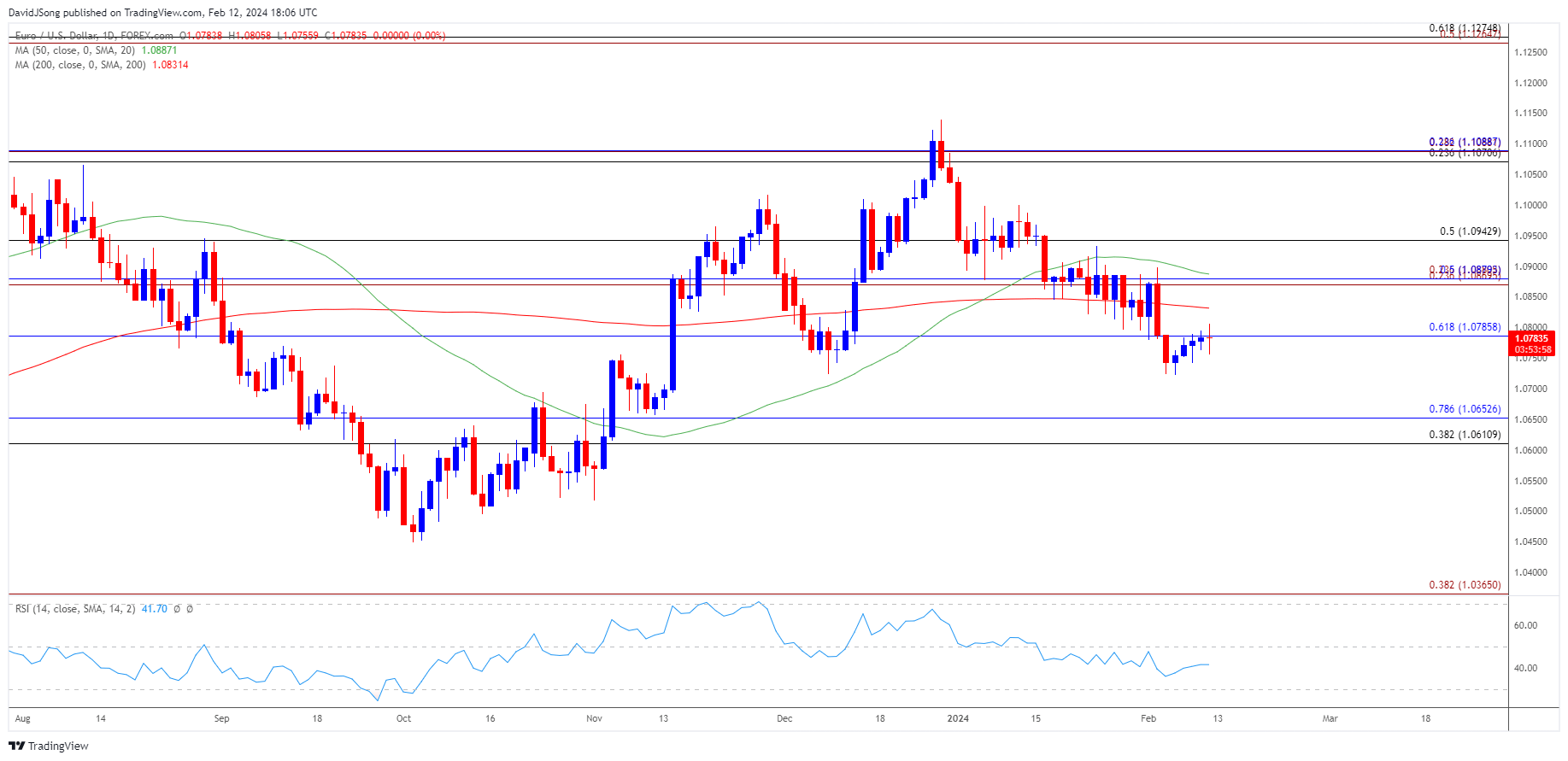

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD may give back the advance from the monthly low (1.0723) as it struggles to close above 1.0790 (61.8% Fibonacci retracement), and the exchange rate may track the negative slope in the 50-Day SMA (1.0887) following the failed attempt to trade back above the moving average.

- A break/close below the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region may lead to a test of the November low (1.0517), with the next area of interest coming in around the 2023 low (1.0448).

- Nevertheless, a close above 1.0790 (61.8% Fibonacci retracement) may push EUR/USD towards 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) area, with a breach above the monthly high (1.0898) opening up 1.0940 (50% Fibonacci retracement).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Fails to Close Below 50-Day SMA

US Dollar Forecast: GBP/USD Struggles to Trade Back Above 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong