US Dollar Outlook: EUR/USD

EUR/USD appears to be reversing ahead of the August high (1.1065) as it snaps the series of higher highs and lows carried over from last week, and the exchange rate may face a further decline going into December as the Relative Strength Index (RSI) falls back from overbought territory to indicate a sell-signal.

US Dollar Forecast: EUR/USD Reverses Ahead of August High

EUR/USD continues to pullback from the monthly high (1.1017) as the Euro Area’s Consumer Price Index (CPI) narrows to 2.4% in November from 2.9% the month prior to mark the lowest reading since July 2021.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

The development may keep the European Central Bank (ECB) on the sideline as the Governing Council expects the current policy to ‘make a substantial contribution to the timely return of inflation to our target,’ and the Euro may face headwinds ahead of the next ECB meeting on December 14 as the central bank seems to be at the end of its hiking-cycle.

Until then, data prints coming out of the US may sway EUR/USD as the Federal Reserve appears to be at a similar juncture, and it remains to be seen if Chairman Jerome Powell and Co. will adjust the forward guidance for monetary policy as the Personal Consumption Expenditure Price (PCE) Price Index reveals easing price growth.

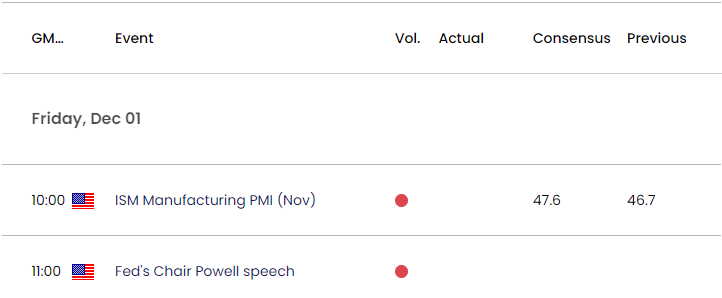

US Economic Calendar

The update to the ISM Manufacturing survey may also encourage the Federal Open Market Committee (FOMC) to retain the status quo as the report is anticipated to show another reading below 50, which would indicate a contraction for the sector.

In turn, signs of slowing economy may drag on the US Dollar as it fuels speculation for a looming change in Fed policy, but a better-than-expected ISM print may generate a bullish reaction in the Greenback as it raises the FOMC’s scope to keep US interest rates higher for longer.

With that said, the failed attempt to test the August high (1.1065) may lead to a larger pullback in the EUR/USD as it snaps the series of higher highs and lows from last week, and the Relative Strength Index (RSI) may continue to show the bullish momentum abating as it falls back from overbought territory.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD reverses ahead of the August high (1.1065) to snap the series of higher highs and lows from last week, while the Relative Strength Index (RSI) falls 70 to generate a textbook sell-signal.

- A break/close below the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region may push EUR/USD towards 1.0790 (61.8% Fibonacci retracement), with the next area of interest coming in around 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement).

- However, EUR/USD may stage further attempts to test the August high (1.1065) should it hold above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) region, with a move back above 1.0940 (50% Fibonacci retracement) raising the scope for a move towards the monthly high (1.1017).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Fails to Push RSI Into Overbought Zone

US Dollar Forecast: GBP/USD Breaks Above Channel Resistance

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong