US Dollar Outlook: EUR/USD

The recent rally in EUR/USD appears to have stalled ahead of the March high (1.0981) as it extends the decline from the start of the week, but the exchange rate may hold within the monthly range if it snaps the recent series of lower highs and lows.

US Dollar Forecast: EUR/USD Stalls Ahead of March High

EUR/USD extends the decline from earlier this week as the Federal Open Market Committee (FOMC) Minutes reveal a hawkish forward guidance for monetary policy, and it seems as though the central bank is in no rush to switch gears as ‘many participants commented on their uncertainty about the degree of restrictiveness.’

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The minutes from the May meeting suggest the Federal Reserve will retain a restrictive policy as ‘various participants mentioned a willingness to tighten policy further,’ and EUR/USD may continue to give back the advance from the monthly low (1.0650) as the FOMC warns of ‘a lack of further progress toward the Committee's 2 percent inflation objective.’

US Economic Calendar

However, the update to the US Durable Goods Orders report may produce headwinds for the Greenback as demand for large-ticket items are expected to contract 0.8% in April, and signs of a slowing economy may curb the recent weakness in EUR/USD as it puts pressure on the Fed to pursue a less restrictive policy.

At the same time, a better-than-expected Durable Goods Orders report may generate a bullish reaction in the US Dollar as it limits the Fed’s scope to implement lower interest rates, and EUR/USD may continue to register fresh weekly lows as the recent rally in the exchange rate appears to have stalled ahead of the March high (1.0981).

With that said, EUR/USD may further retrace the advance from the start of the month as the Relative Strength Index (RSI) moves away from overbought territory, but the exchange rate may hold within the monthly range if it snaps the recent series of lower highs and lows.

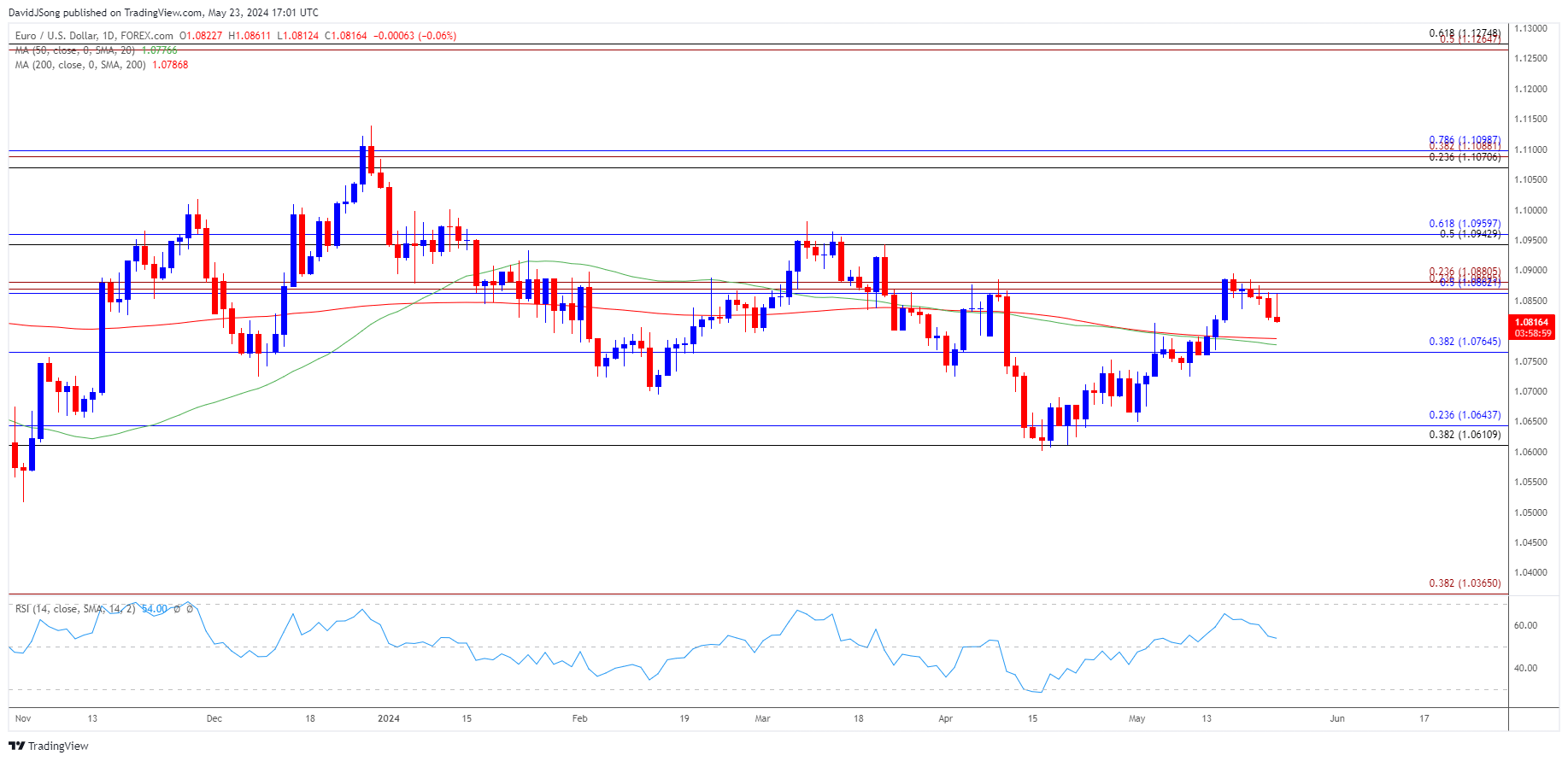

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- The advance from the monthly low (1.0650) appears to have stalled ahead of the March high (1.0981) as EUR/USD carves a series of lower highs and lows, with the weakness in the exchange rate keeping the Relative Strength Index (RSI) below 70.

- The bullish momentum may continue to abate as the RSI moves away from overbought territory, with a breach below 1.0770 (38.2% Fibonacci retracement) raising the scope for a test of the monthly low (1.0650).

- Failure to hold above the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region may lead to a test of the April low (1.0601), but the exchange rate may hold within the monthly range should it snap the recent series of lower highs and lows.

- Need a move back above the 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension) area to bring the 1.0940 (50% Fibonacci retracement) to 1.0960 (61.8% Fibonacci retracement) region back on the radar, with the next area of interest coming in around the March high (1.0981).

Additional Market Outlooks

US Dollar Forecast: USD/CAD Rebounds Within Ascending Channel

US Dollar Forecast: USD/JPY Rate Mirrors Weakness in US Yields

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong