US Dollar Outlook: EUR/USD

EUR/USD holds below the monthly high (1.0781) as it struggles to extend the recovery carried over from last week, and the exchange rate may track the flattening slope in the 50-Day SMA (1.0884) as it continues to trade below the moving average.

US Dollar Forecast: EUR/USD Recovery Fizzles Ahead of Monthly High

EUR/USD may consolidate over the remainder of the month amid the lack of momentum to break above the opening range for February, but speculation surrounding monetary policy in the Euro Area and US may sway the exchange rate as both the European Central Bank (ECB) and Federal Reserve continue to combat inflation.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

It seems as though the Federal Open Market Committee (FOMC) is in no rush to switch gears as Chairman Jerome Powell tames speculation for a rate cut in March, and it remains to be seen if the ECB will follow a similar approach as the Governing Council pledges to ‘ensure that our policy rates will be set at sufficiently restrictive levels for as long as necessary.’

Euro Area Economic Calendar

As a result, the account of the ECB’s January meeting may influence EUR/USD as the Governing Council pledges to ‘follow a data-dependent approach to determining the appropriate level and duration of restriction,’ and the exchange rate may attempt to retrace the decline from the monthly high (1.0781) should the central bank show little hints of altering the course for monetary policy.

However, the ECB may as gradually prepare Euro Area households and businesses for lower interest rates as President Christine Lagarde insists that the ‘current disinflationary process is expected to continue’ while testifying in front of European lawmakers, and indications of a looming change in regime may drag on EUR/USD as the Fed appears to be reluctant to unwind its restrictive policy.

With that said, EUR/USD may consolidate over the remainder of the month amid the flattening slope in the 50-Day SMA (1.0884), but the exchange rate may give back the advance from the February low (1.0695) if it struggles to trade back above the moving average.

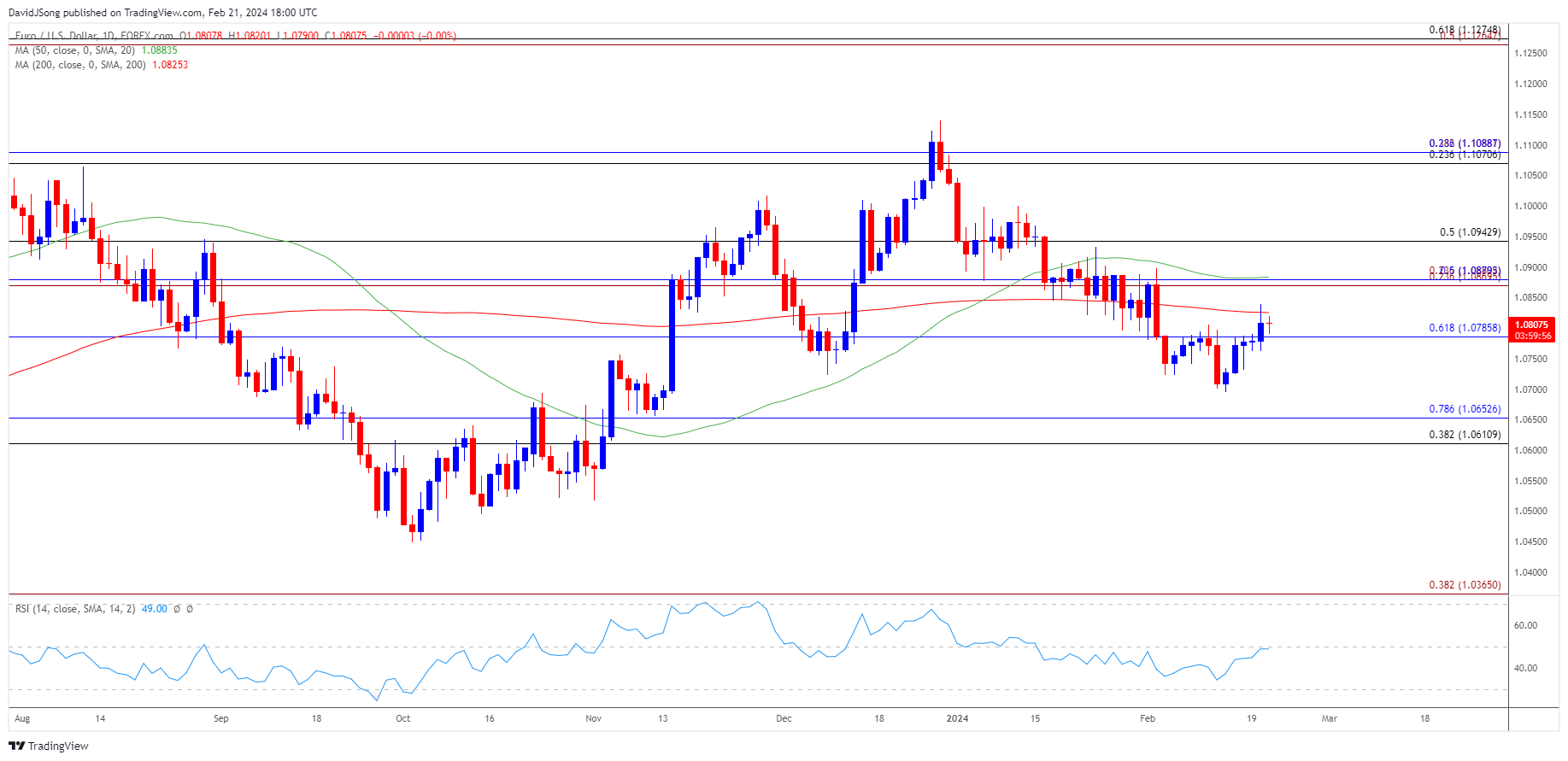

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD bounced back ahead of the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region to stage a five-day advance, with a breach above the 1.0870 (23.6% Fibonacci extension) to 1.0880 (23.6% Fibonacci extension) area bringing the monthly high (1.0898) on the radar.

- Next region of interest comes in around 1.0940 (50% Fibonacci retracement), but EUR/USD may track the flattening slope in the 50-Day SMA (1.0884) if it struggles to clear the opening range for February.

- However, failure to defend the monthly low (1.0695) may push EUR/USD towards the 1.0610 (38.2% Fibonacci retracement) to 1.0650 (78.6% Fibonacci retracement) region, with the next area of interest coming in around the November low (1.0517).

Additional Market Outlooks

US Dollar Forecast: AUD/USD on Cusp of Testing Monthly High

GBP/USD Vulnerable amid Failure to Close Above 50-Day SMA

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong