US Dollar Outlook: EUR/USD

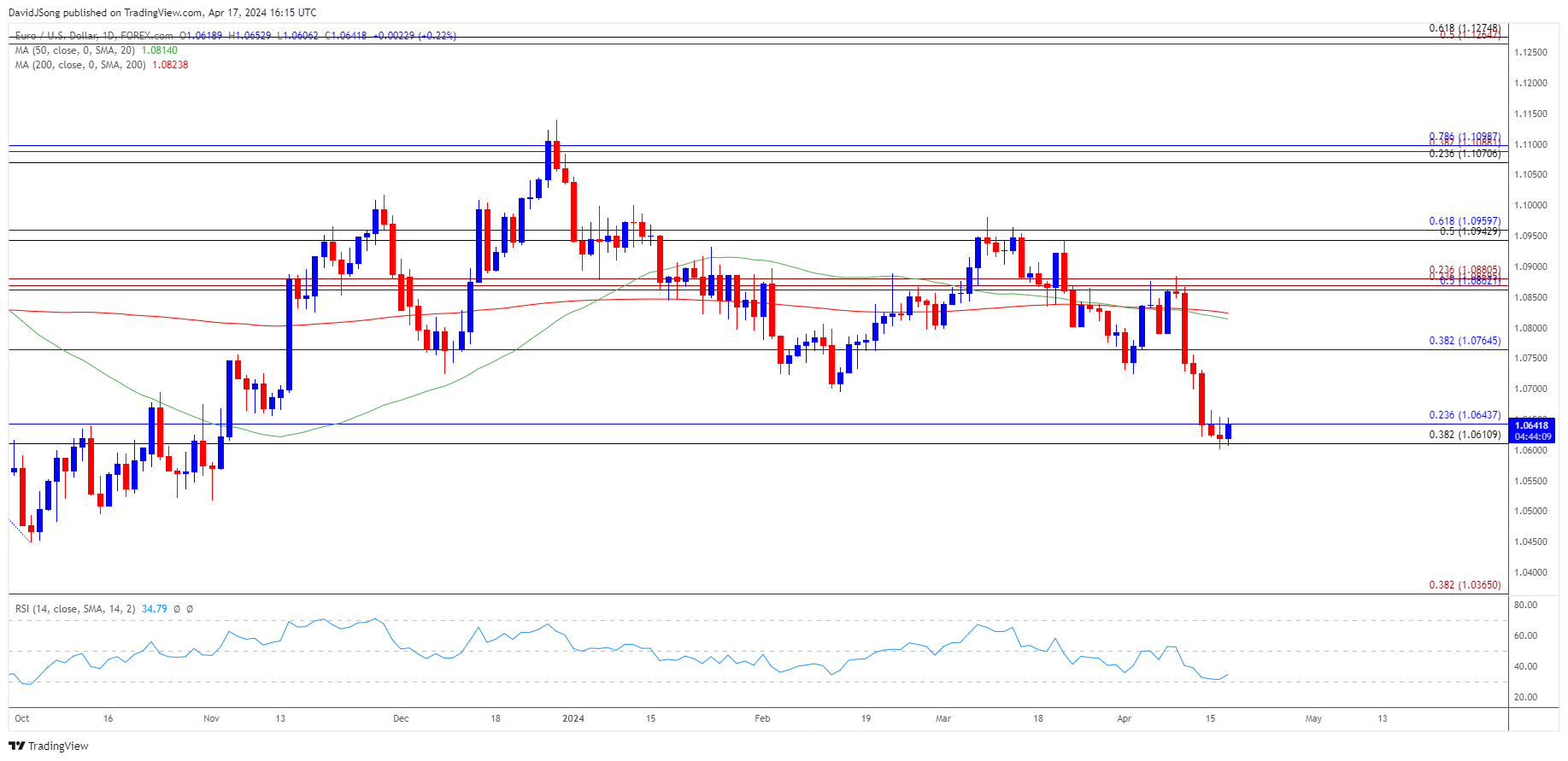

EUR/USD appears to be bouncing back ahead of the November low (1.0517) as it no longer reflects a series of lower highs and lows, and the exchange rate may attempt to retrace the decline from the monthly high (1.0885) as the Relative Strength Index (RSI) holds above oversold territory.

US Dollar Forecast: EUR/USD Recovers Ahead of November Low

EUR/USD seems to be carving a bullish outside day (engulfing) candle as it halts a six-day selloff, but the US Dollar may continue to outperform against its European counterpart as Federal Reserve officials show a greater willingness to keep US interest rates higher for longer.

Join David Song for the Weekly Fundamental Market Outlook webinar. David provides a market overview and takes questions in real-time. Register Here

Fed Vice Chair Philip Jefferson, a permanent voting-member on the Federal Open Market Committee (FOMC), acknowledged that ‘if incoming data suggest that inflation is more persistent than I currently expect it to be, it will be appropriate to hold in place the current restrictive stance of policy for longer,’ with the official going onto say that ‘I am fully committed to getting inflation back to 2 percent’ while speaking at the 13th International Research Forum on Monetary Policy.

The comments largely mirror the remarks from Chairman Jerome Powell as the central bank head insists that ‘if higher inflation does persist, we can maintain the current level of restriction for as long as needed,’ and the FOMC may continue to combat inflation over the coming months as the US Retail Sales report shows another rise in private sector consumption.

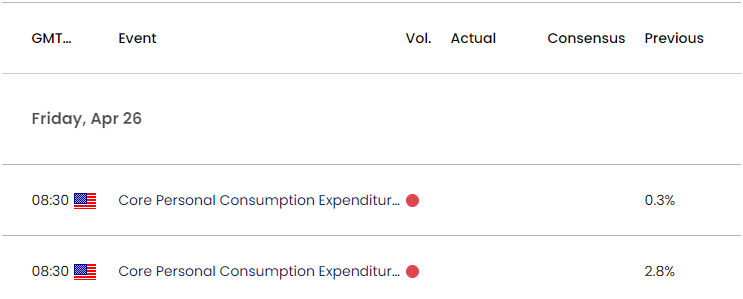

US Economic Calendar

In turn, the update to the US Personal Consumption Expenditure (PCE) Price index may sway foreign exchange markets as the Fed remains reluctant to switch gears, and evidence of persistent inflation may generate a bullish reaction in the Greenback as it puts pressure on Chairman Powell and Co. to retain a restrictive policy.

However, a slowdown in the core PCE, the Fed’s preferred gauge for inflation, may produce headwinds for the US Dollar as it raises the Fed’s scope to deliver a rate cut, and the central bank may continue to prepare US and households for lower interest rates as ‘it will likely be appropriate to begin dialing back policy restraint at some point this year.’

Until then, comments from Fed officials may continue sway EUR/USD as the European Central Bank (ECB) no longer offers forward guidance for monetary policy, but failure to extend the recent series of lower highs and lows may keep the Relative Strength Index (RSI) above 30 as the exchange rate appears to be bouncing back ahead of the November low (1.0517).

With that said, EUR/USD may attempt to retrace the decline from the monthly high (1.0885) should the RSI move away from oversold territory, but the exchange rate may respond to the negative slope in the 50-Day SMA (1.0814) as it failed to defend the opening range for April.

EUR/USD Chart – Daily

Chart Prepared by David Song, Strategist; EUR/USD on TradingView

- EUR/USD appears to be bouncing back ahead of the November low (1.0517) to keep the Relative Strength Index (RSI) out of oversold territory, with the exchange rate carving a bullish outside day (engulfing) candle amid the failed attempt to close below the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region.

- Failure to extend the recent series of lower highs and lows may push EUR/USD back towards 1.0770 (38.2% Fibonacci retracement), with the next area of interest coming in around 1.0860 (50% Fibonacci retracement) to 1.0880 (23.6% Fibonacci extension).

- However, EUR/USD may track the negative slope in the 50-Day SMA (1.0814) after failing to defend the opening range for April, with a close below the 1.0610 (38.2% Fibonacci retracement) to 1.0640 (23.6% Fibonacci retracement) region raising the scope for a test of the November low (1.0517).

Additional Market Outlooks

US Dollar Forecast: AUD/USD Takes Out February Low

US Dollar Forecast: USD/CAD Rallies Within Ascending Channel

--- Written by David Song, Strategist

Follow on Twitter at @DavidJSong